Construction activity in both residential and non-residential sectors in Ontario is expected to be robust coming out of 2024 and the industry should see continuous growth through to the end of the decade says a new report from BuildForce Canada.

The 10-year forecast for Ontario released March 26 suggests the province’s non-residential sector will sustain the strong growth that began in 2016 until at least 2029, with growth fuelled by a long list of major projects in most regions of the province.

Meanwhile, BuildForce said, residential building looks poised to emerge from the stagnancy caused by high interest rates and rising inflation to resume growth starting in 2025 as housing costs ease and population growth drives demand for additional housing.

Known projects add up

BuildForce executive director Bill Ferreira said the annual forecast report did not include the anticipated stimulus to be created by public-sector housing initiatives nor multiple projects to enable the electrification of the economy.

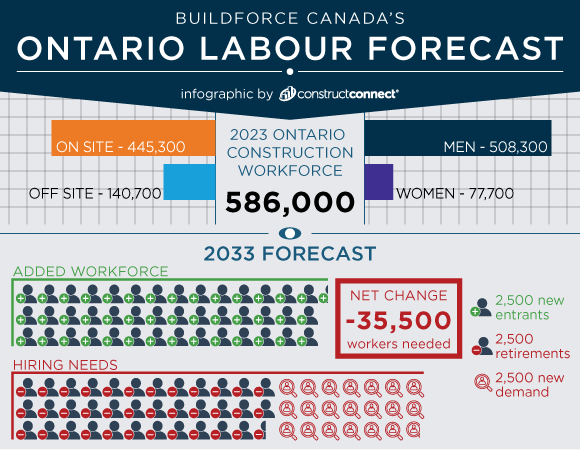

But still, the report predicts, by 2033, residential sector employment is expected to grow by six per cent above 2023 levels, while non-residential employment is expected to grow by just over 10 per cent.

“On the non-residential side, we’re tracking over $180 billion worth of projects over the next decade,” said Ferreira, noting every region in the province is showing strength. “That’s known projects. There’s a number of other projects that we haven’t built into the forecast because we don’t have a timeline yet.

“The main issue has just been that we’ve been experiencing a bit of a pause because of interest rates. The demand for housing in the province remains exceptionally high. Ontario is the recipient of about 44 per cent of all newcomers to the country.

“So generally speaking, the outlook for Ontario is very robust.”

ICI building and engineering-construction investment levels are expected to peak in 2027 and recede later in the forecast period as current projects wind down.

The forecasts are contained in BuildForce’s 2024-2033 Construction and Maintenance Looking Forward Report for Ontario. BuildForce is publishing 10-year project forecasts and workforce assessments nationally and for every province every day this week.

Labour force demand high across Ontario

Ferreira said with many workers exiting the industry due to retirement, many trades and occupations could experience strained conditions.

But with labour force demand expected to be high across Ontario, interregional mobility will be limited.

Over the next decade, the provincial construction industry is expected to recruit approximately 105,700 new entrants under the age of 30 from within the province.

“This leaves a projected gap of 35,500 workers that will need to be filled from a variety of sources outside the existing labour force to meet demands,” the report stated.

Ferreira said recruiting, retention and training efforts from across the sector have been comprehensive and effective. But temporary foreign workers should be viewed as a stop-gap measure and instead stakeholders must continue to strive to find permanent solutions, he argued.

“With apprenticeship registration, the trend is certainly quite positive,” said Ferreira. “And it does, in my opinion, speak to the success of some of those measures and how it is actually helping the industry build out its workforce and try and address what is anticipated to be about a 20-per-cent retirement rate over the next 10 years.”

In 2023, Ontario’s construction industry employed approximately 77,700 women, an increase of over 7,000 from 2022 levels. But women made up just five per cent of onsite construction professions in Ontario in 2023.

“The growth that we’ve identified in our report is from exceptionally high levels of investment,” said Ferreira. “We are not seeing any decline in investment. We are operating at very high levels already. So further growth is going to create some challenges for the industry to continue to staff at that level.

“But we’re optimistic that there’s still lots of areas that we could do more and should do more to help build out that labour force domestically.”

Follow the author on X/Twitter @DonWall_DCN.

Recent Comments