Due to its complexity, much of the subject matter concerning the economy requires detailed editorial commentary, often supported by relevant tables and graphs.

At the same time, though, there are many topics (e.g., relating to demographics, housing starts, etc.) that cry out for compelling ‘shorthand’ visualizations.

Whichever path is followed, the point of the journey, almost always, is to reach a bottom line or two.

To provide additional value, ConstructConnect is now pleased to offer an ongoing series of 1,000-word charts.

These will help readers sort out the ‘big picture’ more clearly.

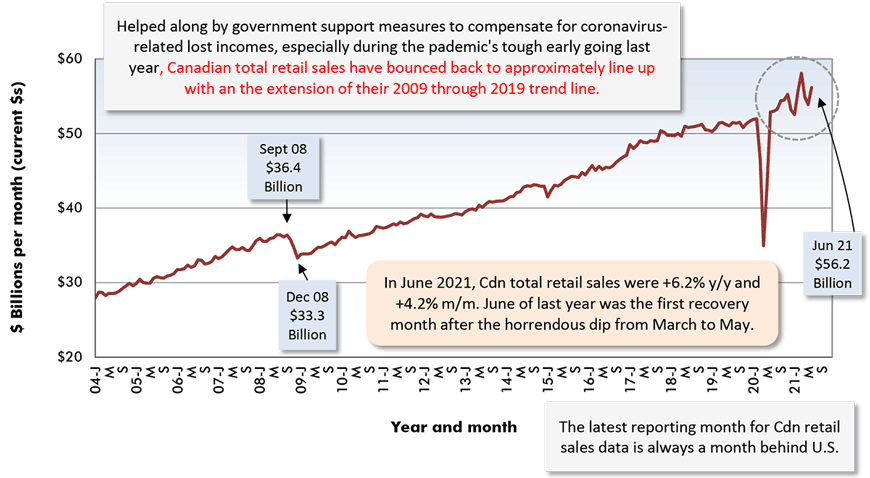

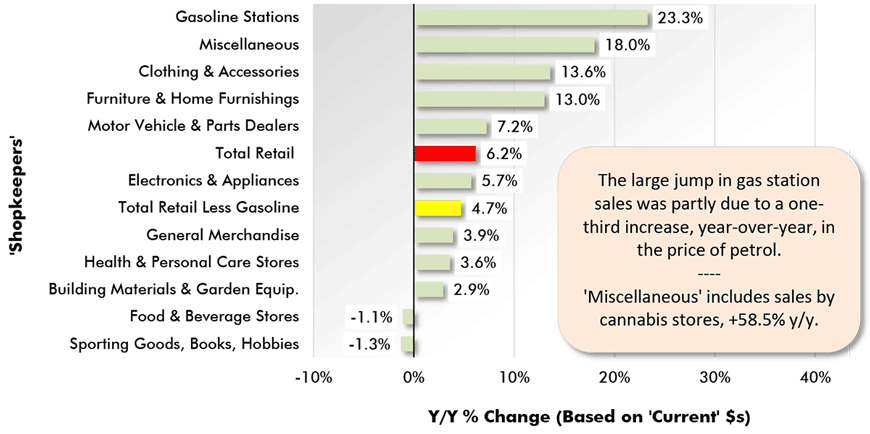

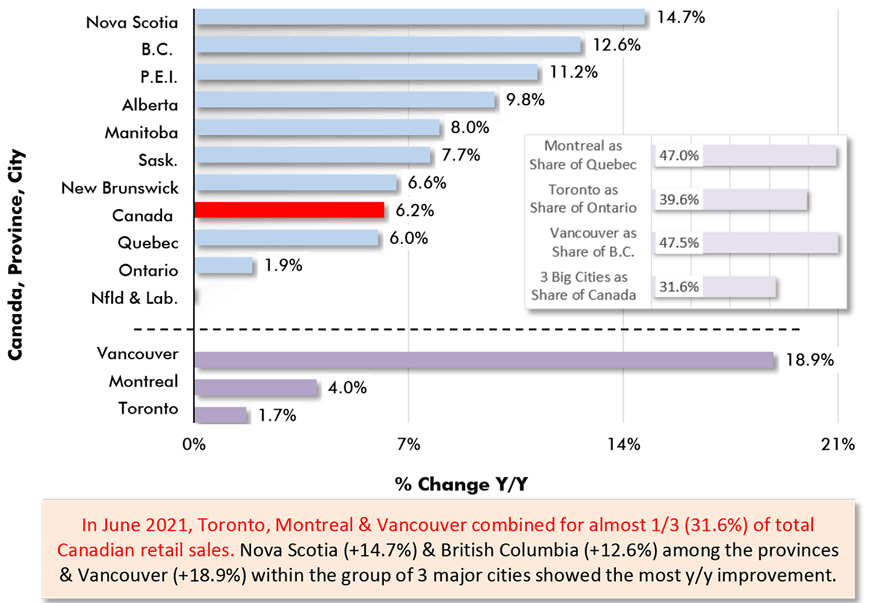

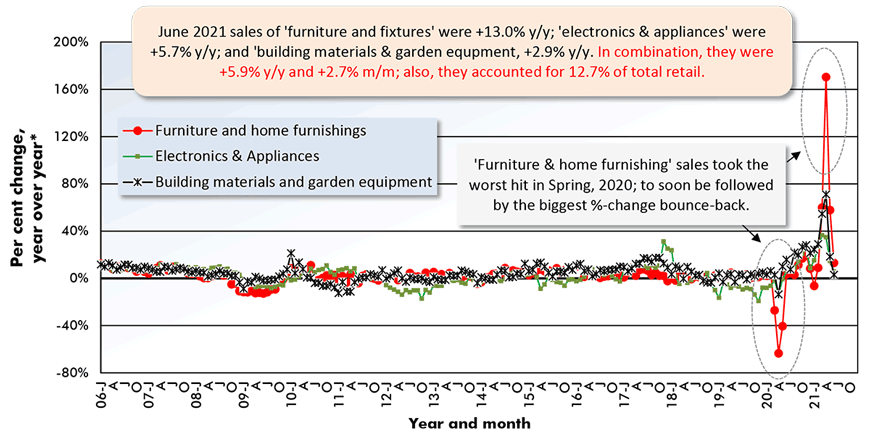

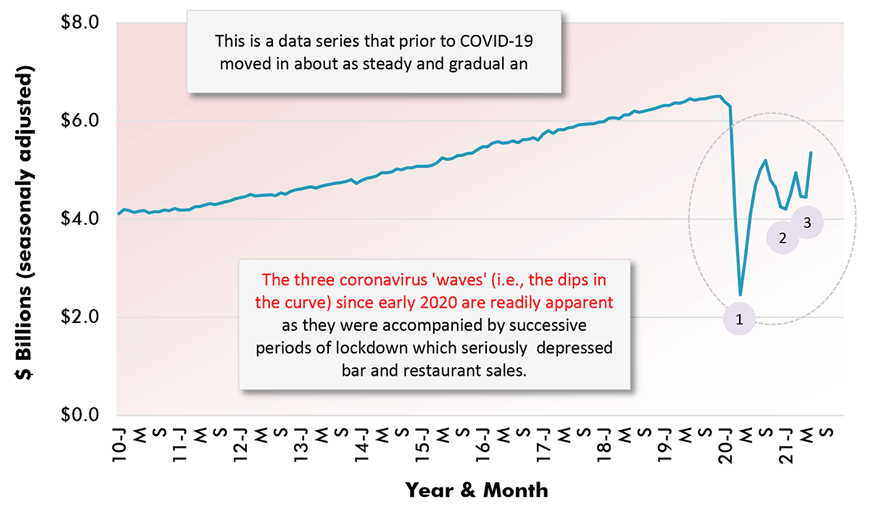

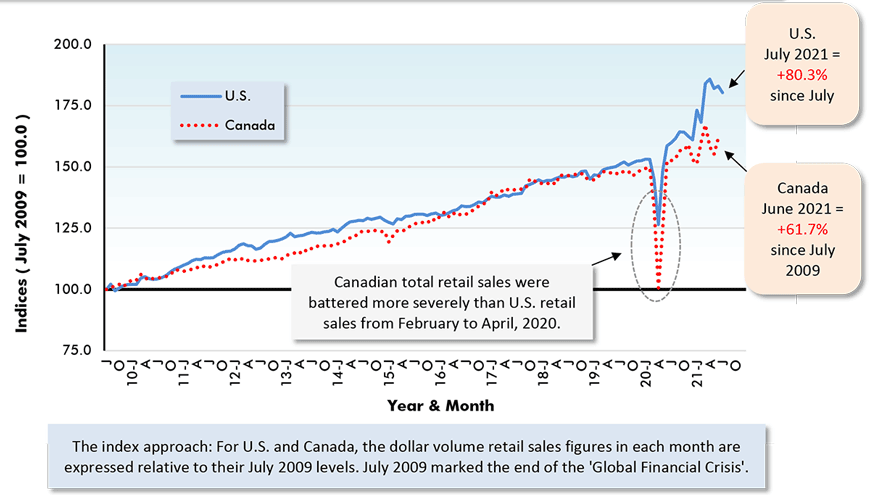

These 1,000-word charts look at the latest retail sales figures in Canada, as of June 2021.

Chart: ConstructConnect.

Chart: ConstructConnect.

June 2021 Year-over-Year (Y/Y) & Shares

Chart: ConstructConnect.

*"Year over year" is each month versus the same month of the previous year.

‘Based on ‘current’ (i.e., no accouting for inflation) dollar and seasonally adjusted data.

Chart: ConstructConnect.

Chart: ConstructConnect.

Based on Data Adjusted for Seasonal, Holiday & Trading Day Differences

Chart: ConstructConnect.

Please click on the following link to view the latest retail sales charts for the U.S. and Canada: CanaData Forecaster Charts & Tables – Retail Sales

Alex Carrick is Chief Economist for ConstructConnect. He has delivered presentations throughout North America on the U.S., Canadian and world construction outlooks. Mr. Carrick has been with the company since 1985. Links to his numerous articles are featured on Twitter @ConstructConnx, which has 50,000 followers.

Recent Comments