New reports from BuildForce Canada suggest the construction industry in Canada’s three western provinces will generally trend upwards over the next decade but with pockets of weakness in all three during the forecast period.

While the 10-year outlook is generally strong, the reports alert stakeholders to stagnant growth in Saskatchewan’s non-residential sector, reductions in Alberta’s new-housing investment after 2027 and a modest decline in non-residential activity in British Columbia in the short term as several major projects reach conclusion or move past peak construction activity levels.

The forecasts are contained in BuildForce’s 2024-2033 Construction and Maintenance Looking Forward reports for the three provinces released March 27. BuildForce is publishing a national report and 10-year project forecasts and workforce assessments for every province all week.

Labour mobility important

BuildForce executive director Bill Ferreira noted with major projects coming to an end and other fluctuations, workforce mobility is a major issue as workers move to find work on new projects.

Workers who had moved to B.C. to help support construction in Kitimat as well as the Site C project will be drawn elsewhere as those projects wind down.

“There are opportunities now in other provinces that may draw them back, such as in the Edmonton area, in Alberta, as well as in Saskatchewan. So there is a little bit more flexibility,” said Ferreira.

“But the demands remain quite high.”

Non-residential activity in B.C. is projected to escalate between 2026 through to 2029 as work begins on a number of major engineering construction projects. Residential activity is expected to remain unchanged in 2024 and 2025 before the market sees a moderate boost to 2029.

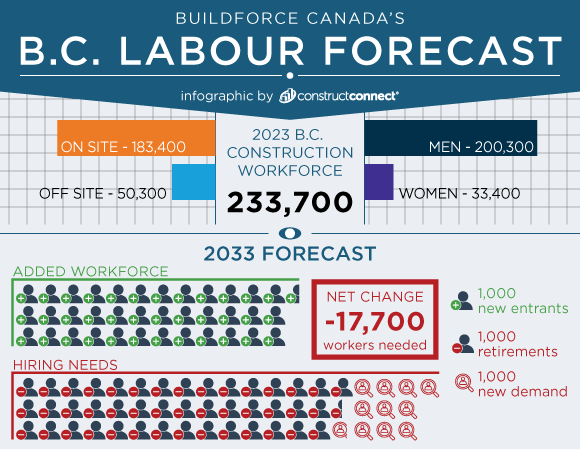

The steady activity in B.C. over the next decade means that the province’s construction industry will need to recruit 54,000 additional workers over the forecast period. Of those, 43,200 workers, or 23 per cent of the current construction labour force, are expected to retire during this period. Although the addition of 36,300 workers under the age of 30 from local recruitment efforts will help to offset these retirements, BuildForce notes, the labour force faces a need for large numbers of experienced skilled workers.

“Despite seeing some growth in new entrants, and bringing people into the industry, they are still not at levels that we would need to be able to keep pace with the demand growth and retirement,” said Ferreira. “So that’s where we end up with a gap of about 17,700 workers that need to be found from outside the industry or from outside the province.”

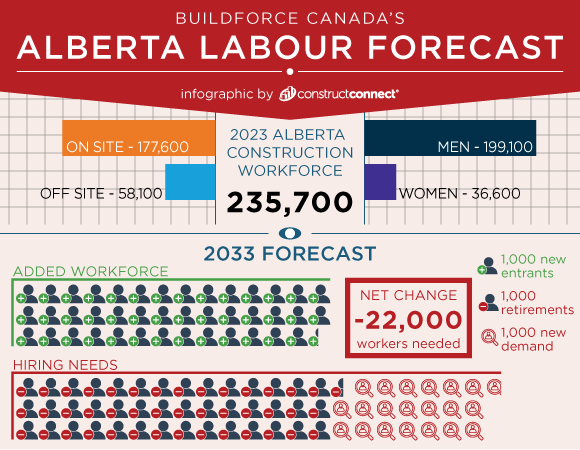

Alberta’s residential and non-residential construction sectors are both projected to record growth across the forecast period.

“Non-residential activity is anticipated to chart a steady trend up to the end of the decade, with growth in the oil and gas sector, as well as in engineering construction and the construction of industrial, commercial and institutional buildings,” BuildForce reports.

Meanwhile, Alberta’s residential sector is expected to cycle up in the short term before contracting modestly in the long run.

Alberta recruiting gap

BuildForce reports the province may be left with a recruiting gap of approximately 22,000 workers to be filled by 2033.

“Like many provinces, Alberta is facing a shift in its population age structure,” said Ferreira. “Many trades across the residential and non-residential sectors are facing recruiting challenges. Although a slowdown in the residential sector will help to ease some of those pressures, a long list of major projects in the non-residential sector, combined with seasonal industrial shutdown and maintenance activity, will keep that pressure elevated.”

In Saskatchewan, BuildForce has found a younger demographic is well positioned to replace retiring workers.

“The outlook for Saskatchewan’s construction sector is dominated by growth in the residential sector, which is projected to strengthen between 2025 and 2028 and remain elevated to 2033,” the report stated.

The non-residential sector, however, is projected to see little growth across most of the forecast period and declines in later years as the current inventory of known projects is completed.

N.W.T., Yukon, Nunavut

The construction economies of Canada’s three northern territories rely largely on transportation, energy and mining projects.

BuildForce has tracked 22 major projects on the horizon totalling under $15 billion, with the 17-year Giant Mine Remediation Project topping the list, valued at $4.38 billion.

BuildForce has also estimated the trades requirements that are generated by the construction of the various projects from 2024 to 2028.

Of just over 3,000 workers needed, the largest trade requirement is heavy equipment operators at 1,069 followed by construction trades helpers and labourers at 696.

BuildForce has determined that meeting labour demands and replacing an aging workforce will require a mix of short- and long-term mobility options that include both the movement of workers into remote locations and more long-term additions of young and permanent workers.

Some new workers may be drawn from the populations of the Northwest Territories, the Yukon and Nunavut; others will have to be drawn from outside the local construction industry.

Follow the author on X/Twitter @DonWall_DCN.

Recent Comments