Ontario’s response to the rapid onset of the Omicron variant of COVID-19 in late 2021 has been similar to how it reacted to the less transmissible Delta variant that peaked early in the second quarter of 2021. The rapid escalation of the incidence of Omicron has, once again, dampened both consumer and business confidence. Business confidence reflected by the Canadian Federation of Independent Business (CFIB)’s Ontario Business Barometer dropped from 68.5 in December to an 18-month low of 56.3 in January. The Conference Board’s Index of Consumer Confidence for Ontario has, over the past two months, retreated from 107 to a seven-month low of 100.

Easing of COVID restrictions will soon liberate consumers

The precipitous drop in the seven-day rolling average case count of the Omicron COVID-19 variant from a high of 19,347 on January 2, 2022, to its current level (February 6, 2022) of 2,225 has, as it did in 2021, prompted the government to implement a plan to ease lockdown restrictions. In the wake of this easing, consumer spending, particularly on services, should exhibit a solid recovery that extends well into the second half of the year.

Employers will start rehiring laid off staff in March or April

The loss of 145,000 jobs in January suggests the onset of the Omicron variant of COVID-19 has stalled the province’s economy. However, a closer look at the data reveals this recent decline is a repeat of what happened when the Delta variant hit the province in April of 2021. Then, as now, employment in services took the largest hit, dropping by 139,000 jobs in January of this year, just slightly less than the minus 141,000 figure recorded in 2021.

The largest jobs gain in the latest month (+19,000) was reported for the construction industry. Over the past 12 months, employment in the province is up by +408,000, just offsetting the -408,600 jobs lost in 2020. The province’s record-high jobs vacancy rate and the increase in the net employment outlook reported by Manpower Canada, suggest firms will rehire laid-of staff once the COVID-19 restrictions are lifted, as they did in 2021.

Strong demand for motor vehicles on both sides of the border

Although it is still weighed down by the residual impact of COVID-19, lingering supply chain issues and a persisting shortage of computer chips, Ontario’s manufacturing industry has steadily strengthened over the past several months, due in part to an increase in the output of transportation equipment (i.e., motor vehicles). Low inventories and evidence of pent-up demand for new vehicles on both sides of the border will boost manufacturing activity in the province as the year progresses.

A dampening in house prices to be expected

Although COVID-19 lockdowns have temporarily depressed consumer spending, they have not hurt housing demand. Following a gain of 8% in unit sales accompanied by a 14.6% rise in average prices in 2020, the combination of record-low interest rates, the above-noted rebound in employment, and a record inflow of permanent migrants drove existing home sales in 2021 up by 18.6% y/y to an unprecedented 270,834 units. Average house prices last year climbed by 25.6% y/y, also a record.

Looking forward, with a record number of dwelling units under construction, the result of a steady increase in housing starts over the past several months, builders in the province are in the process of boosting supply. We project that starts this year will total in a range of 95,000 to 105,000 units and from 80,000 to 90,000 in 2023, compared to 99,000 in 2021. At the same time, upcoming higher interest rates, as mentioned in the Bank of Canada’s January 26 policy announcement, will soften housing demand later in the year. We expect the combination of more supply and some softening in demand, due to higher mortgage rates, will cool house prices heading into 2023.

Capacity utilization, corporate profits, and investor confidence on the rise

Following a COVID-19-triggered drop of just over 8% y/y in 2020, public and private investment in Ontario picked up steam in 2021. The 2021 Statistics Canada Non-residential Capital Expenditures Survey (CAPEX) released in February of last year reported that non-residential capital spending would increase by 9.1% in 2021.

Consistent with the sustained rise in investor confidence as indicated by the 20.5% increase in the S&P/TSE stock price index over the past 12 months and the 18% y/y jump in after-tax profits of non-financial corporations, the Bank of Canada’s Q4/21 Business Outlook Survey reported strong increases in capacity pressure and in firms’ plans to increase investment in machinery and equipment. The soon-to-be-released (on February 25) CAPEX survey for 2022 will provide an up-to-date outlook for capital spending this year and a revised estimate for 2021.

Solid rebound in 2021 will lead to sustainable growth this year and next

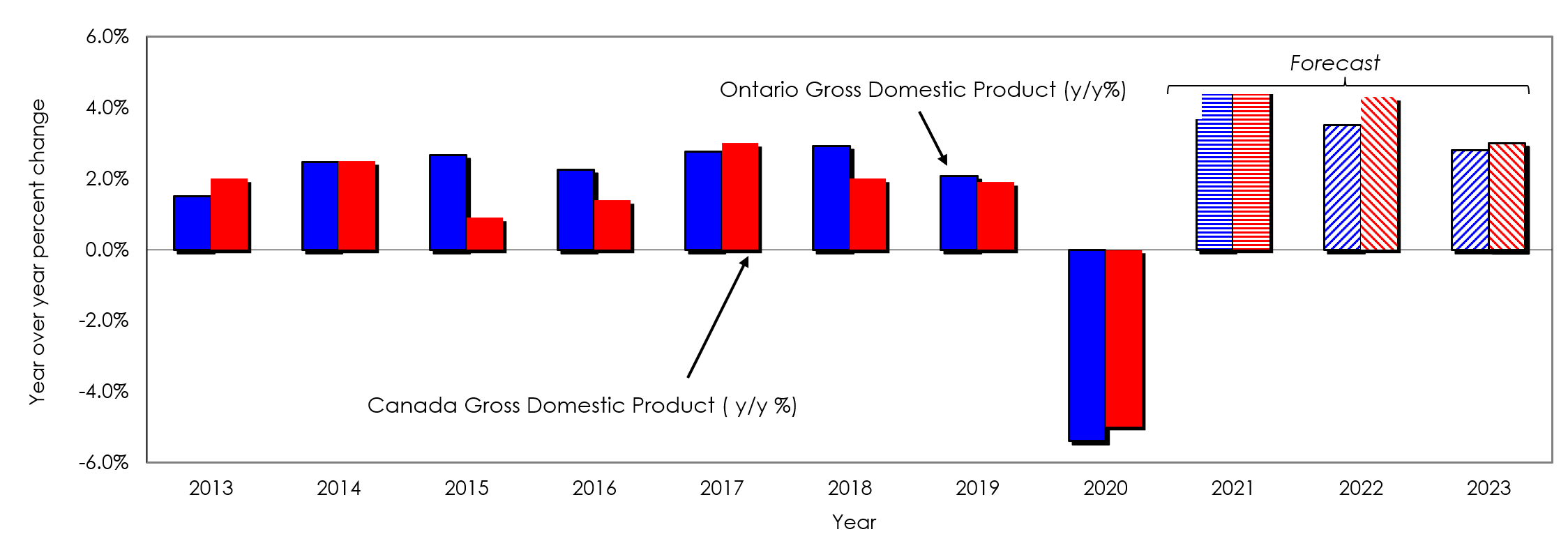

After shrinking by 5.4% in 2020, and despite being hobbled by lockdowns aimed at limiting the spread of the Delta variant early in the year, we estimate the Ontario economy grew by 4.6% in 2021. Lockdowns to muffle Omicron will weigh on growth in the first half of this year. However, the above-noted gains in consumer spending, business investment, and residential construction should put provincial GDP growth in the range of 3.2% to 3.7% in 2022 and 2.5% to 3.2% in 2023.

Graph 1

Gross Domestic Product – Ontario vs Canada

Recent Comments