Today, the Federal Reserve has chosen the middle path in raising its policy-setting interest rate by 25 basis points (where 100 basis points = 1.00). The target range for the federal funds rate is now 4.75% to 5.00%.

Worries about the banking sector not just in the U.S., but worldwide, placed the Federal Reserve in a bind with respect to its interest rate policy. SVB (Silicon Valley Bank) started the downhill ball rolling when its capitalization weakened as a result of interest rates climbing and depressing the value of its bond holdings.

Worries about the banking sector not just in the U.S., but worldwide, placed the Federal Reserve in a bind with respect to its interest rate policy. SVB (Silicon Valley Bank) started the downhill ball rolling when its capitalization weakened as a result of interest rates climbing and depressing the value of its bond holdings.

The prices of existing bonds fall when interest rates rise. That’s the way it has to work to even out yields for potential buyers who have the opportunity to simply purchase new bonds.

Signature and Silvergate Banks have also collapsed, and some other small regional banks have given the impression of being vulnerable. In Europe, the Swiss government has provided encouragement for USB to purchase Credit Suisse.

The Fed has been forced to consider that if higher rates are causing inordinate stress on the banking system and leading the public at large to lose confidence in whether they can access their deposits, would it be responsible to go the extra mile with the federal funds rate.

Apparently, it has decided in the affirmative, although tentatively. A bump of 25 bps isn’t too big a shock when +50 bps was the norm at each previous step along the way.

At the same time, though, the Chairman of the Fed, Jerome Powell, has stated that he doesn’t believe the goal of higher interest rates, i.e., to bring inflation down to +2.0% year over year, is close to being achieved yet.

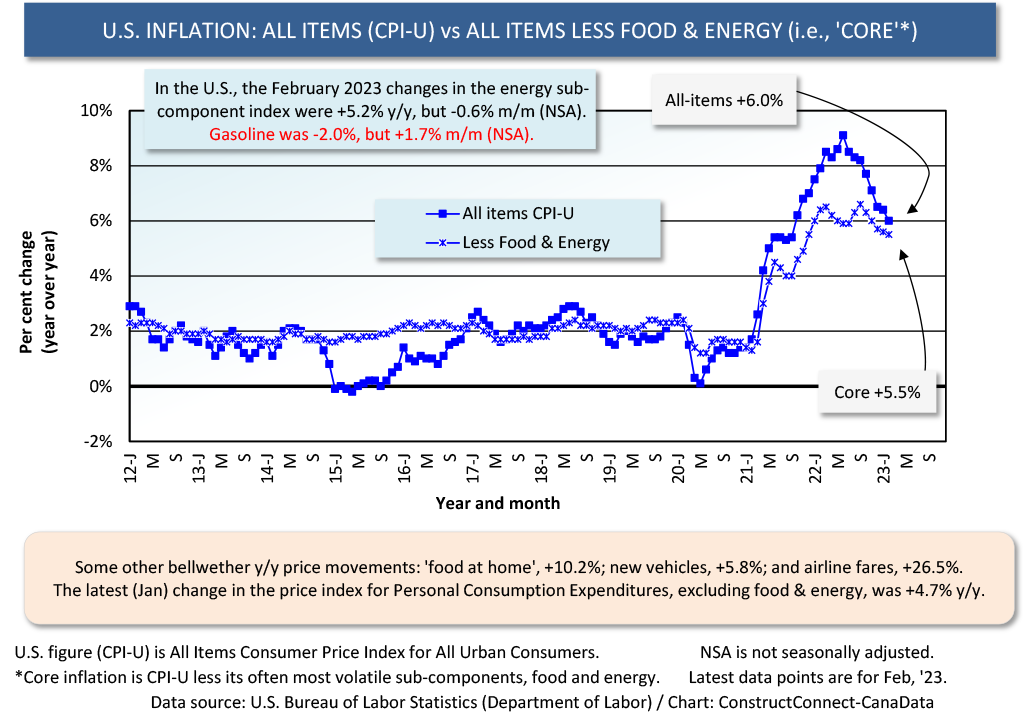

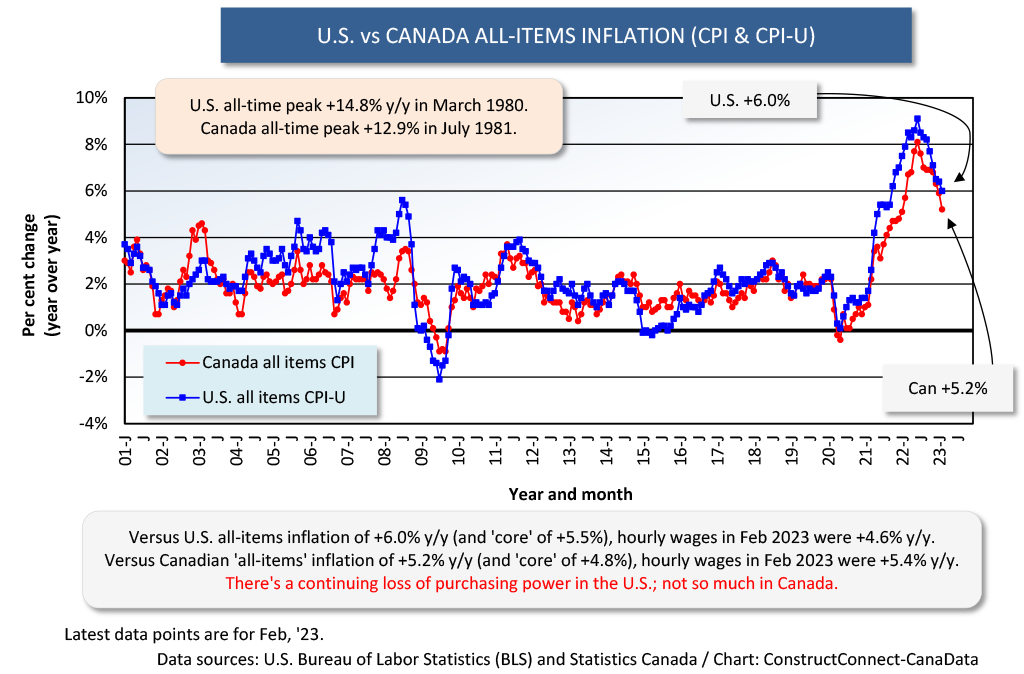

U.S. inflation, as measured by the y/y increase in the all-items Consumer Price Index (CPI) has retreated from a high of +9.1% in June of last, but it was a still daunting +6.0% in February of this year.

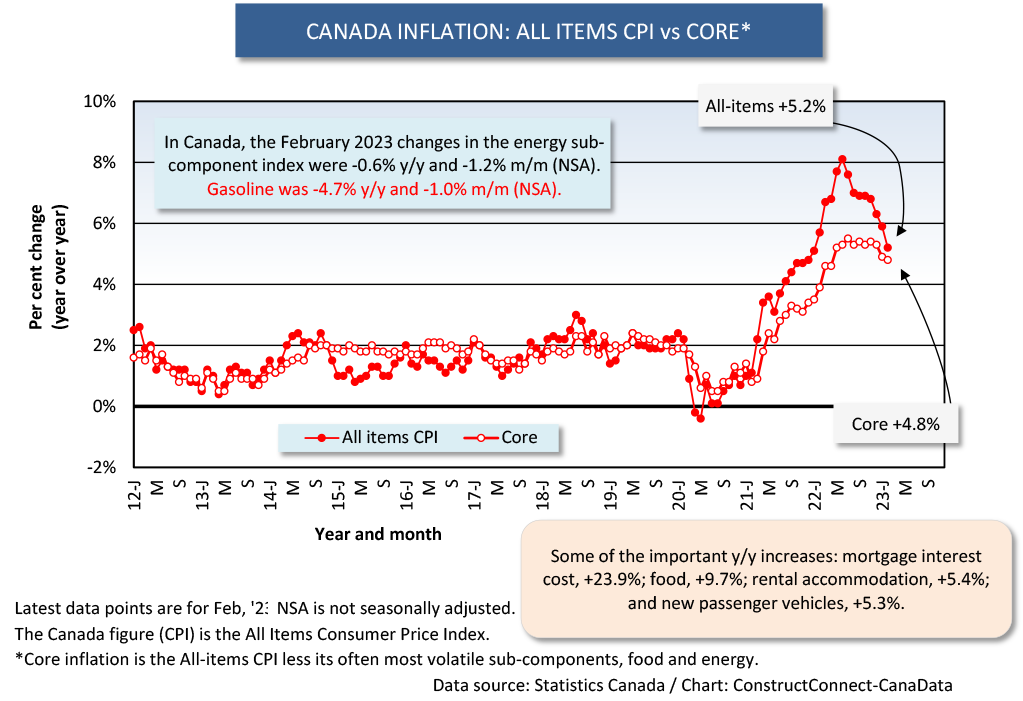

Contrary to the Fed, the Bank of Canada has put a pause on its interest rate moves. The inflation rate in Canada is a little less extreme than in the U.S., but not by much; it’s +5.2% y/y for all-items CPI.

From north of the border, though, there’s an interesting sidebar to employing higher interest rates to combat inflation, as Statistics Canada has been pointing out in its recent CPI press releases.

There’s a way in which the higher rates are adding to a greatly elevated CPI. One of the key drivers of inflation in Canada is a line item titled ‘mortgage interest cost’, and in February it was +23.9% y/y.

Being a central banker and having certainty about what you’re doing these days would seem to be a wished-for mental attribute that’s next to impossible to attain.

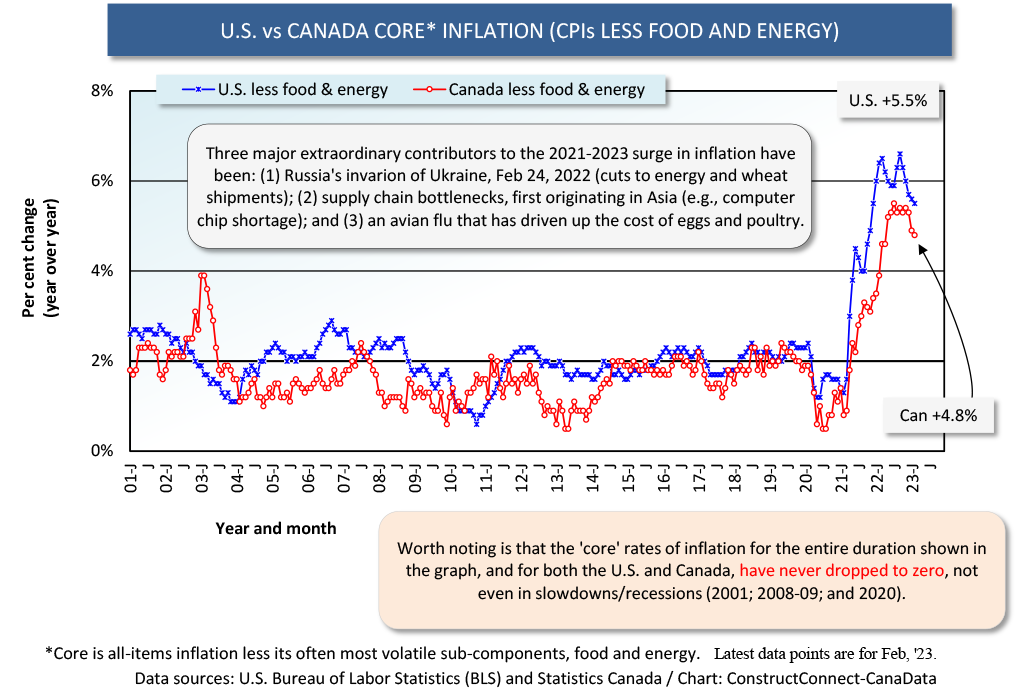

Graph 1

Graph 2

Graph 3

Graph 4

Alex Carrick is Chief Economist for ConstructConnect. He has delivered presentations throughout North America on the U.S., Canadian and world construction outlooks. Mr. Carrick has been with the company since 1985. Links to his numerous articles are featured on Twitter @ConstructConnx, which has 50,000 followers.

Recent Comments