BuildForce senior economist Bob Collins had good news and bad news for delegates attending his presentation on labour force issues on day one of the annual conference of the Ontario Construction Secretariat.

The good news is that there looks to be a tremendous pipeline of projects, valued at over $100 billion, anticipated over the next half-decade in the province.

The bad news is that a number of challenges, some related to the pandemic, could threaten the delivery of those projects.

Threats include an inexplicable decline in the total size of the workforce from 2019 numbers, with some older workers and others apparently sitting on the sidelines as work resumes its pre-pandemic pace; the potential impact of mandatory vaccine requirements; and supply chain challenges.

Meanwhile, project costs are going up; training hit a pause during the pandemic, causing a near-term carryover effect; and it seems likely that worker mobility will not be the answer to local worker shortages as it often is.

“We are caught in this vortex now of how do we meet those peak demands,” said Collins, addressing an in-person audience in Niagara-on-the-Lake, Ont. on Oct. 6. “We have barriers to mobility. We have some people that haven’t returned to the workforce. There will be groups that will probably be tapping into the foreign market — I can tell you, and I keep hearing over and over, the U.S. is looking up here as well.”

Collins started off comparing Ontario construction workforce numbers in 2019 and 2021 — just ignore 2020, he suggested. Comparing the average of three months, June to August, in 2019 versus 2021, unemployment was 3.6 per cent in 2019 versus 3.4 per cent in 2021. But the construction labour force in Ontario has declined from a 581,100 average for those months in 2019 to 570,900 in the same months in 2021, a drop of 1.9 per cent.

“Employment hasn’t come back, nor has the labour force, and that’s causing some noise, even in provinces where there’s not significant growth of construction activity,” said Collins.

“You see low unemployment rates, and guess what, that’s your starting point coming into next year, where we anticipate a long list of projects.”

Normally employment among younger workers drops first during a slowdown but with the pandemic, comparing average employment from June to August in 2019 and 2021 among Ontario construction workers, there was a drop of 0.4 per cent in the 25-to-54 age group and a stiffer decline of 10.5 per cent among those 55 and older.

“These are your skilled workers,” said Collins of the 55-plus workers, pondering the reasons they continue to sit out. “These are the folks that had many family situations, which could be their own concerns about their health. They could be family, it could be the education side of why they may have sat on the sidelines.”

The retirement of baby boomers is a longstanding BuildForce concern, Collins noted, but it could be that older workers who are withdrawing their services are merely being choosy about work as the pandemic plays out.

“What we’re really looking for when we see the next round of numbers for September and October, will be, are they returning, because that’s a group that you do not want to lose.”

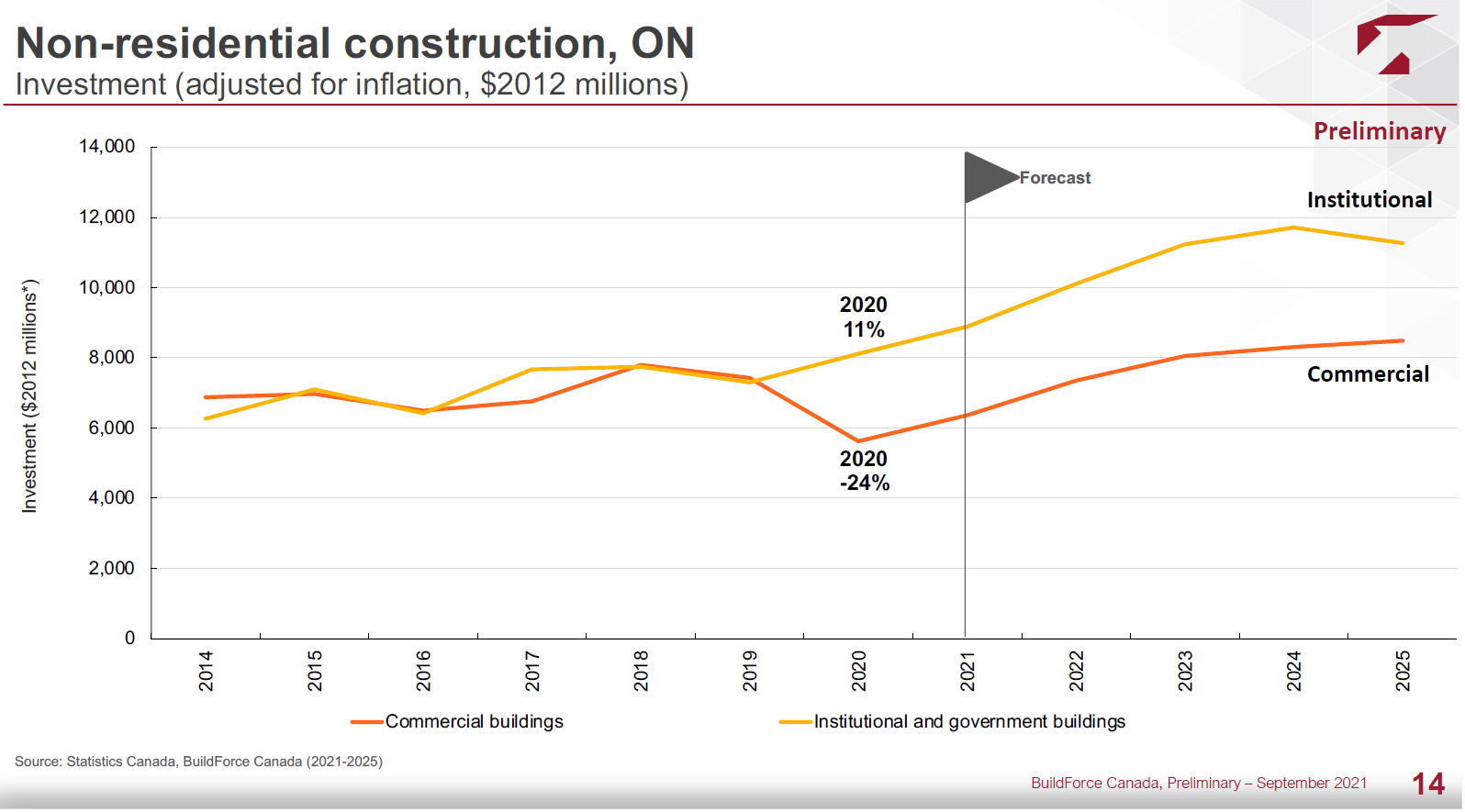

BuildForce project charts indicate continuing growth in Ontario over the next half-decade in most sectors. The expected volume of major transit and transportation projects in the next six to eight years is huge, approximately $60 billion worth. Major health care projects up to 2027 are valued at around $20 billion with nine over $1 billion. Major manufacturing, warehousing and distribution-centre projects are valued at around $6 billion in the next few years. And in the mining sector, a peak is projected in 2023, with $8 billion in new projects in the first half of the decade and beyond.

The list of utilities projects now underway includes the Darlington Nuclear Refurbishment project and Bruce Nuclear Refurbishment, leading the pack in value at $13.5 billion and $13 billion respectively.

Collins also presented a list of current and proposed major projects such as the Centre Block on Parliament Hill ($4.875 billion), the Gordie Howe International Bridge ($3.8 billion) and a dozen others all priced over $350 million.

To undertake all this work, Collins said, the challenge for the construction sector will be to find “tool-ready people that can jump on the job and be productive” in the near term, while “planning that long-term sustainable workforce, so finding that balance will create some disruptions for Ontario as we go forward.”

The work is expected to be so steady across the board in Ontario that employers will not be able to count on recruiting from slow regions, Collins said.

“Most regions rely to a certain degree on mobility, called intra-regional mobility, within the province,” he explained. “I don’t see a lot of that opportunity for Ontario right now. I just don’t see it with the levels of projects that are going on. If you’ve got work in your local market, you’re going to stay there.”

Follow the author on Twitter @DonWall_DCN.

Recent Comments

comments for this post are closed