Rare earth elements (REEs), such as lanthanum, neodymium and cerium play crucial roles in modern technology.

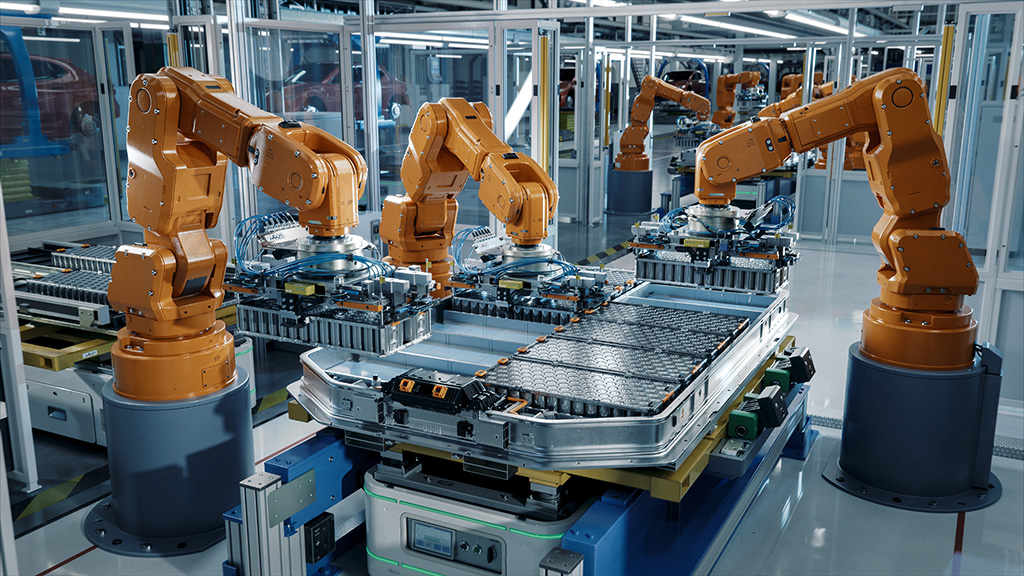

Smartphones, digital cameras, computer hard drives, LED lights, electronic displays, televisions, computer monitors, etc. all require REEs. They are also key to the worldwide energy transition that is underway. These elements improve durability, speed, functionality and thermal stability. For EVs, they lower both emissions and energy consumption.

The market for rare earth elements is steadily rising, mainly due growing sales of EVs, an expanding clean energy industry, and greater usage in the IT and construction sectors. Up to 50 per cent of digital camera lenses, including those on cell phones, are composed of lanthanum. This REE is also used in anodes for nickel-metal hydride batteries. These battery types, which can require up to 15 kg of lanthanum per vehicle, are utilized in hybrid electric cars.

Petroleum is refined using catalysts based on lanthanum. Automotive catalytic converters use cerium. In manufacturing steel, cerium, lanthanum, neodymium, and praseodymium are employed to eliminate impurities and create unique alloys.

Strong magnets are made of neodymium-iron-boron, which is advantageous when weight and space are constraints. These magnets, used in most wind turbines, are also made of dysprosium and terbium to make them resistant to demagnetization. Hard drives in computers, as well as CD-ROM and DVD drives, employ rare-earth magnets as well.

In the construction industry, REEs like cerium are used in high strength building materials. Praseodymium and neodymium can be found in catalysts that produce cement. Material coatings that protect against high temperatures and corrosion also include REEs. Other construction materials use neodymium and samarium-cobalt.

The Columbia Climate School says that over the next few decades, REE demand is projected to climb 400-to-600 per cent. An increased volume of renewable energy products will require more REEs to sustain the global drive away from fossil fuels. The extraction of these elements involves large-scale open-pit mining, which is energy-intensive and can cause environmental problems like radioactive waste, water pollution, and ecosystem disruption. Tracking the origin and quality of REEs is challenging due to the intricate nature of the supply chain and the high level of secrecy surrounding foreign trade activities. Reaching sustainability goals inside the REE mining sector will be difficult, due to a lack of transparency and supply chain disruptions.

Rich REE deposit countries have emerged as key participants in the sector and vital players in global supply chains. According to The Investing News Network, countries with the largest REE reserves in 2024 are China (44 million tons), Vietnam (22 million tons), and Brazil (21 million tons). Even with its current leading position, China intensified the oversight of its REE industry just last month. As written on its website, the Chinese State Council established that rare earth elements are national property and cannot be claimed by any group or person(s). It mentioned that the resource’s mining will be managed by the state, with new regulations coming into force in October of this year. Government organizations will set up a system for product traceability and have authority over the entire volume of rare-earth mining and smelting. Included with the recently established new guidelines are penalties for unauthorized mining activity.

China’s current dominance in the world’s renewable energy production creates a supply chain risk. Changes in national laws and regulations, as well as other geopolitical ramifications, can have a big effect on the industry. Many nations are trying to diversify their supply to reduce the dangers related to their reliance on China. The high cost of mining and production, which also requires large infrastructure investment (e.g., new roads to remote mining sites), as well as the negative environmental effects of REE extraction and processing, have hindered these attempts.

Rare earth elements play essential roles in current technological advances, encompassing electronics, green energy, and construction. But the process of extracting them presents environmental risks. With China dominating much of the world’s REE marketplace, achieving supply chain diversification is crucial to reducing geopolitical risks. Many countries are making efforts to increase domestic production, but there are still major obstacles due to high mining costs and environmental concerns. To properly address future technological needs, securing a sustainable REE supply chain will require strategic diversification and international cooperation.

Dmytro Konovalov has over 10 years of experience in equity research and analysis for global markets at leading international financial institutions.

Recent Comments