A year ago, Statistics Canada reported that the residential building construction price index for the 11 largest census metro areas in the country posted a year-over-year gain of +11.0% in Q1 2021. At the same time, the non-residential building construction price index rose by +2.0% y/y.

Not long after, in July of last year, the Bank of Canada (BOC) stated in its Monetary Policy Outlook that “The factors pushing up inflation are transitory, but their persistence and magnitude are uncertain and will be monitored closely”.

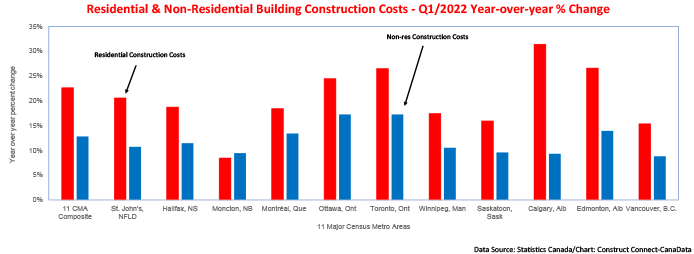

Fast forward to this year and we learn that residential building construction prices for Q1 are up by an unprecedented +22.6% while the non-residential construction price index is up by +12.8%. Obviously, the factors the BOC was referring to back in July 2021 were not as transitory as they expected.

Labour shortages, lumber and energy prices drive up residential construction costs

The faster increase of residential construction prices relative to non-residential construction prices over the past four quarters stems in part from a stronger activity level for the former than the latter. Plus, on the supply side, because residential construction is more labour intensive, it has been hit harder by rising labour costs, stemming from a widespread shortage of construction workers, as verified by a record-high construction job vacancy rate.

Another major contributor to higher residential construction costs has been the price of lumber, which rebounded by +39% in the first quarter of this year after retreating in the second half of 2021.

Finally, both residential and non-residential construction costs have been driven upwards by higher prices for energy, including natural gas, gasoline, and diesel fuel. On average, the price of those three key fuels has risen by +76% year to date, just under twice the +43% increase they posted in the first three months of 2021.

Calgary, Toronto, and Edmonton saw largest gains in residential construction costs

Among the 11 major metro areas surveyed by Statistics Canada, residential building construction costs in Calgary exhibited the largest quarter-over-quarter increase (+6.9%) due in part to higher lumber prices, which boosted the cost of townhouses (+7.4%) and single-detached dwellings (+7.2%). Construction costs rose by +6.8% q/q in Toronto and Edmonton, also led by increases in the cost of building townhouses and single-detached dwellings.

On balance, apartment construction costs increased at a slower rate (+5.0% q/q) than single-family dwelling costs (+6.3%), due in part to an easing in the cost of cement and ready-mix concrete through the final quarter of 2021 and into early 2022.

Slower non-res investment dampens growth of building costs

Consistent with the -0.5% year-to-date decline in non-residential investment, related construction costs in Q1 2022 slowed to +2.6%, driven by higher prices for structural metal products, fabricated steel plate, other metal products, energy, and persisting shortages of labour.

Across the country, non-residential construction costs exhibited the largest year-over-year gains in Toronto (+17.3%) and Ottawa (+17.2%). In both CMAs, construction costs appear to have been spurred on by outsized investments in warehouses, industrial buildings, and factories.

Rising Interest rates will cool residential construction costs faster than non-res costs

There is growing evidence that the combination of recent and projected hikes in mortgage rates and softening demand for building materials will gradually depress the growth of residential building construction costs. In May, seasonally adjusted sales of existing homes declined in all 11 of Canada’s largest CMAs, led by Vancouver, (-18.4%), Calgary (-15.9%) and Ottawa (-11.4%). Also in May, average house prices retreated, and the sales-to-listings ratios declined across all 11 major CMAs.

On the supply side, although lumber prices have recently started to trend lower, the prices of most construction materials have shown few signs of moderating. And, until there is a decline in residential building in the second half of this year, labour shortages are likely to keep upward pressure on wages.

Also, the impact of Russia’s attack on Ukraine appears likely to maintain upward pressure on energy prices well into the second half of this year and possibly into 2023. Given that they have not accelerated as much as residential construction costs, non-residential construction costs will probably not retreat as much over the near term. This prospect is reinforced by the relatively large +36% year-to-date gain in non-residential building approvals.

John Clinkard has over 35 years’ experience as an economist in international, national and regional research and analysis with leading financial institutions and media outlets in Canada.

Recent Comments

comments for this post are closed