The theme for 2018 across Canada was wait and see.

Many in the industry watched as the future of massive construction companies and projects unfolded.

For some, the decisions were final. For others, it still remains unknown.

Early in the year it was announced that one of the U.K.’s biggest contractors had collapsed.

Carillion PLC said it had no choice but to go into compulsory liquidation, a move that would have a ripple effect across Canada.

In late January, Carillion Canada was granted protection from creditors by the Ontario Superior Court under the Companies’ Creditors Arrangement Act. It said the event in the U.K. gave rise to “unexpected liquidity challenges” for the Canadian operations.

Not long after the protection was granted, the sell-off of Carillion Canada’s assets began.

In early February it was announced Fairfax Financial Holdings Limited would acquire the services division of Carillion Canada. Later that same month, EllisDon Corporation announced it would acquire Carillion’s interests in four Ontario hospitals. Other highway maintenance services in Ontario and Alberta were also sold in the summer.

While services and assets were being sold for one company, another potential sale was also in the works – a transaction that eventually would be shut down by the federal government.

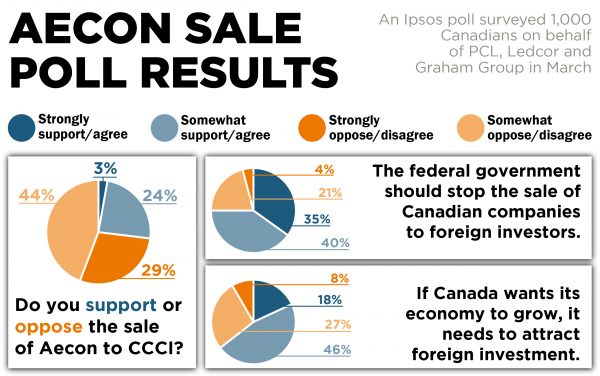

Aecon Group Inc. announced in October 2017 it had agreed to be acquired by China Communications Construction Company International (CCCI) for $1.5 billion. CCCI is a subsidiary of publicly traded China Communications Construction Company Limited (CCCC) whose largest shareholder is a state-owned enterprise.

Although the Aecon board unanimously approved the transaction, it was not a done deal as regulatory approvals under the Investment Canada Act and the Canadian Competition Act were needed. News of the transaction spread quickly throughout the industry, with numerous associations and construction companies spearheading initiatives to make their voices heard to the federal government that the sale of a Canadian company to one “controlled by a Chinese state-owned enterprise” should not proceed.

Early in 2018 the federal cabinet told Aecon it was extending its review of the proposed takeover, citing security concerns. This pushed the deadline back for closing the deal to March 30, five weeks later that the previous deadline of Feb. 23.

In March, then Aecon Group Inc. president and CEO John Beck spoke at length with the Journal of Commerce, looking to “set the record straight” about the sale. The interview came after Beck spoke to the Canadian Construction Association (CCA), of which Aecon is a member, during an in-camera session of a board meeting held at the association’s 100th annual conference in Banff, Alta.

Beck said there were important clarifications that needed to be made and stipulated there “is absolutely no financial subsidization by the China state” of the companies involved in the transaction.

Despite Aecon’s best efforts to encourage both the industry and the federal government that the sale did not pose a threat, in late May the Liberals made the decision to disallow the takeover. At the time Prime Minister Justin Trudeau stated, “proceeding with this transaction was not in the national-security interests of Canada.”

CCA president Mary Van Buren added, “We are happy the government recognizes the fact that government-owned or -controlled entities have no place to compete against private and publicly traded companies in the Canadian construction industry.”

The country faced an entirely different matter when it came to the Trans Mountain pipeline expansion project.

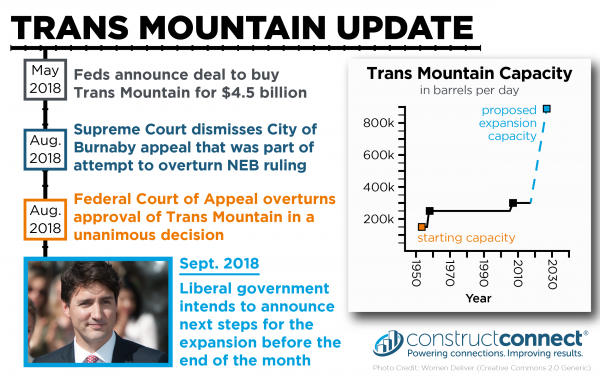

While the expansion, which would triple the amount of oil flowing from Alberta to Burnaby, B.C., was approved by the federal government in 2016, it continued to be met with fierce opposition throughout 2017 and early 2018 with protestors gaining momentum at construction sites.

By April, Kinder Morgan, the company slated to carry out the $7.4-billion project, suspended all non-essential activities and related spending on the Trans Mountain project. Its decision was based on the B.C. government’s opposition to the project, which had been the focus of sustained protests. Initially a deadline of May 31 was set to see if an agreement could be reached and the project could proceed.

Kinder Morgan said it would make a decision about the project’s future based on whether it could get “clarity” on its ability to do construction in B.C. and protect its shareholders.

By the end of May, the federal government made a move, announcing it was buying the Trans Mountain pipeline and all of Kinder Morgan Canada’s core assets for $4.5 billion. The idea was to keep construction moving with the end goal of selling the whole project down the road.

It appeared everything was a go, that is until the end of August when a Federal Court of Appeal decision stopped the Trans Mountain pipeline project in its tracks. The court ruled a National Energy Board’s assessment of the project was flawed and should not have been used as a basis to proceed when the federal government gave final approval. The court ruled more consultation with First Nations was needed as well as more study on the effects of increased tanker traffic.

Trudeau has been steadfast the project will proceed once more study and consultation is complete.

The prime minister was also just as determined to legalize the recreational use of cannabis, with the government officially doing so on Oct. 17.

Before it was made official though, construction industry stakeholders across the country lobbied the government and educated the industry about the potential safety concerns associated with the legalization of cannabis. Numerous conferences, panel discussions and the like were held in order to better educate employers and workers alike on what their rights were and what policies needed to be set in place.

Even after legalization, the general consensus is that as much as the industry prepared for the move, cannabis and construction remains a complicated issue, with many unanswered questions.

Recent Comments

comments for this post are closed