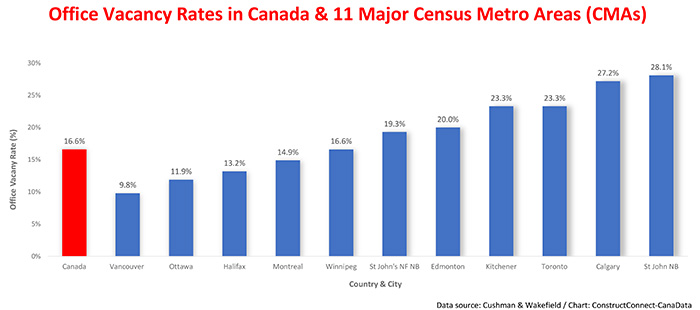

Rising office vacancy rates due to glut of empty space

According to Cushman Wakefield, Canada’s national office vacancy rate increased from 16.3% in Q2 2023 to a 29-year high of 16.6% in Q3. While vacancy rates increased at a slightly more moderate rate in the latest quarter, this gain indicates Canada’s post-pandemic glut of empty space has persisted into the second half of 2023.

Across the country, Vancouver’s office vacancy rate, at 9.8%, was the lowest among the 16 major CMAs surveyed by Cushman Wakefield. At the top of the list was Saint John, New Brunswick (28.1%), followed by Calgary (27.2%); Kitchener tied with Toronto (23.3%); London (21.8%); and Edmonton (20.0%).

Appeal of working from home shrinks during 2023

Although the national office vacancy rate posted a small increase in the third quarter, the trend of working from home continued to bend lower. This observation is based on a recent Statistics Canada report which found that in May of this year, 15.9 million individuals were commuting to a location outside the home for work, up by 724,000 (+4.8%) from the same month a year earlier.

The share of workers working outside the home has now reached 79.9% up from 77.6% in May of 2022. Industries with the most significant increase in the number of those working outside their homes include public administration (+9.7% to 63%); information, culture, and recreation (+6.7% to 67.6%); and professional, scientific, and technical (+4.1% to 45.2%).

More commuters on public transit, but vast majority in cars/vans

Statistics Canada’s paper titled Commuting to Work by Car and Public Transit reports that between May 2022 and May 2023, 82.6% of commuters used a car, truck, or van to get to work, up 24.2% over the past year. Following a post COVID-19-driven drop of almost 50% in 2021, the steady decline in the incidence of the virus has caused commuters to be much less apprehensive about hopping on a bus or subway to go to work. While the share of commuters using public transit (10.1%) pales compared to those getting behind a steering wheel, since May of 2022, it has risen by 67.6%.

A chill in plans to increase office space supply

Although the steady increase in commuting to a location outside the home signals more workers are back in the office, absorption of vacant space continued to contract in Q3 of this year and total leasing activity retreated to its lowest level since Q4, 2022. Given the record-high level of office vacancy rates, plus interest rates which are unlikely to materially ease before mid-2024 (i.e., based on the Bank of Canada’s latest policy rate announcement), and also the decline in investment plans reported in the Bank of Canada’s Third Quarter Business Outlook Survey, it is not surprising that applications to build new commercial office space have retreated 6% year to date. Across the country, applications to increase office space have exhibited significant declines in Saskatoon, Winnipeg, and Toronto.

Leasing outlook brightens beyond 2024

While the near-term outlook for commercial office space is severely impeded by the weak fundamentals noted above, the fact that the office vacancy rate for the country as a whole has flattened into a range from 15.9% to 16.6 suggests Canada’s office markets are stabilizing. This outlook is reinforced by the combination of a limited supply of new office space, the steady increase in workers heading back to the office, and the fact current space under construction is the lowest it has been since mid-2018.

Across the country, year to date, the stronger growth of office-based employment in Edmonton, Calgary, and Kitchener paints a brighter picture for leasing activity and eventually for commercial building in those CMAs than in others. Slight increases in vacancy rates in Montreal and Toronto speak of an excess supply of office space in those two urban centres that has yet to be absorbed.

Recent Comments