During an afternoon of economic analysis where four economists speaking at CanaData’s virtual conference spoke of wildly uneven prospects across various sectors, hope emerged that next year Canada’s economy would see a strong rebound from the carnage of 2020.

Both Peter Hall, vice-president and chief economist for Export Development Canada, and Graham Robinson, global business consultant at Pinsent Masons LLP, said during the Oct. 1 CanaData session they expected GDP growth next year would surpass this year’s loss. Hall predicts that a GDP decrease this year of 5.5 per cent will be followed by a rebound of 5.7 per cent next year, while Robinson thinks the economy will bounce back 6.2 per cent next year after a drop of 5.1 per cent this year.

The optimism came amidst frequent doses of economic realism. Introducing the day’s speakers, ConstructConnect’s chief economist Alex Carrick said, “Now we come to the economy and what we might expect after the worst two months, March and April, in the history of U.S. and Canadian data reporting.”

“Everything stops and starts with the pandemic data”

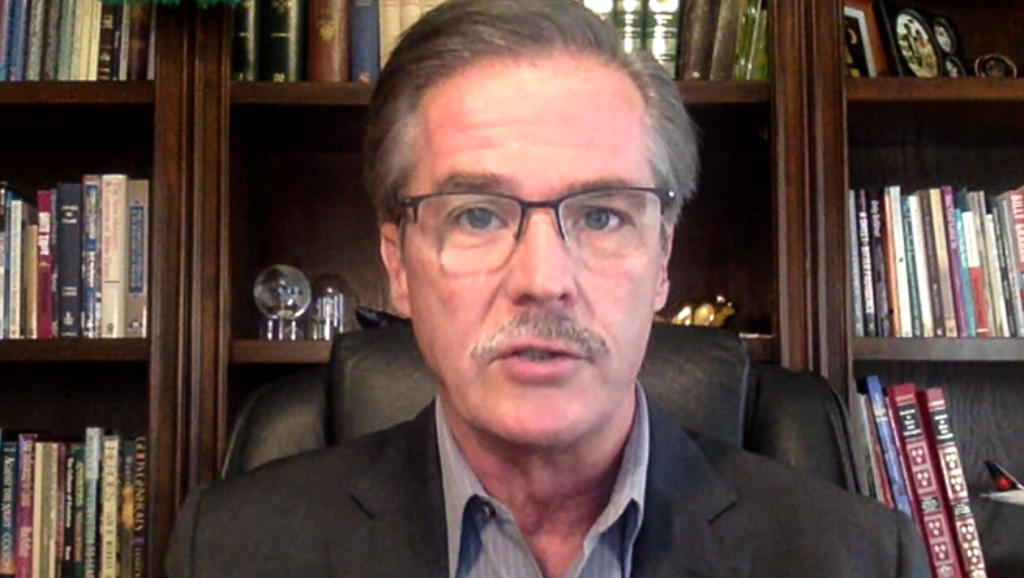

Hall spoke first, addressing the volatility of the times.

“I can confidently say, no living economist has ever seen or studied what we are experiencing at the moment,” he remarked.

“The speed with which we have collapsed in a short period of time and the degree with which we have responded globally on the fiscal and monetary side of things has no peer.”

Economic activity will rise and fall in lockstep with COVID statistics, Hall said. Companies around the world are strategizing based on infection rates.

“Everything stops and starts with the pandemic data,” said Hall. “What we are struggling with is, what’s next?”

Hall noted there was tremendous pent-up demand in Canada with consumers ready to spend when the time seems right. Canadians who are working are piling up money in bank accounts.

“There is an absolute explosion in savings rates,” said Hall.

Other positive trends come from recent stats on retail sales and goods exports. Both have had V-shaped recoveries with retail spending in Canada leading that of the U.S. and Europe and topping levels in November 2019.

But sectors such as tourism and aerospace are experiencing the “dreaded” L-shaped growth, Hall said.

Then there are K-shaped graphs, with some sectors split between strong recovery and poor. That’s energy (low costs and revenues) and food (high levels of activity). Of course low energy costs are helpful for some constructors, Hall noted: “If that is an input cost for you, the prices are quite stable.”

Hall noted that construction ranked well against other sectors in terms of the journey back to pre-pandemic activity. And business optimism is on the rise.

Laying out takeaway trends, Hall said the construction sector would benefit from the spike in tech use and increased mechanization, and the trend towards re-shoring and “glocalization,” meaning realignment of supply chains closer to home, would benefit some Canadian construction suppliers and contractors.

Population drives basic construction

Robinson offered analysis and forecasts for 10 national construction sectors.

Canada’s construction output declined 14 per cent between Q4 2019 and Q2 2020 but it’s expected that by Q2 2021 construction output will have rebounded to 98.8 per cent of Q4 2019 levels.

Looking ahead the next five years, Canada’s economy is expected to benefit from the nation’s continuing population growth, spurred by immigration.

“A big driver of construction is population growth. Population really drives basic construction,” Robinson said, mentioning housing and utilities as examples.

Looking through a 10-year lens, construction spending in Canada ranked against global nations is expected to drop one slot, to ninth from its current status as the eighth largest output. It now accounts for 2.7 per cent of global construction output but will fall to 2.4 per cent in 2020. China is expected to increase its lead in that time and will account for 24.1 per cent of global construction output by 2030.

“Steelmageddon” is on the horizon

Next up at the conference was Timna Tanners, metals and mining specialist at the Bank of America.

Offering analysis of the cost of construction materials in the U.S. market, she warned of a coming “steelmageddon” next year south of the border as four new steel mills open or finish expansions in the U.S. and two others open in Mexico.

That is good news for buyers and bad for manufacturers.

Tanners predicted a “shakeout that could involve prolonged battles for market share that result in depressed prices.”

Carrick wrapped up the proceedings with more Canadian analysis.

Canada’s new home starts in August were the second most ever, with its 262,000 starts second only to the 277,000 units started in September of 2007.

Carrick also presented statistics showing significant swings in civil construction forecasted for this year and next. Civil is expected to drop 35.1 per cent in 2020 but it should rebound 36.3 per cent next year. Double-digit growth is expected the next two years after that.

“The economic recovery is going to be uneven, there is no way to escape that,” he said.

Follow the author on Twitter @DonWall_DCN.

Recent Comments

comments for this post are closed