The federal and Ontario government budget announcements are expected to head in opposite directions, with the province focusing on restraint while the feds produce “a classic pre-election document” that could contain a number of infrastructure goodies.

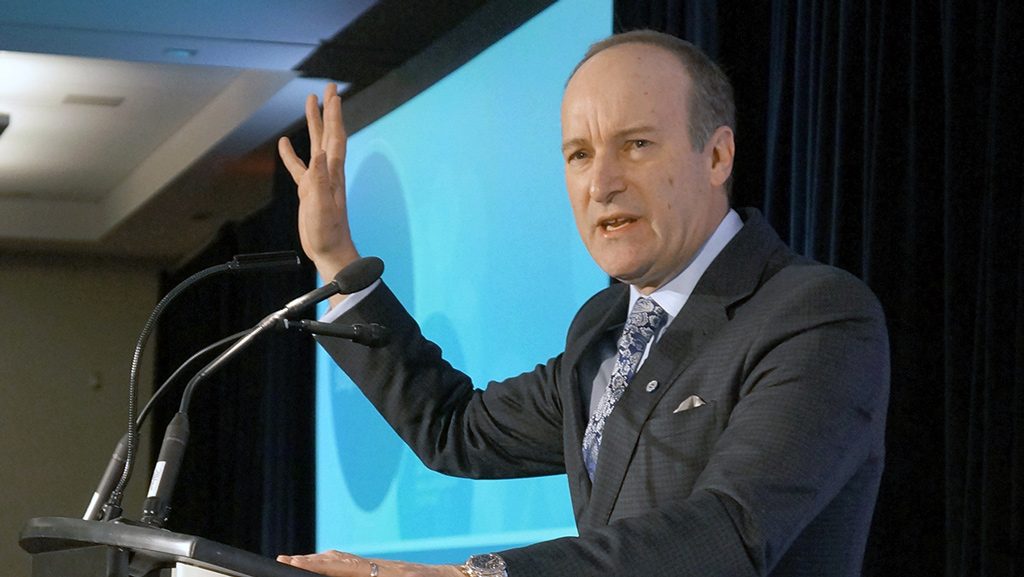

That is the word from Douglas Porter, a chief economist and managing director with BMO Financial Group, who gave his economic prognostications at the Ontario Construction Secretariat’s (OCS) 19th annual State of the Industry and Outlook Conference recently in Toronto.

“They (the federal Liberals) desperately want to change the conversation from all the noise we’ve heard around the former justice minister and SNC-Lavalin,” he said.

The federal government budget will be unveiled March 19.

Porter said the federal government’s promise of big infrastructure spending over its four-year term hasn’t happened — other than “a temporary burst in 2017.”

He believes its finances are “running about $9 billion better” than tabulated in the original budget, which “gives them lots of room to announce new things,” such as infrastructure spending.

But there is “a fundamental friction” between the provincial and federal governments that could hamper a partnership on infrastructure spending.

Porter told OCS delegates that current polls indicate a minority government in October “but the polls could swing and swing violently.”

The economist said he is “quite concerned” for Ontario that steel and aluminum tariffs are still in play. If they remain that could “clip Canadian growth by 0.4 percentage points. That doesn’t sound like a huge deal but it is a big hit.”

He said in Ontario “the tide will turn” on budget restraint measures in about two years when the Conservatives “wheel out better news” in the latter half of their term in power.

Porter told delegates growth in Canada is expected to be about 1.5 per cent in 2019 — down 0.5 per cent from an average year. The first quarter is dampened largely by cold weather and oil industry woes.

He said over the past two years Canada strayed off its usual economic path being near par with the U.S. The U.S. led growth among G7 countries last year mainly because it has “run a huge budget deficit.” That deficit is projected to hit $1 trillion in 2019.

“This was basically a one-off party they had,” he said. “We think by next year Canadian/U.S. growth will be level at a slightly below-average pace.”

He said the auto sector — Ontario’s main economic driver — has been gearing down and is a key factor in why the economist sees modest growth in the province this year.

While B.C., Quebec and some Atlantic provinces have small budget surpluses, other provinces will run deficits, he said. Alberta and Newfoundland will have the largest deficits per capita.

Meanwhile, a third of the contractors polled in the annual OCS contractor survey said they expect more work this year than in 2018. Only 17 per cent of respondents expect to do less work.

Based on the responses of 500 union and non-union contractors across the province, the survey found that 61 per cent of the contractors prefer when owners or buyers of construction have a pre-qualification requirement during procurement, Katherine Jacobs, the OCS’s director of research, told delegates at the conference.

About half of them indicated they would more likely bid on a project if they would be pre-qualified. Most of those contractors indicated it was “fairer for us” bidding against equally qualified contractors.

Sixty-nine per cent of contractors see the recruitment of skilled labour as a growing problem and 79 per cent said it has dampened their business growth plans, Jacobs said. A third of the contractors said the quality of their work was deteriorating because of the shrinking skilled worker pool.

Top solutions to the crisis for union contractors included hiring more apprentices and adopting new technologies, while non-union employers saw raising wages and deploying labour more efficiently as answers.

About a third of the contractors polled by the OCS were concerned about the prospect of cuts by the provincial government and they were also concerned about new technology’s impact on their work world, Jacobs said.

Recent Comments

comments for this post are closed