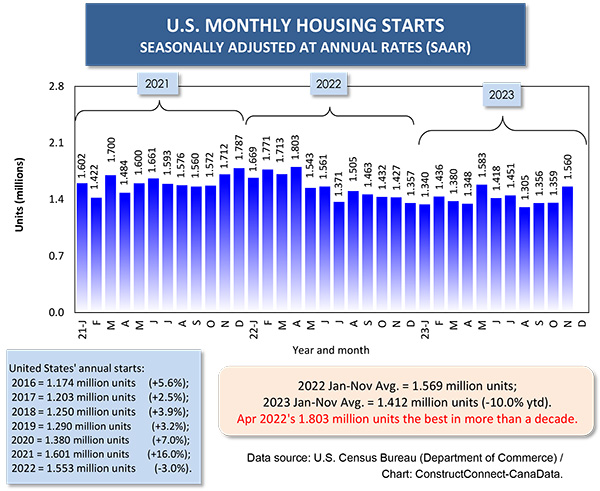

The negative impact of higher interest rates on U.S. housing starts has been dissipating since late summer 2023, culminating in a near normal month for residential groundbreakings in November.

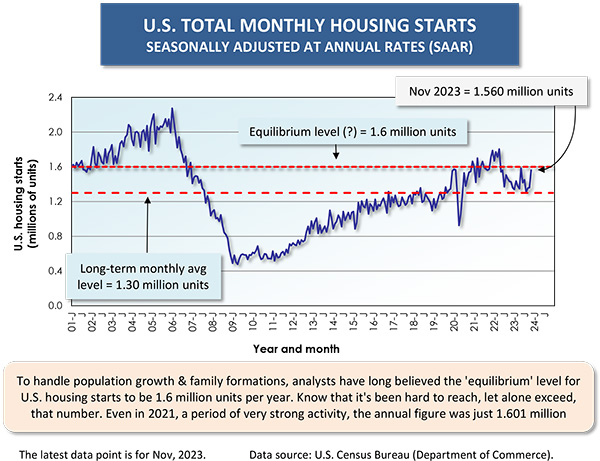

The 1.560 million units (annualized) reported for November was a decent jump upwards from the low point of 1.305 million units in August (see accompanying Graph 1). Furthermore, it was quite close to the ‘equilibrium’ position as set out in Graph 2.

The ‘equilibrium’ level, to handle population growth, new family formations, and replacement of demolished properties, is generally taken to be 1.6 million units.

The ‘equilibrium’ level, to handle population growth, new family formations, and replacement of demolished properties, is generally taken to be 1.6 million units.

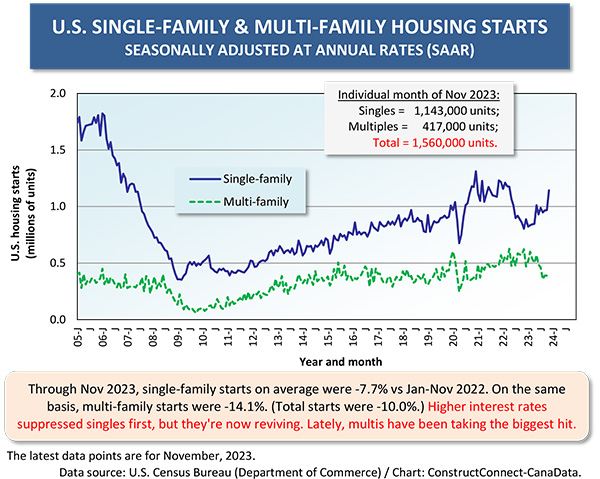

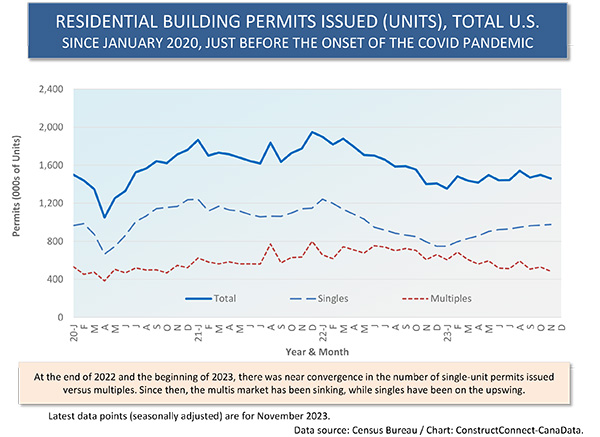

The uptick in starts is all occurring in the single-family market. The multi-unit marketplace, after showing strength in 2021 and 2022, has recently been sliding (Graph 3). Historically, U.S. home buyers have preferred single-family purchases (including most townhouses) over condominiums and paying rent on apartments. This relationship has only been challenged when deteriorating affordability (i.e., a big jump in house prices and/or interest rates) has forced individuals and families to reconsider what living space is truly practical.

An earlier acceleration in single-family house prices across America has recently slowed considerably, helping to restore the old singles-multiples ratio.

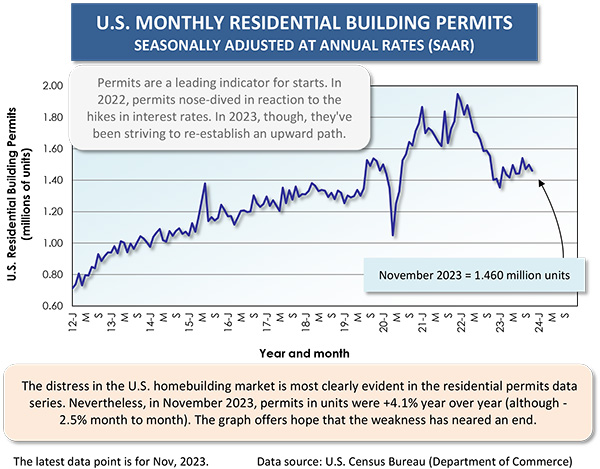

Interestingly, the numbers on residential building permits, often adopted as leading indicators for starts, are not particularly bullish yet. For total U.S., there was a gradually rising sawtooth pattern throughout 2023, but at a level still way below previous peak (Graph 4). Again, nationally, it’s been singles contributing to the uplift, while multiples have been flailing.

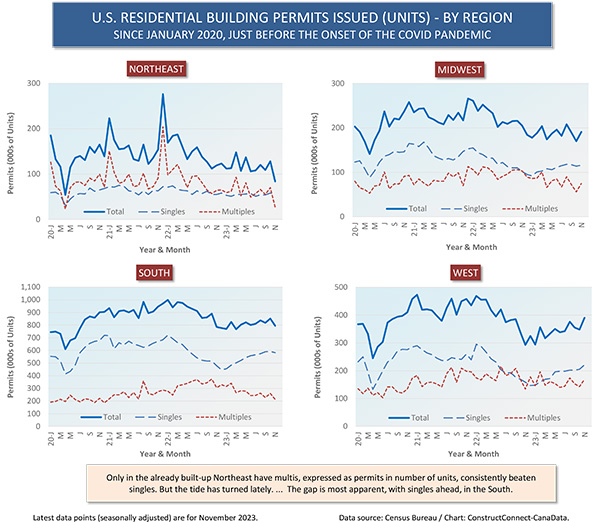

Regionally, the failure of multiple-unit permits to stand their ground has been most apparent in the Northeast Region (Graph 6), where they have nearly dropped out of sight, although the gap in favor of singles has also become quite evident and exaggerated again in the South.

(Only in the Northeast region has there been a past pattern of permits for multiples in units consistently beating the number of permits for singles.)

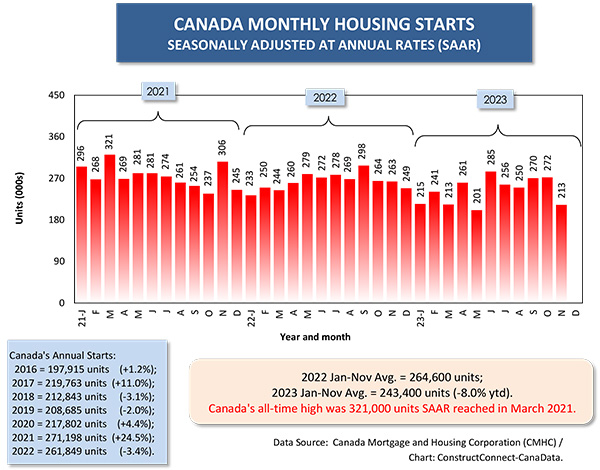

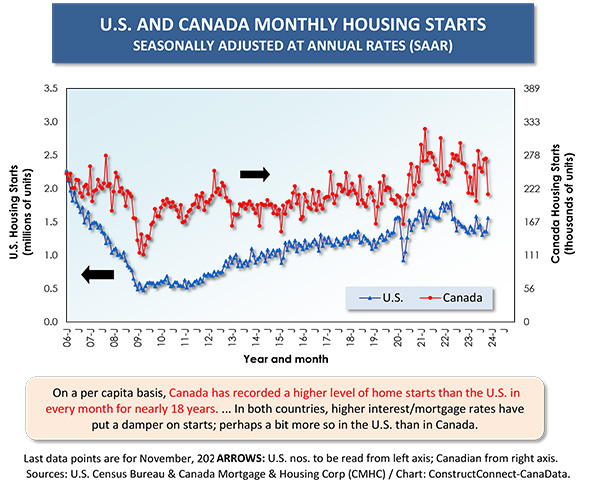

In Canada, November’s housing starts took a nosedive to 213,000 units annualized from 272,000 in October. The monthly average of housing starts north of the border from January-November 2023 was -8.0% compared with the same period in 2022 (text box in Graph 7). The U.S. comparable percentage change was -10.0% (text box in Graph 1).

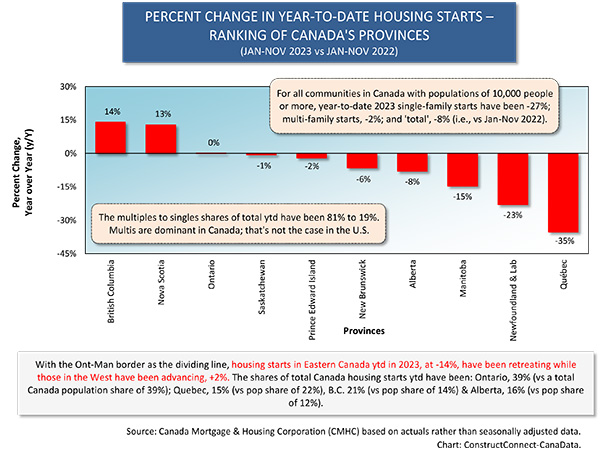

Only two provinces saw an increase in housing starts through the eleventh month of last year, British Columbia (+14%) and Nova Scotia (+13%). Because of its dominance in the nationwide homebuilding market, it’s been important that, regardless of the high interest rate background, housing starts in Ontario stayed flat (0%) year to date in 2023’s penultimate month (Graph 8).

On the downside, the truly depressing statistic is the -35% figure for Quebec.

Long term, housing starts in Canada are sure to be supported by the enormous gain in population that is taking place (i.e., more than +3.0% annually compared with +0.4% in the U.S.).

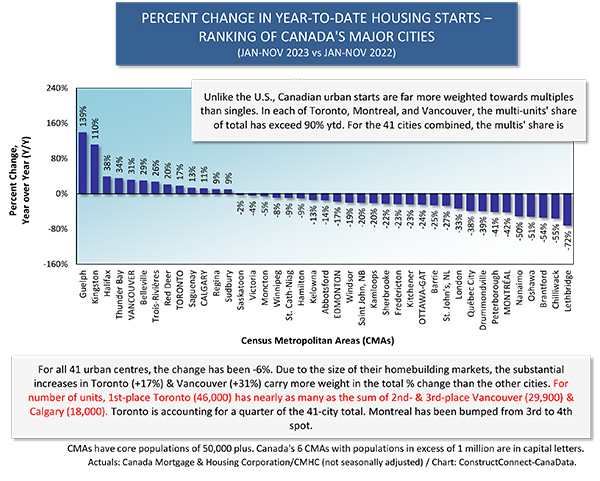

Toronto’s home starts year to date through November 2023 were +17%; Vancouver’s, +31%; Calgary’s +11%; and Montreal’s, -42% (Graph 9). As for level of new home starts (in units), Calgary has moved up into third position after Toronto and Vancouver.

Toronto’s home starts account for one-quarter (25.0%) of the total contributed by all 41 census metro areas in Canada.

In a big contrast with America’s major urban markets, multiples as a share of total unit starts are more than 90% in Toronto, Montreal, and Vancouver, the country’s three biggest population centers.

Graph 1

Graph 2

Graph 3

Graph 4

Graph 5

Graph 6

Graph 7

Graph 8

Graph 9

Graph 10

Alex Carrick is Chief Economist for ConstructConnect. He has delivered presentations throughout North America on the U.S., Canadian and world construction outlooks. Mr. Carrick has been with the company since 1985. Links to his numerous articles are featured on X/Twitter @ConstructConnx, which has 50,000 followers.

Recent Comments