Upward revisions to resource investment in 2022

Statistics Canada’s latest (2023) Non-residential Capital and Repair Expenditures (CAPEX) survey results held both good and not-so good news. First, the good news. Based on the preliminary CAPEX survey, total non-res capital spending for the year just ended, 2022, at $307 billion, was revised up by +7.3%. This increase to the initial estimate was driven, in large part, by four major industries.

First, fueled (pun intended) in large part by an upward revision to the oil and gas number, investment in mining, quarrying and oil and gas extraction, initially projected at +23% y/y in 2022, is now estimated to have increased by +46% y/y, to reach an eight-year high of $53 billion.

Three other industries also saw stronger than initially reported capital spending in 2022: manufacturing, +25%; utilities, +11.6%; and construction, +36.4%.

2023 dimmed by higher interest rates, weak profits and drop in business confidence

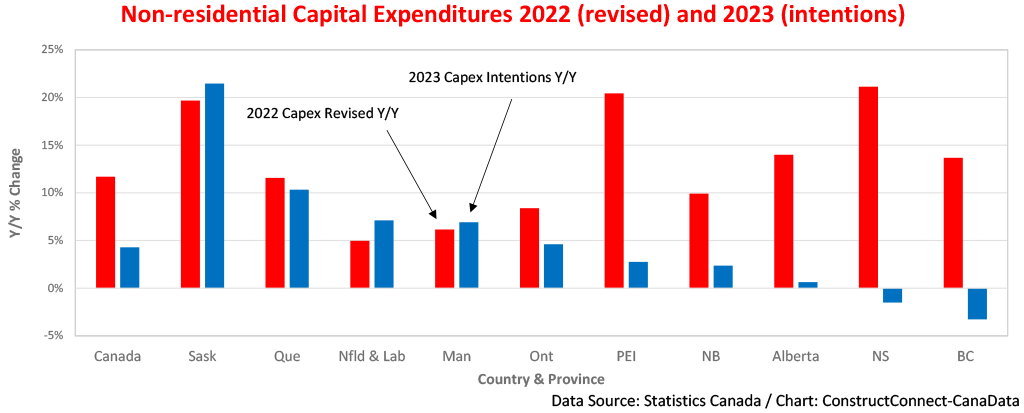

The outlook for non-residential capital and repair expenditures in the current year, 2023, is definitely not as bright as it was in 2021 and 2022. After posting double-digit increases in 2021 (+10.3%) and in 2022 (+11.7%), growth of public and private capital spending is projected to slow to +4.3% this year.

Assuming inflation this year is +5% to +6% y/y, the “real” value of capital spending will likely be flat compared to 2022. The key contributors to this softening include a steady deterioration in investor confidence, reflected by a -12% y/y decline in the S&P/TSX Composite Index; a -29% y/y drop in after-tax profits of non-financial corporations; and a +4.25 percentage-point increase in the Bank Rate.

However, this sombre spending outlook for 2023 CAPEX is not shared by all major industries. Roughly half the gain in total CAPEX in 2023 is projected to be the result of recent strength in petroleum, natural gas, and potash pricing, the latter tied to restricted exports from Russia since its invasion of Ukraine.

Following a -3% decline in 2022, capital outlays in the manufacturing sector will increase by +13% this year. Expenditures on transportation equipment manufacturing, which account for the bulk of total manufacturing CAPEX, are projected to retreat by -6% in 2022, in part due to completion of the work to retool the BrightDrop electric van assembly plant in Ingersoll, Ontario. However, this drop will be partly offset by Stellantis and LG Energy planning to build a $5 billion lithium ion battery plant in Windsor.

Saskatchewan, Quebec, and Ontario to see strongest CAPEX in 2023

After posting growth of +16.7% y/y in 2022, public sector CAPEX is projected to slow to +2.7% in 2023. This will be its weakest showing since 2019. Private sector CAPEX intentions have also moderated, from +8.9% y/y in 2022 to +5.2% this year.

Across the country, non-residential construction is projected to increase in eight of the 10 provinces, led by Saskatchewan. Following a +20% increase in 2022, Stats Canada is reporting that non-res investment will increase by a projected +22% y/y in the wheat province, due to a +61%y/y jump in mining and quarrying, resulting from a sharp escalation in the world price of potash that has caused BHP group to speed up construction of its Jansen potash mine. This increase will be augmented by an oil-price-induced increase in fossil fuel extraction, and a +32% rise in food manufacturing, the result of more canola processing facilities being built, including Cargill’s crushing plant in Regina that broke ground last July.

For the past two years, CAPEX spending in Quebec has increased by double digits. Based on the survey, it is projected to increase by +10.3% this year, second only to Saskatchewan. Most of the gain will be the result of a +28% increase in manufacturing projects, centred in primary metals, chemical manufacturing, and transportation equipment.

After posting gains of +11.0% and +8.4% in 2021 and 2022 respectively, non-res capital spending in Ontario is projected to increase by +4.6% this year, driven in large part by the ongoing refurbishment of the Darlington Nuclear Generating Station.

The winding down of several major projects in British Columbia, including the Coastal GasLink pipeline, the LNG Canada liquid natural gas export terminal, and the Trans Mountain Expansion Project, will likely cause capital spending in the province to exhibit its largest retreat (-3.3%) since 2015.

Heightened global uncertainty increases downside risk

The shock to financial markets caused by the recent failure of the SVB Financial Group, compounded by the pre-existing climate of uncertainty generated by Russia’s invasion of Ukraine, increases the risk that some firms and governments will postpone or possibly cancel major projects, thereby causing non-residential capital spending to retreat more than indicated by the CAPEX survey.

John Clinkard has over 35 years’ experience as an economist in international, national and regional research and analysis with leading financial institutions and media outlets in Canada.

Recent Comments