Hiring cools in province but remains in positive territory

Last fall, when we overviewed Ontario’s economic outlook, we noted that while some

forward-looking economic indicators were flashing amber, few were flashing red (i.e., indicating a sharp contraction). A year later, although there are a few bright spots, the outlook for Ontario remains clouded. For example, year-to-date retail sales in the province are up just +1% in June. This weak pattern of spending appears due in part to the lingering impact of high interest rates, which depressed consumer confidence through the second quarter.

On a more upbeat note, heading into the second half (H2) of this year, total employment increased by +22,000 jobs in July, mostly due to a +13,000 increase in private sector hiring which exceeded a smaller +3,400 increase in public-sector employment. Further, the bulk of the jobs added were full-time and they more than offset a small drop in part-time hiring.

Although the province’s unemployment rate retreated to 6.7% from the 35-month high of 7.0% it reached in June of this year, the fact that it is well above the 5.3% it averaged through 2022 and early 2024 suggests firms’ hiring plans have cooled over the past six months. This observation is reinforced by the gradual decline in the province’s job vacancy rate from a high of 4.3% in April 2023 to 3.0% in May 2024. Furthermore, and consistent with the -10.2% year-over-year decline in housing starts, the job vacancy rate among firms that construct buildings hit 3.7% in the first quarter of this year, down from 7.8% in early 2021.

Stronger growth in U.S. will boost province’s exports in 2025

From an external perspective (i.e. foreign trade), the recent announcement by Jerome Powell, the Chairman of the U.S. Federal Reserve, that “the time has come” for the central bank to cut interest rates brightens the outlook for the American economy, Ontario’s largest trading partner. Since Ontario’s exports to the U.S. are down by -6.1% year to date, there is some ground to recover.

Driven by a drop in motor vehicle exports, manufacturing shipments of transportation equipment have retreated by -7.3% year to date. There is no doubt that lower rates will provide a late-year boost to interest-sensitive components of U.S. demand that will extend a positive impact into 2025. However, the National Bank’s U.S. Recession Risk monitor moved solidly into negative territory in August, to now stand at its lowest value since 2001, indicating a continuation of clouds hanging over the U.S. economy.

Lower mortgage rates will support home sales in 2024’s H2

Against a backdrop of lacklustre home sales and softening house prices through the first half of this year, housing starts have retreated by -10.2% year to date. Given that headline inflation has trended gradually lower since the beginning of the year, there is a growing consensus that the Bank of Canada will continue to reduce interest rates. However, given the limited impact of the 75-basis point decline in the bank rate over the past few months, most analysts expect that further interest rate reductions will have only a minor immediate impact on new construction.

Year to date, the value of residential building approvals (i.e., permits) is down by -15% due to weakness in applications to build both single-family (-13.5%) and multi-family (-15.0%) properties. Fuelled by the decline in interest rates, and the prospect they will continue to move lower, Ontario housing starts should total in the range of 80,000 to 90,000 units in 2025, up modestly from an estimated 80,000 units this year.

Expect non-res capital spending to exhibit moderate growth

Year to date, the value of non-residential construction appears marginally better than for residential buildings. This observation is based primarily on the survey of Non-residential Capital and Repair Expenditures (Capex) survey released in this year’s Q1. Following a gain of +5.9% in 2023, businesses plan to boost capital spending by a further +5.6% in 2024.

Gains in public sector capex spending have been outpacing the private sector, rising by +12.8% in 2023 and by +14.7% in 2024. After posting a relatively strong first quarter, prospects for spending on industrial and commercial projects deteriorated sharply in the second quarter, due to a slowdown for manufacturing facilities that was only partially offset by an increase on institutional/government projects.

Major projects that will underpin non-residential capital spending in the period ahead include the St. Thomas battery cell manufacturing plant for Volkswagen, Scarborough Town Centre’s redevelopment, and the Windsor Acute Care Hospital Facility.

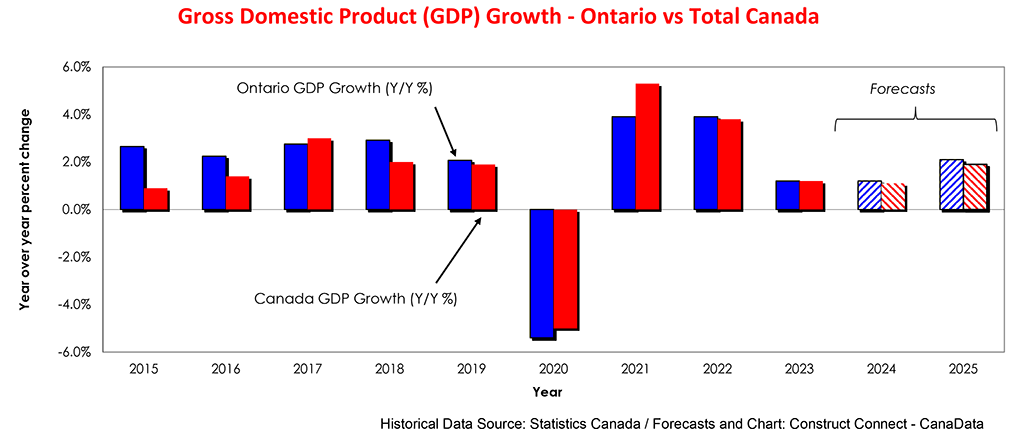

Lower interest rates will keep growth positive heading into 2025

While concerns remain about the current health of the U.S. and Canadian economies, the positive impact of recent cuts in Canadian rates and their imminent pull-backs in the United States will underpin economic growth on both sides of the border through 2025 and into 2026.

John Clinkard has over 35 years’ experience as an economist in international, national and regional research and analysis with leading financial institutions and media outlets in Canada.

Recent Comments