While it is clear workers have had to make immense adjustments to respond to the COVID-19 pandemic, the inner workings of contracts and other legal issues have also faced significant challenges.

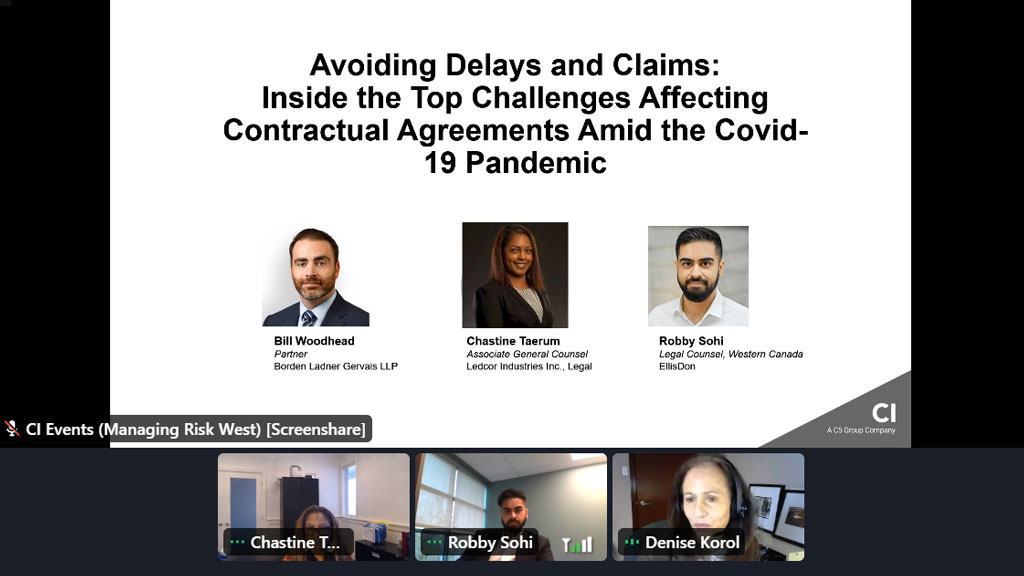

Legal experts discussed their experiences dealing with construction during the pandemic at the Managing Risk in Construction Contracts and Projects conference, hosted by C5 Group Inc. – ACI, CI and C5.

The event featured EllisDon’s western legal counsel Robby Sohi; Ledcor’s association general counsel for infrastructure Chastine Taerum; and Borden Ladner Gervais LLP partner Bill Woodhead.

The trio agreed that delays, labour shortages, insolvency in supply chains, safety concerns, law changes and inflation have all presented significant legal challenges for projects and contracts.

“When it first hit, obviously everyone was dealing with new rules,” said Sohi. “One of the major restrictions was on human and vehicle movement. We have projects with cross-border movement so it was definitely interesting writing letters to various border services explaining there were essential workers for things like health care facilities.”

Sohi noted when many pored over their contracts to try and address COVID concerns they found force majeure clauses – which are intended to mitigate unpredictable catastrophes – lacking in financial assistance.

“I don’t think we can rely on a contract’s force majeure clause to get relief for COVID,” said Sohi, noting some contracts explicitly don’t mention pandemics or epidemics, and much of the relief they provide is time related rather than financial. “We need to look at these force majeure provisions a lot more carefully.”

In terms of managing costs and contracts, Sohi said there have been good owners who are reasonable and willing to work with contractors to share the risk of rapidly fluctuating materials. In some cases, contractors are buying materials six months in advance due to price instability and owners are helping pay for storage. He believes it is worth looking to the insurance industry for possible solutions.

Woodhead explained that currently many projects are facing significant inflation on prices as well as insolvent suppliers.

“Now the contractor is faced with the issue of paying for a new supplier to come save the day,” he said.

He explained with the risks of COVID-19, extreme weather and price instability stacking on top of each other, the traditional risk allocation of a fixed-price contract is being reconsidered in favour of Integrated Project Delivery (IPD) or Alliance models.

“I think owners are willing to have that conversation,” he said. “I think you are already seeing B.C. introduce the IPD and Alliance models because the industry is having challenges getting bidders on traditional projects.”

He believes the issues could even lead to COVID-specific changes to standard industry documents.

“The best options here are working together,” he said. “Owners are now having those conversations with contractors.”

However, Woodhead noted he knows of contactors losing millions and their project owners are not willing to make any concessions.

“I don’t know how those contractors will continue to bid,” he said. “I think owners will start to see a significant price difference in the projects they are looking at and you may see a switch in contract preference to cost plus contracts for the next little while.”

Taerum said those working on large projects with long-term contracts signed before COVID are in a difficult situation, but she has seen some clients prepared to listen and come up with solutions on moral grounds, even if it isn’t required by the contract.

She is also seeing contractors ask for COVID-specific measures in contracts, however, public owners often have less flexibility as they have strict budgets and must answer to the public if a project schedule needs to be extended or its budget needs to increase.

“Probably the biggest issue we are seeing now are standalone measures for material price escalations for things like steel or lumber where there may be a cost-sharing mechanism,” she said. “We are seeing that more on bigger projects.”

Taerum is also seeing vaccine requirement challenges for contractors who must prove their workforce is vaccinated to access certain sites.

“There has to be an internal process to collect that information and deal with the nuances of privacy,” she said. “It’s not just a cost thing. It’s a time thing and there’s administrative things that add costs to projects that weren’t there previously.”

All three experts agreed in the future there could be three major areas of change. First the industry could see more focus on contract models that allocate risk differently. Second, the market could become less willing to bid without modification. And third, there could be increased insolvency and security requirements in contracts.

Recent Comments