Montreal, Que. – Following poor financial performance, engineering company SNC-Lavalin plans to cease lump-sum turnkey contracting to focus on other parts of its business.

“Lump-sum, turnkey projects have been the root cause of the Company’s performance issues. By exiting such contracting and splitting it off from what is otherwise a healthy and robust business, we are tackling the problem at the source, and as a result we expect to see a material improvement in the predictability and clarity of our results,” said Ian L. Edwards, interim president and CEO, in a press release.

“We have a very impressive integrated professional services offering in EDPM, Nuclear, Infrastructure Operations & Maintenance (O&M) and Linxon, as well as a robust investment in Capital, the results of which have been overshadowed by LSTK projects.”

Lump-sum projects are done at a fixed cost which can put contractors at risk for delays and cost overruns. These types of projects made up about 43 per cent of SNC-Lavalin’s revenue last year.

The company announced it will reorganize the company’s resource work and infrastructure construction segments into a separate business line after poor performance. The company is also considering “all options” for its resources work, particularly oil and gas, including transition to a services-based business or scrapping that type of work entirely.

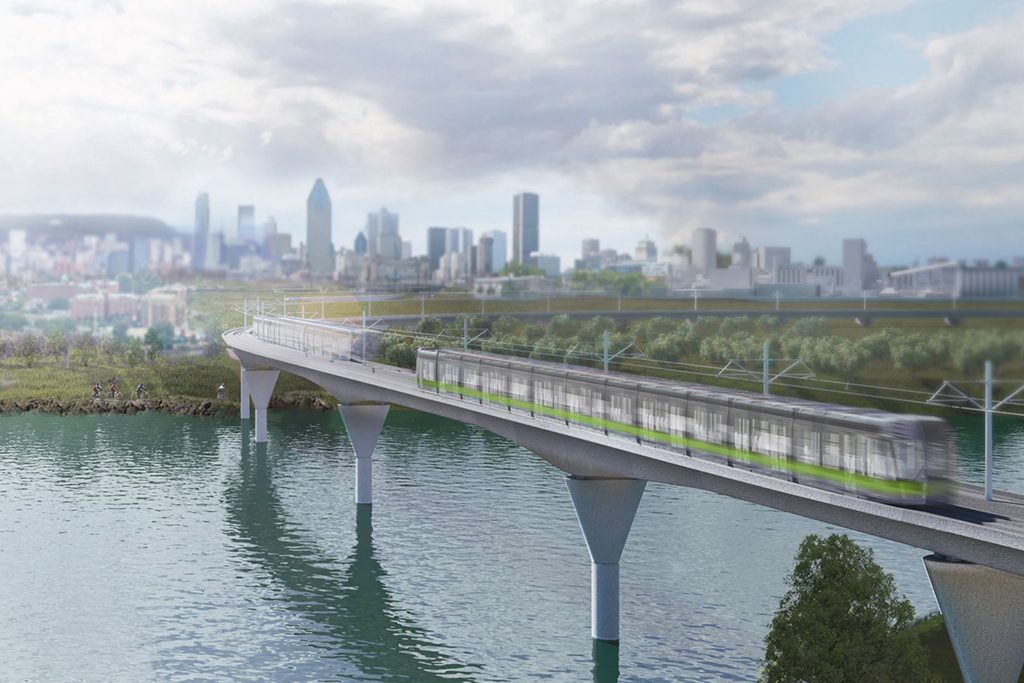

The company explained the changes will allow it to focus on the high-performing and growth areas of the business, which will be reported under SNCL Engineering Services. The company still plans to fulfil the contractual obligations of its current lump-sum turnkey projects, including the Réseau express métropolitain (REM).

Company officials stated that it is the first step of a new strategic direction focused on de-risking the business and generating more consistent earnings and cash flow.

Officials expect the change, along with the $3 billion sale of Highway 407 ETR, will strengthen its balance sheet and enhance financial flexibility, while removing volatility.

SNC’s biggest shareholder, Quebec’s provincial pension plan known as Caisse, issued a stern statement responding to the changes.

“The deterioration of SNC-Lavalin’s performance, as indicated in the Company’s statement issued today, is a cause of growing concern for la Caisse,” read the statement. “The situation of the Company requires decisive and timely action on the part of the Board. We note the Company’s intention to make changes to aspects of its strategy. For the benefit of all the Company’s stakeholders, the new strategic direction must be comprehensive and capable of reversing the current unacceptable trend of the business. We also expect this strategy to be accompanied by a realistic plan for its execution.”

The company’s shares fell 7.7 per cent to just over $23.55 this week, their lowest point since 2005.

Recent Comments