BuildForce Canada executive director Bill Ferreira shed some light on the labour market and residential construction forecasts out to 2027 during a recent housing summit.

The session, Elephant Not in the Room: Labour Supply Shortages, was held during the Residential Construction Council of Ontario’s Housing Summit.

Ferreira’s presentation was titled BuildForce Canada Construction and Maintenance Looking Forward, An Assessment of Construction Labour Markets from 2022 to 2027. It focused on the Greater Toronto Area.

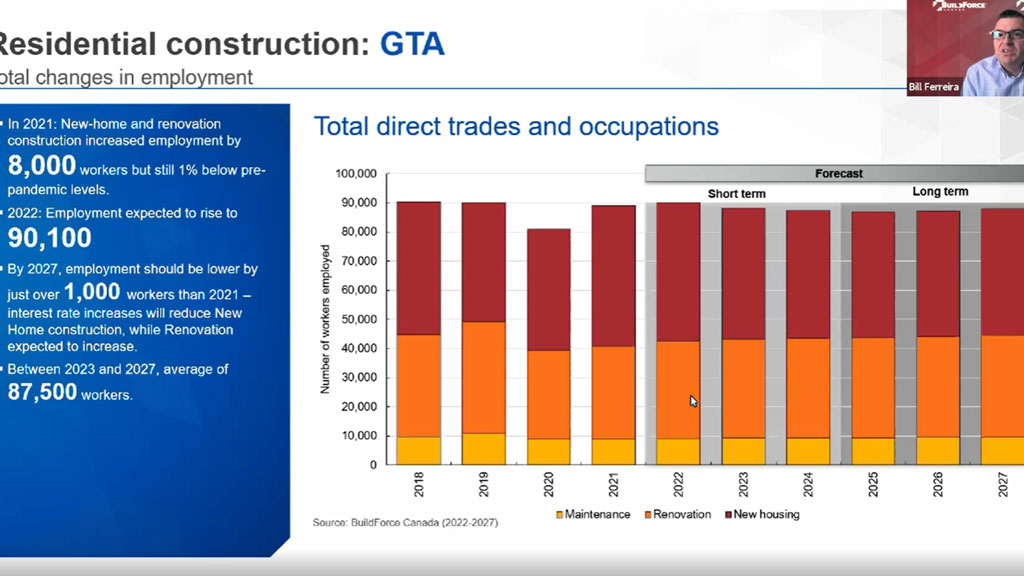

“Looking out over the forecast period, we see 2022 as really the peak for residential construction employment,” Ferreira said. “As interest rates start increasing, we anticipate that is going to have a bit of a moderating impact on overall employment in the construction sector. What we are anticipating is that there will be a slight decline in overall employment in construction at the same time. This is not unique to Toronto but it’s certainly a feature that we see in areas with very mature markets.”

Ferreira said in 2020 there was a dip in both employment and labour force which was driven by the pandemic.

“The unemployment rate shot up to 8.2 per cent in the region but since then what we have been seeing is that the labour force or employment in the industry has been growing much faster than the labour force,” Ferreira said.

“It’s up 9.9 per cent from 2020 levels which again is not surprising given the decline, but the labour force has only grown by 5.6 per cent. So many of those workers that were displaced from the labour force as a result of COVID have been slow to return. What that did in 2021 as we saw heightened demand for construction is bring the unemployment rate in the region down to 4.5 per cent, which is just slightly above the 4.3 per cent that was achieved back in 2018.”

A slight slowdown in construction activity is anticipated in the next few years and that, in part, is because 2021/2022 are very exceptional years in terms of overall activity, Ferreira explained.

“What we are anticipating is that the labour force is going to more or less catch up to employment and it will more or less mirror it throughout, up to about 2026 and 2027, at which point then we’re going to start seeing a slight decrease in unemployment again.”

As a result of the pandemic and people spending more time at home, there was a pickup in housing starts which peaked in 2021.

“Due to rising interest rates we anticipate that it’s going to moderate somewhat right out to about 2023 and then essentially flatline and pick up again towards 2027, the tail end of our outlook,” Ferreira said.

The study also monitors investment in both new housing and renovations over the outlook period.

“New housing construction was up significantly. We do expect to see a bit of a drop over the next couple years,” said Ferreira. “It’s a very minor drop but it will be levelling out and then remaining relatively steady right through to about 2026 and then picking up again.”

Overall, during the period, BuildForce reports the demand for construction workers is expected to decline slightly.

“At the same time, we have nearly 15,000 workers exiting the labour force which is about 15.8 per cent of the 2021 labour force,” Ferreira said. “During that period, and again this is based on current recruitment rates, we anticipate just under 10,000 workers will join the industry recruited locally in the region leaving the industry with a gap of just over 4,600 workers that will need to be filled from outside the region”

“There is not a region in Ontario that isn’t experiencing very tight labour markets, so pulling workers in from other regions is going to become increasingly more challenging for the sector in the GTA,” he added.

In his presentation, Andrew Brethour, executive chairman of PMA Brethour Realty Group, compared housing prices in Toronto to Houston, Texas.

“Toronto became the most expensive city in Canada this month — $1.2 million is our average household price. That makes us number one in Canada and number two as the most unaffordable city in the world,” Brethour said. “Why? The approvals process.

“In Houston I can get a plan approved in 18 months from zero, purchasing the land to actually putting a shovel in the ground. In the GTHA it takes 10 years on average.

“We’ve got an issue of supply that we created by government decree by the restriction under the growth plan,” he said. “We’re competing in North America for jobs and we’re going to be under severe strain given our current house prices.”

Follow the author on Twitter @DCN_Angela.

Recent Comments

comments for this post are closed