The next decade looks bright and busy, delegates attending the recent Mechanical Contractors Association of Canada (MCAC) conference were told during a workforce presentation, but the exact project path is far from clear.

BuildForce Canada executive director Bill Ferreira said the demands of increased immigration and the evolution to a green economy will keep the mechanical contracting sector working hard up to his forecast year of 2032.

But there is significant uncertainty such as where fuel switching will end up, whether the construction sector can find workers outside of its traditional sources and the degree to which the conversion of office buildings to residences gathers steam.

Mostly, however, the news is good.

“The volume of work before the industry is tremendous,” Ferreira said. “Now, there are challenges on the labour front…but the real message here is that there’s a lot more work coming.”

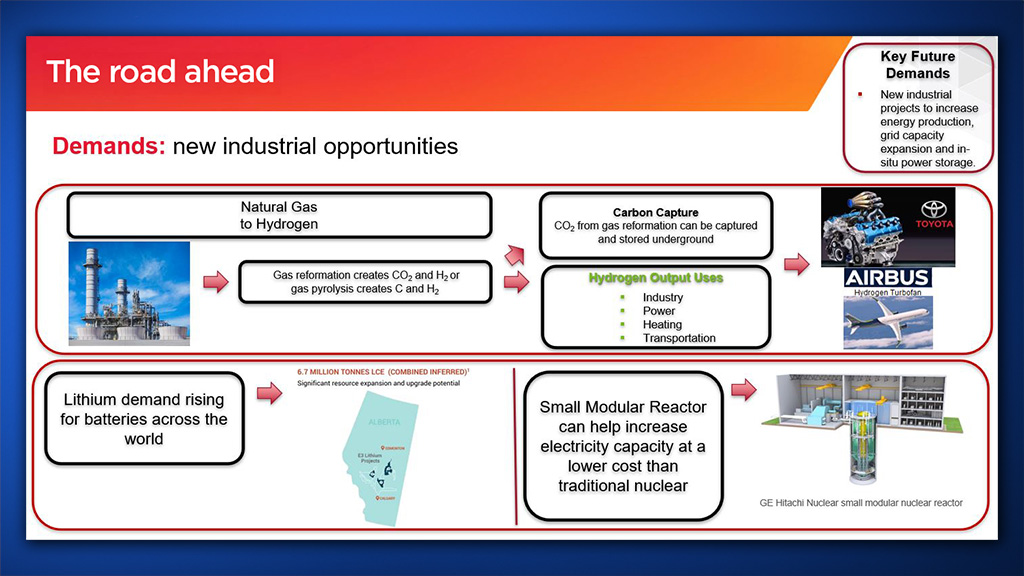

Ferreira’s Oct. 20 presentation to the MCAC delegates was titled The Road Ahead: Demand Drivers of Construction Activity.

The national conference was held in Napa, Calif.

Ferreira told the delegates replacing fossil fuel heating and cooling and appliances with equivalent electrical units is the fastest way to net-zero, if the incoming electricity is also green. At the same time, energy efficiency retrofits will be required to reduce baseload grid demands.

This shift will impact several trades both positively and negatively, he said.

“Reliance has told us that almost every heat pump that they’re installing in Ontario requires a panel upgrade,” said Ferreira.

BuildForce is currently undertaking research across the country to determine exactly how many workers and which trades will be required to steer the transition.

RBC has estimated to get to Canada’s 2050 energy targets, all sources will need to invest an additional $5.4 billion annually, and some 4.5 million homes need to be retrofitted.

“On the plus side, most of the solutions that the industry needs to achieve net-zero or the economy needs to achieve net-zero, they exist for the built environment,” said Ferreira. “It’s just the question of accelerating the process of transition and bringing that into the economy.”

BuildForce estimates there could be roughly 60,000 additional workers required just to do renovations, many of them in the mechanical sector.

Office conversions offer opportunities for the mechanical sector, but not all offices are ripe for conversion, Ferreira explained.

Class A buildings have become much more affordable, and Class B and C buildings are under considerable pressure as tenants move to more affordable Class A space.

“A lot of those buildings are going to get sold off by REITs and likely converted into rentals, purpose-built rentals,” said Ferreira. “The challenge for that is that not all of them are set up for that. Because you’re in the mechanical contracting business, you know that most commercial buildings will have two washrooms on each floor. That’s not really conducive to setting up five to 10 units on each floor.”

The other challenge for office conversions is the nearby infrastructure, he said.

“It’s not just going in and gutting the building. It’s the actual infrastructure that these buildings tie into, that’s going to have to be upgraded across the country.”

Moving to electrification, Ferreira noted it has been estimated that output needs to increase by about threefold.

“It really depends on how much investment we see going into homes and businesses to try and reduce the amount of electricity required to let that transition play out,” he said. “But one way or another we know we need more electricity.”

The energy equation is far from settled, Ferreira continued.

Canada has a huge opportunity to be a significant player in hydrogen and it is now recognized that maybe the future of the transportation sector may not be all EVs and batteries.

“Toyota has now introduced an internal combustion engine that is entirely driven by hydrogen. We have the fuelling infrastructure across the country. With some transition, hydrogen could easily become the fuel of choice in the future.”

In terms of absolute workforce numbers, between 2023 and 2032, the net mobility needs for the construction workforce is 61,400, Ferreira said. That is how many new workers need to be brought into the industry from other industries or other sources, in addition to the 237,800 anticipated new entrants from traditional sources.

This does not include the additional residential demands, the retrofitting required as a result of electrification, he said.

“This is the time for the construction industry to shine,” said Ferreira. “It’s now up to this industry to find creative ways to be able to achieve results.”

Follow the author on X/Twitter @DonWall_DCN.

Recent Comments