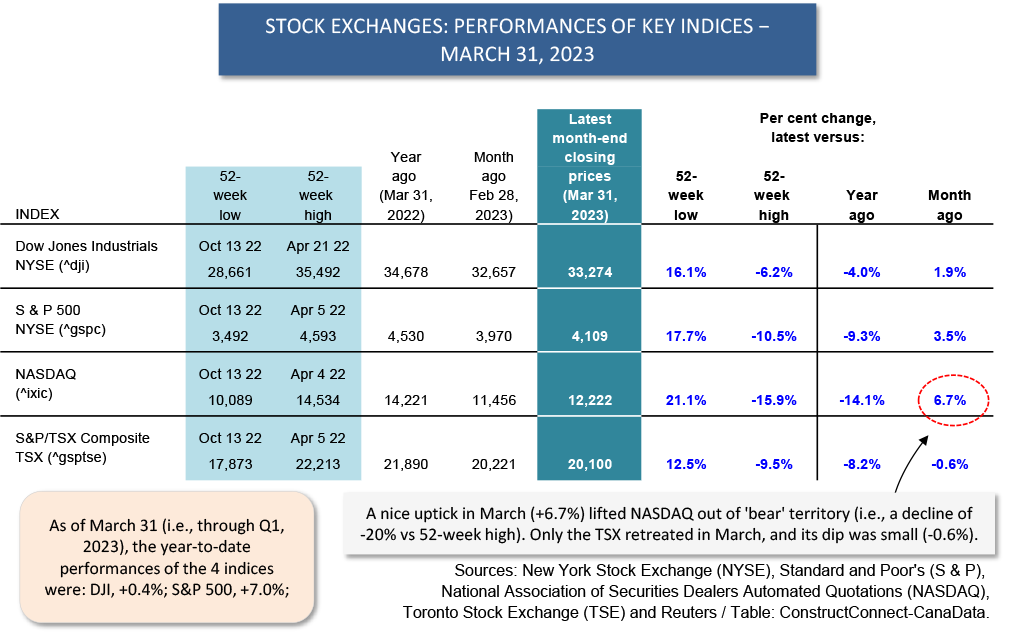

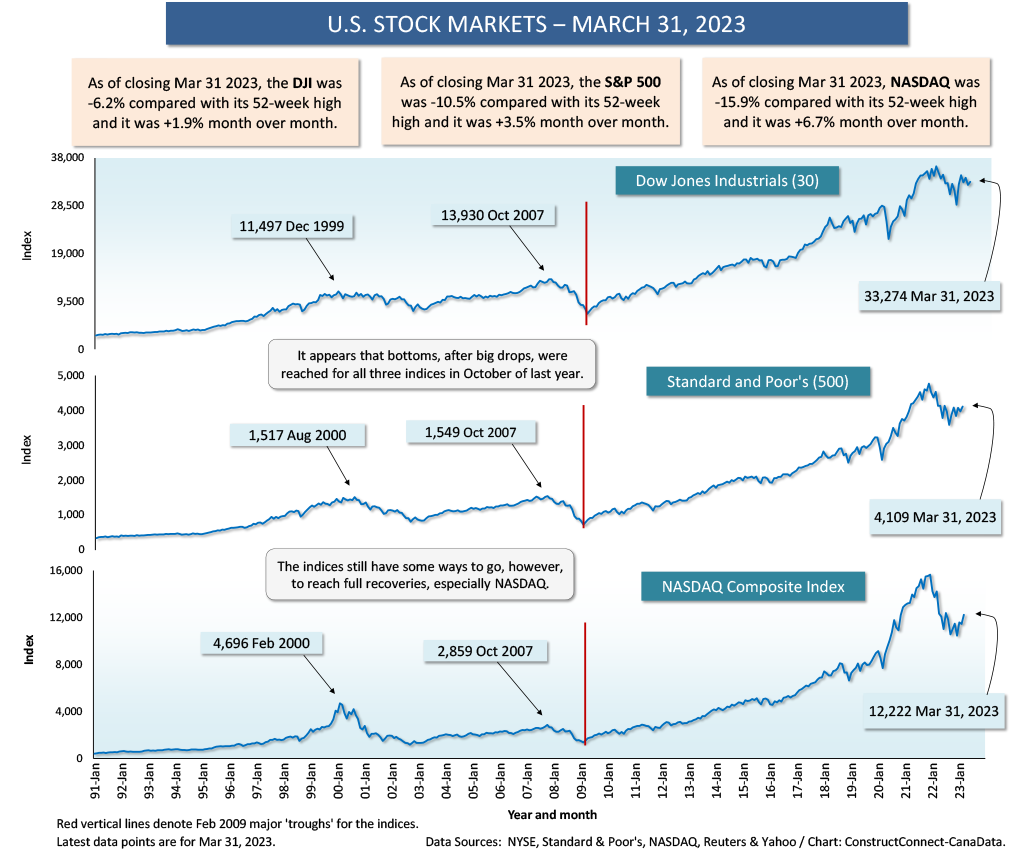

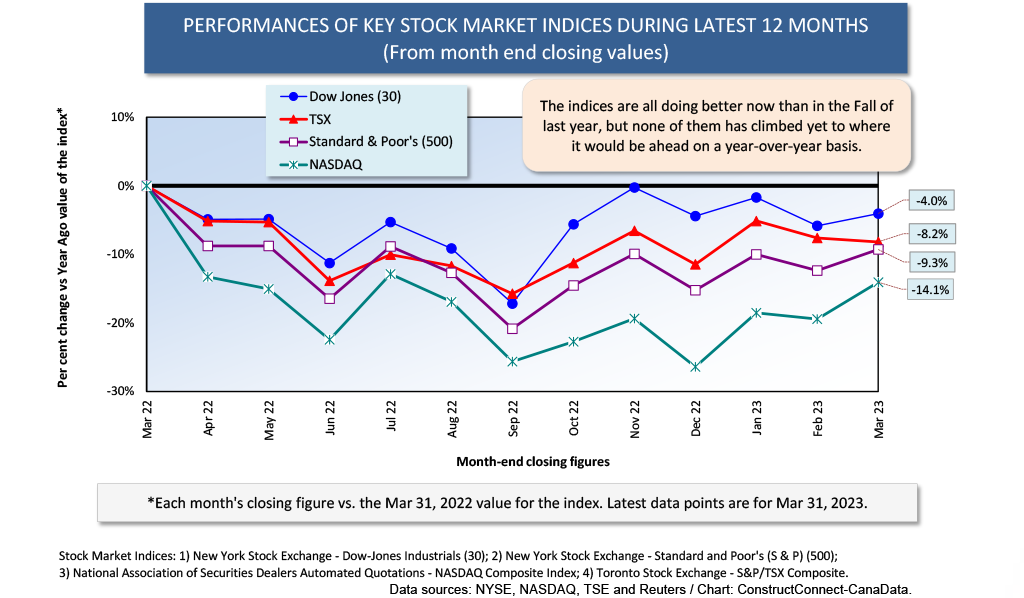

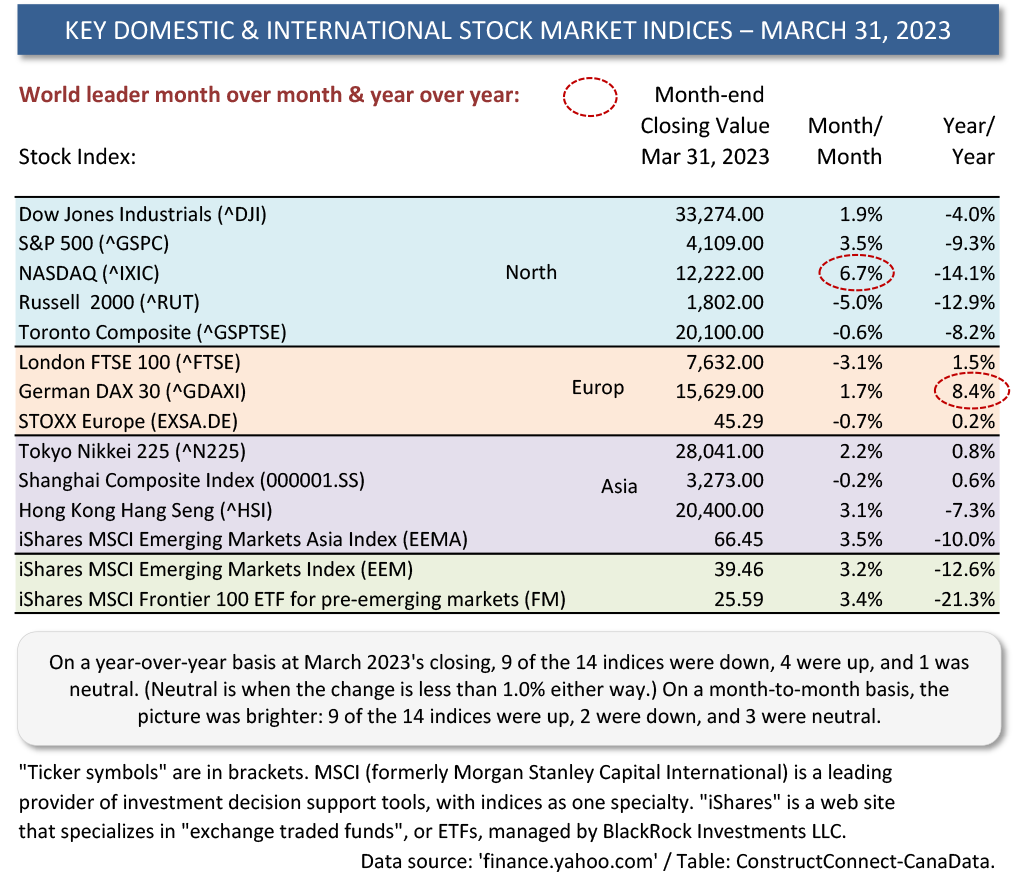

During March just passed, the DJI 30 index moved +1.9%; the S&P 500, +3.5%; and NASDAQ, +6.7%. The TSX stayed more or less flat, -0.6%. Only the Russell 2000, which reflects equity price movements for the 2,000 smallest publicly traded companies, was hesitant about putting a brighter face on things, backtracking -5.0% (Table 1).

A similar pattern was evident internationally (Table 2). While London’s FTSE was -3.1% month to month, the German DAX 30 was +1.7%; Tokyo’s Nikkei, +2.2%; and Hong Kong’s Hang Seng, +3.1%. STOXX Europe stayed essentially level, at -0.7%.

A similar pattern was evident internationally (Table 2). While London’s FTSE was -3.1% month to month, the German DAX 30 was +1.7%; Tokyo’s Nikkei, +2.2%; and Hong Kong’s Hang Seng, +3.1%. STOXX Europe stayed essentially level, at -0.7%.

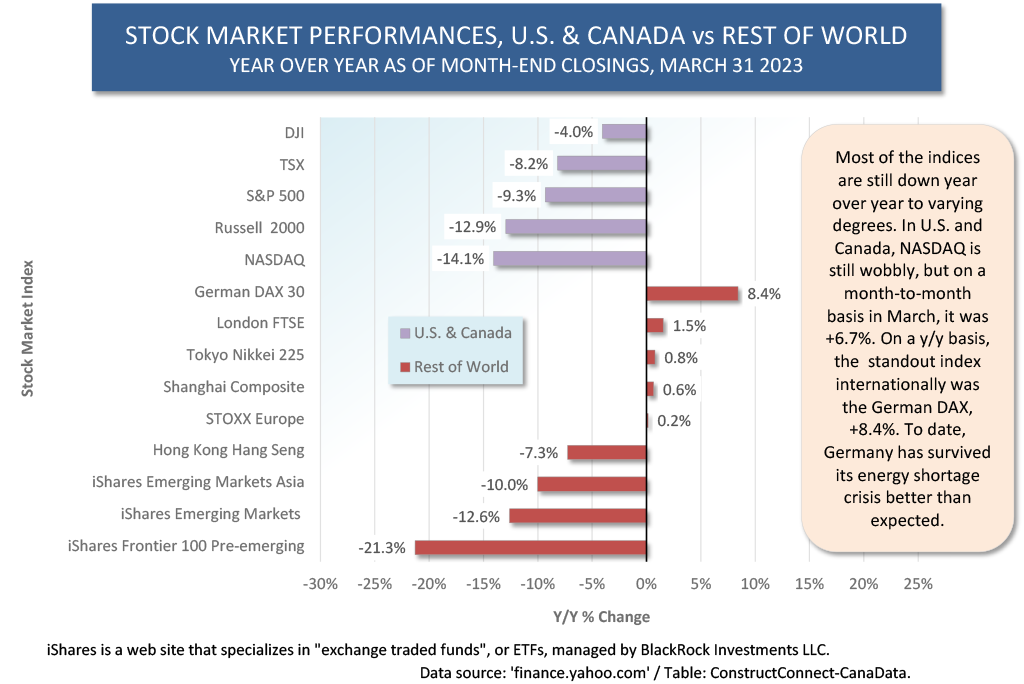

Germany’s DAX led all indices globally on a year-over-year basis in the latest month, +8.4%. New factory orders in Germany came in considerably stronger in February than had been expected. They were +4.8% versus January. Moreover, they marked three consecutive months of forward motion.

Furthermore, Europe’s biggest economy has managed, so far, to navigate its energy shortage crisis with surprising dexterity, finding alternative sources of natural gas (e.g., from nations in Africa, plus LNG from the U.S.) to substantially (50%) replace what was previously being shipped from Russia.

In an upside-down manner, some recent news items about a weakening economy, and job markets in particular, are perhaps causing investors to turn more optimistic about the medium and longer-term outlooks. If central banks believe their rate-tightening measures are finally paying off in slowing economic activity and putting a damper on inflation, they’ll be more likely to cease their hawkish behavior. That’s the hope, at least.

There have been numerous reports about job layoffs in the technology sector. This is beginning to spread to retail. These employment adjustments have not been appearing in the weekly ‘initial jobless claims’ figures. Suddenly, that has changed. The Department of Labor (DOL) has undertaken an extensive revision of its data series. In the DOL’s new findings, just released today, the last time ‘initial jobless claims’ were less than 200,000 was for the week ending January 28th (199,000).

Since the end of January, the number has been close to 250,000 on three occasions, for the weeks ending March 4 (245,000), March 18 (247,000) and March 25 (246,000). Those are still not terribly alarming statistics. They would have to shoot to 300,000 and above for serious brow mopping to occur. Nevertheless, they do suggest the heady days of record low unemployment and unlimited job opportunities are slipping away. Apparently, to achieve success in its smothering inflation fight, this is what the Fed wants to see.

By the way, there is an oddity about the calculation of the DJI index. The weighting of the companies in most stock market indices is based on their market valuations, also known as capitalizations (i.e., share price times number of shares). The weighting of companies in the DJI, though, is based on the actual share price. Therefore, if a company with an individual share price of $800 has a stock price uptick, it may overwhelm decreases for several other companies with share prices of $200 or $50, etc. Clearly, this introduces a hard-to-judge distortion.

There’s a bit more to the calculation of the DJI index in that something called a ‘Dow Divisor’ is applied to the sum of the constituent share prices. The ‘Dow Divisor’ has become a multiplier over the years, since it’s fallen below the number 1.0 due to corporate share splits and spinoffs.

This is going too deep into the weeds. In any event, the curious way in which the DJI is calculated does not seem to have had much impact on how widely it is accepted as a gauge of the performances of 30 marquee corporate stocks.

Table 1

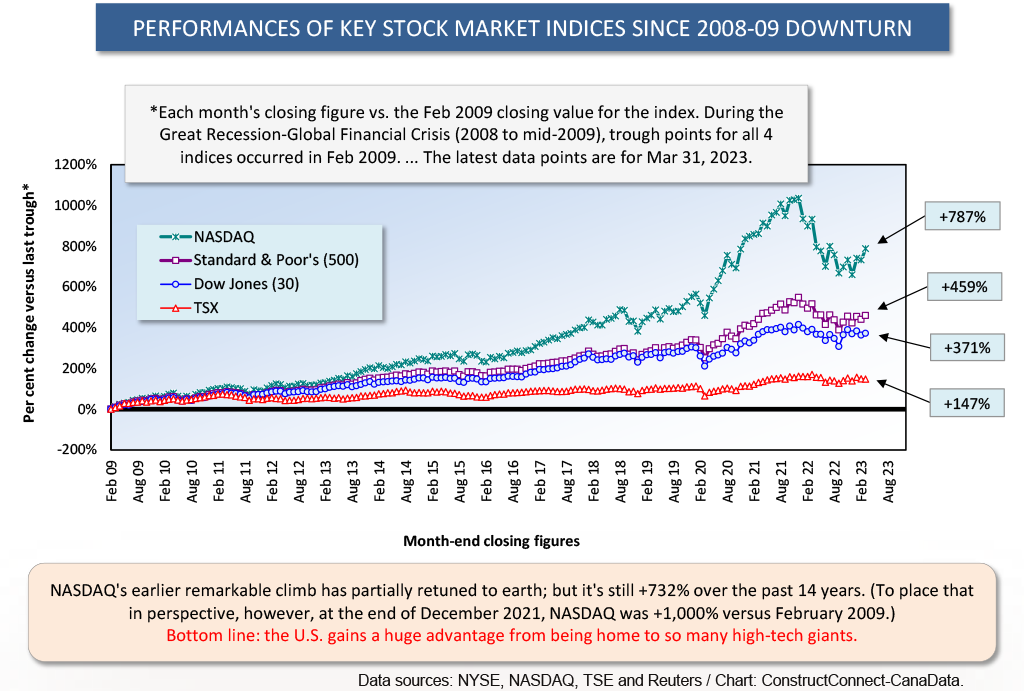

Graph 1

Graph 2

Graph 3

Table 2

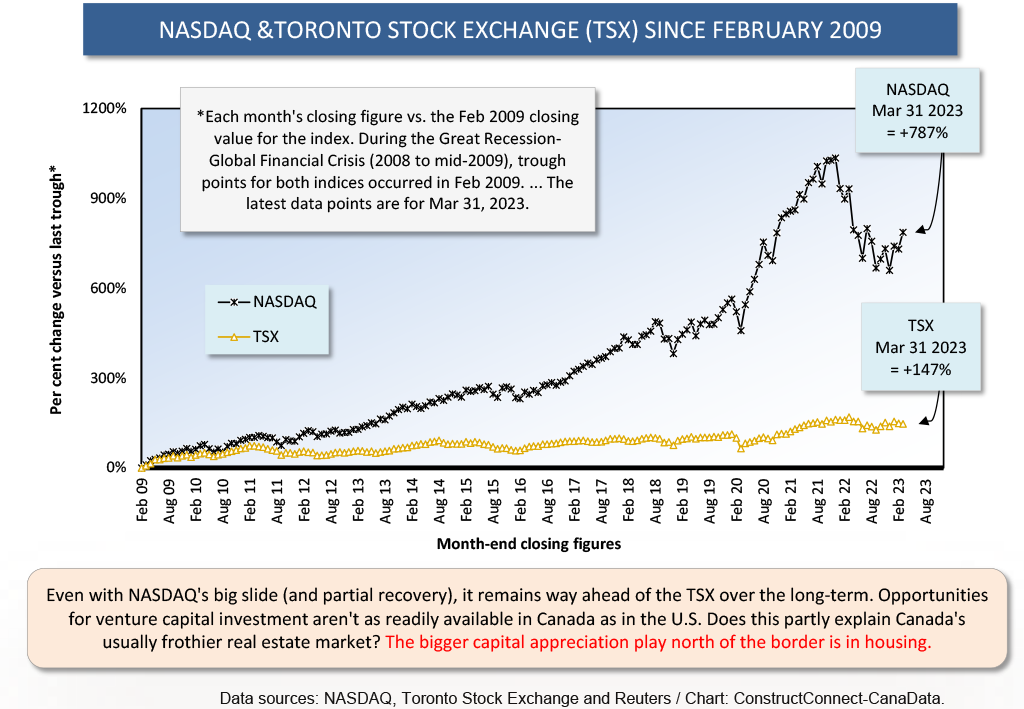

Graph 4

Graph 5

Alex Carrick is Chief Economist for ConstructConnect. He has delivered presentations throughout North America on the U.S., Canadian and world construction outlooks. Mr. Carrick has been with the company since 1985. Links to his numerous articles are featured on Twitter @ConstructConnx, which has 50,000 followers.

Recent Comments