Consider this article an addendum to my usual monthly Nuggets report. Here are some of the economic and other consequences of Russia’s unilateral war on Ukraine.

- Utility, public/private and corporate cybersecurity have moved up several notches in importance.

- Some (many?) going-green initiatives may be elbowed aside for a while in favor of different priorities. In short, there are presently other things to worry about.

- Washington may want to rethink its rejection of the Keystone Pipeline proposal. The U.S. and Canada together can be self-sufficient in energy. The proportion of imported oil in total U.S. consumption has fallen dramatically. The days of heavy reliance on OPEC are gone. Canada already accounts for nearly two-thirds of U.S. crude imports.

- The reliance of much of Europe (especially Germany) on Russian natural gas will irrevocably be acknowledged as a huge mistake. Gas in many parts of the world is priced at a factor five or six times greater than it is in North America. With Nord Stream 2 not advancing, that multiple is about to go much higher. This opens immense opportunities for the establishment of LNG exporting facilities along the U.S. and Canadian coastlines.

- The energy price differential will also promote more fertilizer and petrochemical production, with a view to world markets, in America and Canada.

- China may become emboldened in its ambitions concerning Taiwan, resulting in scary ripple effects. (Also, of course, the potential for the Ukraine conflict to spin out of control and extend beyond its current confines is alarming.)

- World travel, which has been experiencing a mild revival, may withdraw back into its shell. Hot war zones put a damper on tourism enthusiasm.

- Governments in multiple countries will likely divert some of their spending away from other objectives, such as in the social sphere, in favor of beefing up their defense and other military capabilities. Some needed infrastructure works may also become a casualty of this re-ordering of goals.

- Commodities (gold, silver, base metals, fossil fuels) are always a hedge in times of uncertainty and recent rounds of price spikes will likely be extended and exaggerated. The incentive for more extraction of raw materials has received a boost. Stock market investors are taking a dimmer view.

After two years of intense anxiety tied to the coronavirus, who needs this? One man, apparently, Vladimir Putin. Even his coterie of ‘yes men’, if they’re being honest, can’t believe this Ukraine invasion is a good idea.

What we’re seeing is an example of one of the extreme dangers when a citizenry comes under autocratic rule. Such a leader can go down a dark path and take all his or her countrymen, willingly or not, with them. A whole nation then becomes designated an international pariah.

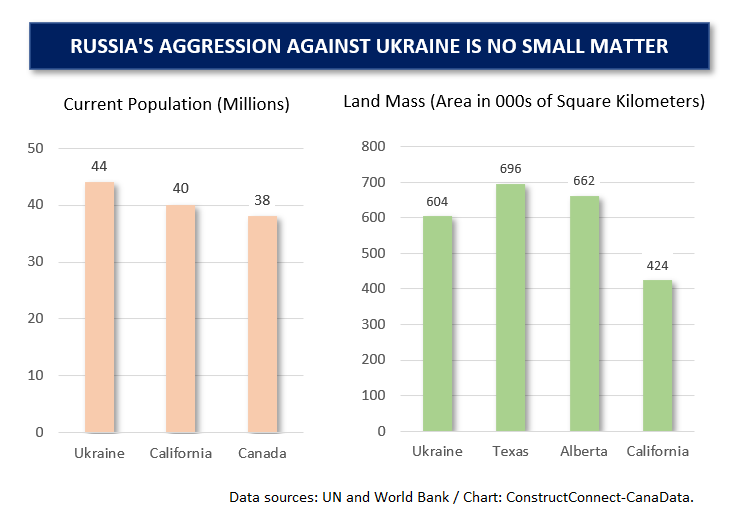

Ukraine has a population roughly equivalent to California and Canada. Its land mass covers an area approximately the same size as Texas or Alberta.

With occupation, will come overlords and intense patriotic resistance that will drag on forever.

Taking over Ukraine, which in 1991 voted 92% to separate from the Soviet Union, will be an enormous pungent bite to swallow.

It’s easy from a North American vantage point to take comfort in our geographic distance from the conflict.

But I have no doubt that many of us have awakened this morning with a great deal of sympathy for the people immersed, through no fault of their own, in a nightmare scenario on the other side of the world.

Recent Comments