Tighter-for-longer monetary policy

The Organization for Economic Co-operation and Development, the International Monetary Fund, and the World Bank have all scaled back their estimates for growth in 2023 and 2024, highlighting that they consider the health of the global economy to be very fragile. The principal contributor to these lower growth projections is the impact of the tighter-for-longer monetary policy adopted in most developed countries, to bring headline inflation back to target, a process which is heightening the risk of a global recession. Reflecting the deteriorating outlook for European manufacturing activity, the HCOB Eurozone Manufacturing Purchasing Managers Index dropped from 43.4 in September to 43.0 in November due, in part, to one of the strongest contractions in the new orders component ever recorded.

U.S. economic activity to cool heading into 2024

Following an increase of +2.1% in the second quarter, the U.S. economy posted a much stronger than expected +4.9% gain in its third quarter GDP. While the most recent measure of U.S. overall economic activity exceeded expectations, other statistics are not looking as positive. First, the U.S. Conference Board’s Leading Economic Indicator declined by -0.7% in September after falling by -0.5% in August and by -0.3% in July.

Second, the ISM’s Purchasing Managers Index (PMI) shed 2.3 percentage points in October, indicating the economy had started to contract after briefly signaling earlier the beginning of an expansion.

Third, despite the moderate gain in establishment employment in October, U.S. consumer confidence trended lower for the second consecutive month.

Finally, persisting inflation is largely responsible for causing small business optimism to trend lower in September following a brief uptick in August.

In Canada, weakening hiring, spending, and investment plans

While the outlook for the U.S. economy is overcast, with a material risk of a recession early next year, several forward-looking indicators suggest Canada’s near-term economic prospects are much bleaker. Also, the country faces major challenges in the longer-term.

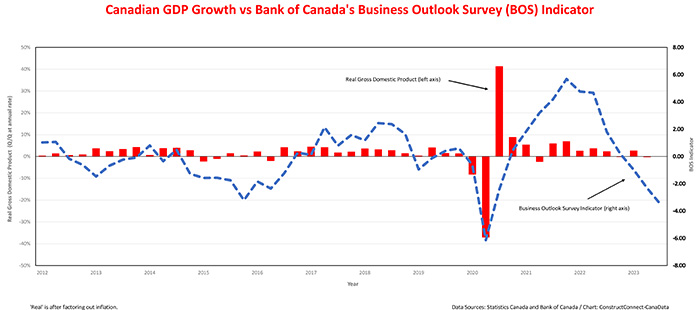

The most troubling report is the Bank of Canada’s latest (2023 Q3) Business Outlook Survey. It reported that the BOS indicator, a summary measure of the main Business Outlook questions, fell in Q3 2023 to its lowest print since Q2 2020, in the depths of the pandemic.

Subcomponents of the BOS indicator that contributed to its weakness included deteriorating expectations of future sales due to inflation’s negative impacts on real incomes, investment, and hiring plans.

The latest Canadian Survey of Consumer Expectations, which the Bank of Canada released at the same time as the BOS, revealed that 64% of respondents expected inflation to remain above 3% for the next 12 months.

Given these persisting above-target inflation expectations, it is not surprising that, in its last policy rate announcement, the Bank of Canada held its target for the overnight rate at 5.00% for the third consecutive quarter and gave itself the option of further rate hikes in the event inflationary pressure intensifies.

Reflecting the weakness indicated by the Business Outlook Survey, Canada’s GDP stalled in July and August and appears likely to remain flat or possibly contract in Q4. This prospect is reinforced by the persisting drag of high interest rates on consumers carrying a household debt load which, at 180.2% of disposable income, is the second highest among the 26 countries in the OECD, and just slightly below the record high of 184.7% reached in the third quarter of last year.

While inflationary pressure may dissipate more quickly than many expect, thereby enabling the Bank of Canada to take its foot off the monetary policy brake, the likelihood of this happening is highly uncertain.

Looking beyond 2024, and assuming that fiscal and monetary policy are no longer fixated on reducing inflation, Canada faces two major challenges. First, consistent with the deterioration in the outlook for future sales noted in the Bank of Canada’s BOS, the rate of business openings fell to its lowest level on record in July. Reflecting an erosion of confidence in the near-term outlook, business openings in construction declined to their lowest level since early 2021.

Second, weak business investment since 2015 has resulted in a decline in capital per worker, leading to a drop in the nation’s standard of living vis-à-vis Canada’s major trading partners.

On balance, the recent data on the status of the Canadian economy is in line with the view we expressed in late August, that growth will contract in the final quarter of this year and on into early 2024.

Recent Comments