Recent forecasts of global economic activity by the World Bank, the International Monetary Fund (IMF), and the OECD all highlight the fact that the health of the global economy is very fragile. For example, in its latest (July 23) World Economic Outlook, the IMF stated that “the balance of risks to global growth remains tilted to the downside”.

The World Bank’s (June 23) Global Economic Prospects report projects that the global economy will slow substantially this year to +2.1% and make a “tepid” recovery amounting to +2.4% in 2024.

Finally, in its midyear economic outlook, the OECD noted that “the global economy is showing signs of improvement, but the upturn remains weak”. The OECD is projecting global growth of +2.7% this year and +2.9% in 2024. It is worth noting that none of these forecasters is expecting the world economy to contract as it did in 2009 (-1.9%) and again in 2020 (-3.1%)

Is U.S. outlook brighter or a lighter shade of gray?

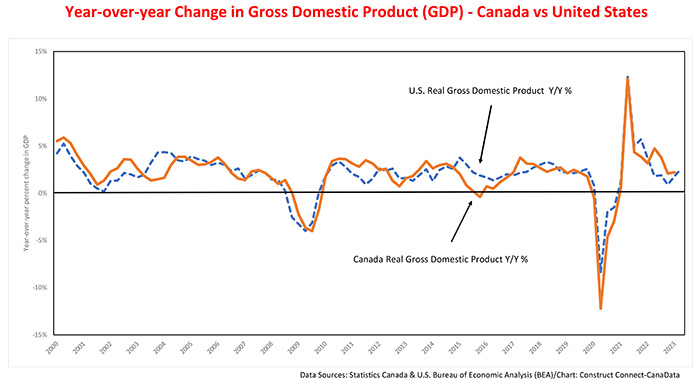

From a Canadian perspective, the old saying that goes, “If the US economy sneezes, the rest of the world gets a cold” applies, given that America is the market for just over three-quarters of our exports. The chart illustrates the close relationship between the two economies.

Over the past few weeks, the consensus outlook for the U.S. has brightened. Following comments by U.S. Federal Reserve Chairman Jerome Powell that the Fed was no longer forecasting a recession, the Bank of America became the first major Wall Street bank to retract its recession call.

However, some forward-looking indicators have yet to reflect a more upbeat outlook. These include the Chicago National Activity Index, which has trended lower over the past two months. Also, manufacturing activity, as reflected by the Purchasing Managers’ Index (PMI), contracted for the ninth consecutive month in July due to weakness in all ten of its constituent series.

In addition, the recent (June 22) further tightening of monetary policy by the Federal Reserve’s Open Market Committee, aimed at cooling inflation (which the Fed sees as remaining well above its longer-run +2% target) will weigh on both housing demand and consumer spending.

Finally, the more sanguine view of the U.S. economy’s near-term outlook which some have adopted is not shared by all. Especially noteworthy, David Rosenberg head of Rosenberg Research, who correctly anticipated the 2007 recession, is still calling for a recession in the U.S. starting late this year or early in 2024. He bases this outlook, in part, on the recent performance of the U.S. Leading Economic Index (published monthly by the U.S. Conference Board) which has fallen by -1.3% over the past two months and is down by -4.2% since the beginning of the year.

Recessionary clouds darken over Canada

While several recent measures of Canada’s economic health remain positive and the consensus is not currently penciling in a recession, the country’s economic prospects have deteriorated over the recent past. First, the forward-looking Bank of Canada Business Outlook Survey dropped to a two-and-a-half-year low in the second quarter based on deteriorating expectations for future sales, weakening investment, and declining business sentiment.

Largely due to softening U.S. demand for Canadian exports, Canada’s foreign sales of goods in June dropped by -3% versus April and were off by -9% since the beginning of the year.

Finally, given the Bank of Canada’s expectation that inflation will remain above its +2% target for an extended period, we expect that it will keep rates at their current high level longer than they have in the past. Persisting high-interest rates and a record-high ratio of consumer debt to disposable incomes will weigh on the two interest-sensitive components of demand, notably housing and consumer spending.

The softening of these two expenditure components, plus inflation-eroded growth of disposable incomes, significantly heighten the risk that a protracted slowdown in the U.S. will cause growth in Canada to contract in the final quarter of this year and early in 2024.

John Clinkard has over 35 years’ experience as an economist in international, national and regional research and analysis with leading financial institutions and media outlets in Canada.

Recent Comments