BuildForce Canada has hiked its estimate of national construction workforce needs significantly over the next decade after sizing up the next 10 years of projected sustained growth in the sector.

BuildForce executive director Bill Ferreira says the new workforce estimates are prompted by project demand that looks to fire on all cylinders through 2033.

“Demand keeps growing. And we’ve been seeing heightened demands, as opposed to plateauing,” said Ferreira recently. “Every year that we look at this, the demand for construction services seems to be rising.

“As a result, we keep seeing hiring requirements that keep rising. Last year, we were estimating we needed about 300,000. We are now estimating we need about 350,000 individuals between growth and retirements that need to be hired over the next 10 years.”

BuildForce Canada released its 2024–2033 Construction and Maintenance Looking Forward national forecast March 28.

Huge employment growth since 2002

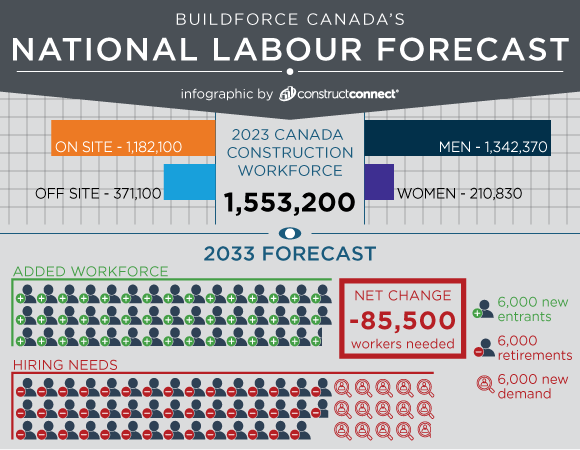

Employment in construction has increased by about 80 per cent nationally since 2002, and now counts about 1.5 million people.

Ferreira said the labour force requirements reflect a business-as-usual scenario. When new multi-level government housing initiatives as well as economic electrification forecasts are included – as they will be in another BuildForce report due soon – the new 10-year labour force demand estimates could be staggering.

“If we see a significant rise in construction demands for residential homes, related to the doubling of the number of new homes built over the next 10 years, that’s a federal-provincial initiative, it’s going to place even more demands on the industry to try and find individuals that are willing and interested in working in the trades to help support that build-out effort, which is quite significant,” said Ferreira.

“The electrification of the economy, which is another significant challenge and one that is more concentrated, some very specific trades, that will certainly put significant pressures on those trades to keep pace with the demand.

“We’re seeing a lot of conversions away from fossil fuels, particularly the Atlantic provinces, New Brunswick in particular, towards more energy-efficient electrical sources such as heat pumps.”

High volume of large projects planned

The report projects construction activity in the non-residential sector will remain strong across the forecast period, given the high volume of large projects planned and underway in most regions of the country.

“Engineering construction demands are projected to cycle lower in the short term before rebounding in middle years, in line with the schedule of planned transit projects in Ontario and British Columbia, as well as utility projects in New Brunswick, Nova Scotia and British Columbia,” states the report.

High demand in the ICI sector is being created by high levels of investment in the construction of institutional and government buildings, and by a rebound in commercial building construction as the economy returns to growth, says BuildForce.

Non-residential employment is projected to grow almost continuously across the forecast period, reaching a peak of seven per cent above 2023 levels by 2033.

19 per cent induced growth

Ferreira identified another source of growth in the non-residential sector – induced growth created by those federal-provincial housing initiatives.

BuildForce modelling suggests increased demand for infrastructure created by the supplemental housing construction will prompt labour force growth in the non-residential sector of about 19 per cent.

By 2033, the industry’s overall hiring requirements are expected to reach 351,800 due to the retirement of approximately 263,400 workers, or 21 per cent of the current labour force, and growth in worker demand of more than 88,000.

Based on historical trends, Canada’s construction industry is expected to draw an estimated 266,300 first-time entrants aged 30 and younger, leaving the industry with a possible retirement-recruitment gap of 85,500 workers.

The report notes women accounted for just five per cent of the onsite construction workforce in 2023, although their numbers are rising in the broader construction workforce. Ferreira said concerted efforts from all players have begun to address the broader recruitment gap as well as the deficit of workers from underrepresented demographics.

“We continue to see rising new entrants, and that really does speak to not only the collective efforts of the industry to draw more people into the trades, but also the efforts of governments to help the industry through a number of support programs, the Canadian Apprenticeship Service being one at a federal level,” he said.

Follow the author on X/Twitter @DonWall_DCN.

Recent Comments