While recently released data on the Alberta economy still paints a mixed picture of its economic health, underlying fundamentals remain strong. First, although total exports over the past 12 months are down by -15.6% compared to the same period a year earlier, this decline is mostly due to a -13% drop in exports of oil, together with a -56% decline in foreign sales of natural gas, caused by record warm temperatures which depressed prices and enabled consumers to turn down their thermostats.

However, the province’s export story is not over. The Trans Mountain Pipeline is rapidly nearing its ‘fill’ date. Once this is reached, the capacity of the twinned pipeline will jump from 300,000 barrels per day (bbl/d) to 890,000 bbl/d, an increase of +196%.

An unprecedented boost to Alberta’s population in 2023

Further on the positive side, over the past year, total employment in the province has increased by +134,000 jobs, well ahead of the +92,000 jobs added by second-place Ontario. Moreover, +69,000 of the new jobs have been in the private sector compared to +52,700 in neighbouring British Columbia.

Most jobs added over the past 12 months have been in service-producing industries in the private sector led by the ‘professional, scientific and technical’ sub-sector, +46,700 jobs. Among goods-producing industries, manufacturing has added +19,000 jobs, followed by agriculture, +15,600.

Fuelled by the sustained growth of full-time employment, plus a record high inflow of permanent residents, and despite the headwind of persisting high-interest rates, sales of existing homes in Alberta were up +32.9% y/y in February. This was their largest year-over-year gain since March of 2023.

Consistent with the strong gain in home sales, the Alberta House Price Index was ahead +9% y/y in February, its largest annual gain since September of 2022. Although interest rates remain an impediment to home ownership, housing starts are +5.4% year to date, led by a +21% y/y increase in initiations of row dwellings, followed by apartments, +10.6%, and semi-detached properties, +10.2%.

After retreating by -2% in 2022, single-family starts fell by a further -6.7% in 2023. Going forward, the fundamental drivers of both ownership and rental accommodation appear strong for several reasons. First, the steady downtrend in the consumer price index to within the Bank of Canada’s +1% to +3% target range increases the likelihood the Bank of Canada will ease interest rates mid-way through this year for the first time since May of 2022.

Second, consistent with the climb in the inflow of permanent residents, applications to build row dwelling units have risen by +15% y/y over the past 12 months, while applications to build apartments are up by +13.4% y/y over the same period. The increases in these two types of dwellings more than offset declines in applications to build single-family (-5.5%) and semi-detached (-17%) units.

Given the positive forward-looking indicators of residential construction, we expect the province’s housing starts to total in the range of 42,000 to 45,000 units this year and 45,000 to 47,000 units in 2025, after hitting 35,900 units in 2023.

Capital spending moderation in wake of Trans Mountain’s completion

According to Statistics Canada’s 2024 non-residential capital and repair expenditures survey, total investment by businesses and governments in Alberta slowed from a Trans Mountain Pipeline-fueled +25.6% year-over-year gain in 2022 to a -1.1% y/y moderation in 2023. A further easing of -0.9% is projected for 2024.

Across industries, spending on transportation and warehousing dropped the most, by -35%. Spending on public administration is also projected to decline this year consistent with the government’s commitment to restrain its expenditures to put additional reserves into the Alberta Heritage Savings Trust Fund, which is targeted to reach $250 billion by 2050.

Major Alberta projects which are proposed or under construction include the Meadow Creek East SAGD Project in Wood Buffalo, the Pathways Alliance Carbon Capture and Storage Hub, and the Mildred Lake Mine Extension at Wood Buffalo.

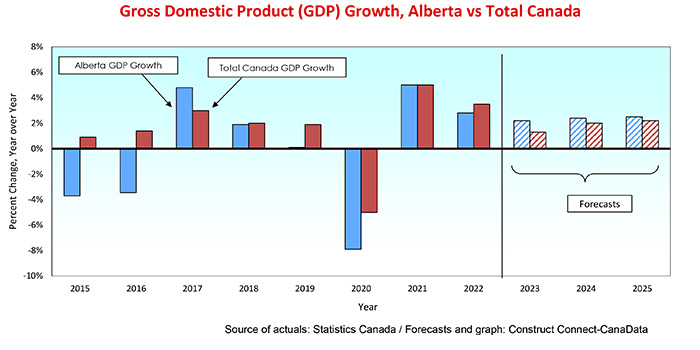

Alberta’s economic pulse will outpace rest of country once again

The back-to-back gains in consumer confidence reported by the Conference Board in Canada in March, the sustained growth of full-time employment over the past three months, and the probable boost to the province’s commodity exports stemming from the doubling of oil shipments tied to the start-up of the Trans Mountain pipeline, will collectively cause growth in Alberta to outpace the rest of the country (with the possible exception of Prince Edward Island) this year and next.

Recent Comments