Industrial construction continues to be one of Canada’s most reliable building sectors with record completions in Q4 2023, balanced fundamentals and anticipation of robust demand going forward.

Two Altus Group analysts said recently industrial has remained strong despite high interest rates and continued inflationary pressures, continuing its pandemic and post-pandemic momentum.

Many trends point to continuing growth, said Altus Group vice-president of data solutions Ray Wong – examples include construction of “big bombers,” huge warehouse spaces alongside the conversion of older industrial spaces for modern uses such as pickleball courts; strong consumer demand coupled with population growth fuelling development of retail distribution centres on the periphery of big cities; and tremendous resources being poured into battery, EV and other new-industry plants, certain to spur major growth in ancillary industrial spaces.

Altus Group senior research analyst Jennifer Nhieu said emphatically “yes,” industrial looks to continue its growth alongside multi-unit residential, although a recent report she wrote noted some industrial markets have experienced a return to moderation after the “feverish demand” of the first half of 2023. Nhieu wrote investors have exhibited “cautious optimism” of late.

“In the post-pandemic era, there was definitely a boom for e-commerce, distribution and warehousing and we really saw that push into 2023,” she said.

“The GTA, southwestern Ontario and Calgary markets are in relatively good health despite the economic slowdown that we have.”

The Altus Group Canadian industrial market Q4 2023 update released Jan. 11 reported that investors continue to favour the asset class for its minimal risk and stable returns. In the fourth quarter of 2023, the national availability rate increased by 0.7 percentage points to 4.3 per cent, with increases observed in all major markets, but there was a good balance with supply of industrial spaces generally keeping up with demand, although the market remained tight.

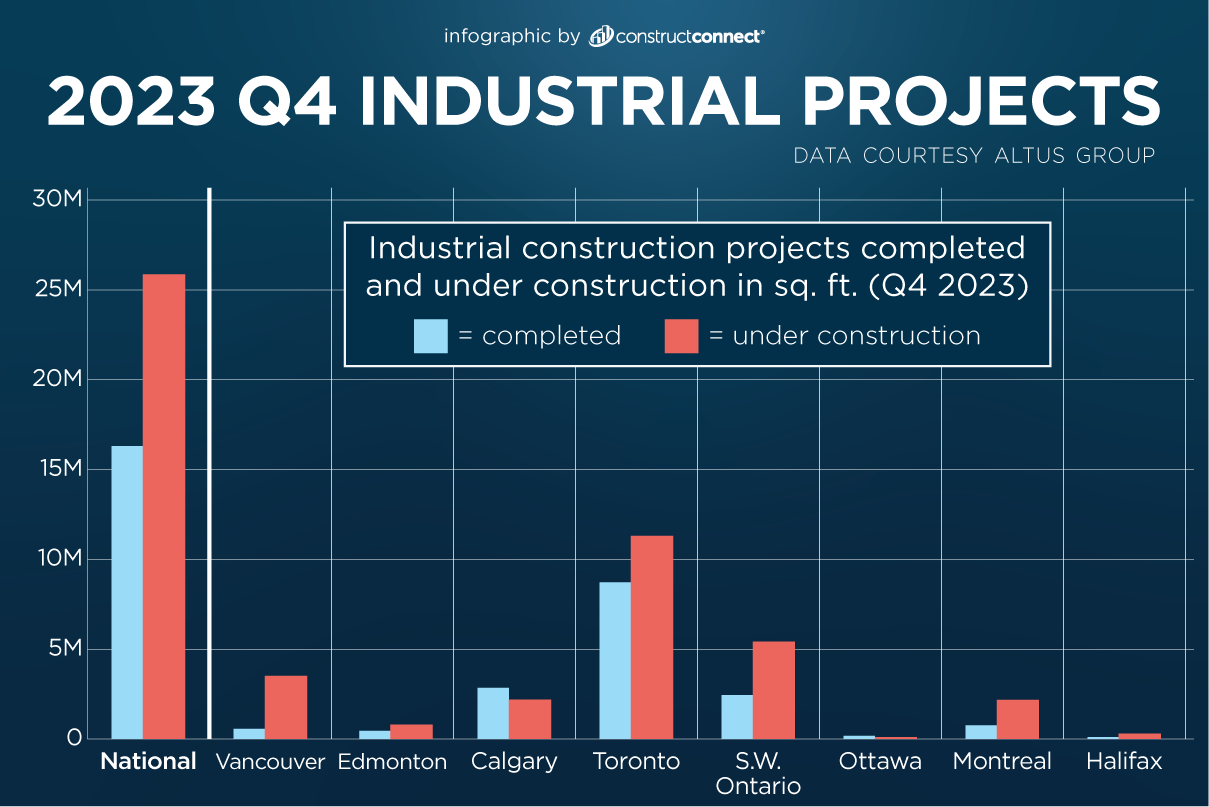

The record construction completions contributed to the increase in availability rate, with 16.3 million square feet and 62 per cent of the new space available. Normally, Q4 output is below 10 million square feet.

There were 79 buildings completed in Q4 across Canada, with 38.3 per cent pre-leased. Toronto led the way contributing new supply, with 8.7 million square feet, followed by Calgary (2.9 million square feet) and southwestern Ontario next in the ranking.

In the fourth quarter of 2023, there were 144 industrial projects in the construction pipeline, totalling 25.9 million square feet, with 41.1 per cent pre-leased. Again, Toronto doubled the second-place region, southwestern Ontario, with 11.3 million square feet under construction compared to 5.4 million. Vancouver was third with 3.5 million square feet.

Projects adding to supply were often found in suburban Toronto, such as light industrial projects in Burlington, Ajax and Milton, Nhieu said.

“These are mostly industrial parks of the e-commerce nature, some in manufacturing as well,” she said.

Wong said the growth in e-commerce predated the pandemic and ballooned during the pandemic. Even pre-pandemic, there was a shortage of industrial space, especially in logistics, he said, which is why the overall availability rate remained low.

“We’ve sort of caught up a little bit on the industrial logistics side,” he said.

“Whether or not we’re at a point where we’re getting close to meeting that underserved demand on the logistics side, that’s something we’re going to watch.”

Rents have gone up 15 to 20 per cent in the past four years, Wong said, keeping investors interested. But there’s a trend he identified starting about 18 months ago – users facing that kind of an increase in rents can be tempted to build their own spaces if they have capital.

“They’d rather have a little bit more stability whereby they can control their assets,” said Wong.

Industrial is a sector in regular transition, Wong said, which is another factor driving refits.

In some cases, if a space has outlived an economic cycle, it might be transformed into residential or a residential mix; or a newer space might be retrofitted and go taller to accommodate today’s more sophisticated racking and stacking.

Other sectors with sustained demand, Wong said, are life sciences and pharmaceutical uses. And as the distribution market has grown, the distributors have had to figure out how to address returns – distribution centres were not generally built to accommodate that major new use, so distributors have had to build on new sites or retrofit existing sites.

The domestic industrial sector has been called upon to find solutions to global supply chain problems in numerous ways, some not so obvious, Wong said. One was the adoption of just-in-case ordering.

“What we saw was a slight increase in demand for industrial space moving from just-in-time to have more warehouse needed to meet just-in-case and store extra inventory, just in case there’s a supply chain issue we’re running into,” said Wong.

Follow the author on X/Twitter @DonWall.

Recent Comments

comments for this post are closed