COR is becoming a major competitive advantage for ICI construction companies in Ontario, yet some are still slow to adopt it. In October, we reported that Metrolinx and the TTC will require COR for prequalification in 2016.

Recently, Metrolinx and the TTC have revised their rollout plan to give lagging companies time to catch up so bidding on their projects remains competitive.

All those wanting to bid on Metrolinx projects in 2016 must have the following status with the Infrastructure Health and Safety Association (IHSA) by these dates:

- "Internal Assessment" by April 1, 2016, regardless of estimated project value;

- "Certified" status by April 1, 2016, for construction projects with an estimated value in excess of $25 million; and

- "Certified" status by Oct. 1, 2016, regardless of the estimated project value.

The TTC has changed their required dates for COR certification as follows:

- Jan. 1, 2016 for contracts greater than $5 million; and

- Jan. 1, 2017 for all contracts, regardless of value.

While these revised dates provide some leeway, companies should not wait to get started. To remain competitive, companies should achieve COR as soon as possible.

As the CEO of a growing safety software company, eCompliance, I appreciate the hesitation some executives have before undergoing new projects. Although there are many factors to consider, the main ones are cost and return on investment (ROI). To help companies understand the value of COR beyond the competitive advantage created, my team and I have crunched the numbers and discovered not only the cost of achieving COR, but the ROI as well.

Investing in COR

Although COR can be difficult to achieve, it isn’t requiring companies to go beyond what they should already be doing. Therefore, the investment required to achieve COR depends on two key factors, the levels of gaps within your current safety program versus the COR standard; and the size and scope of the organization.

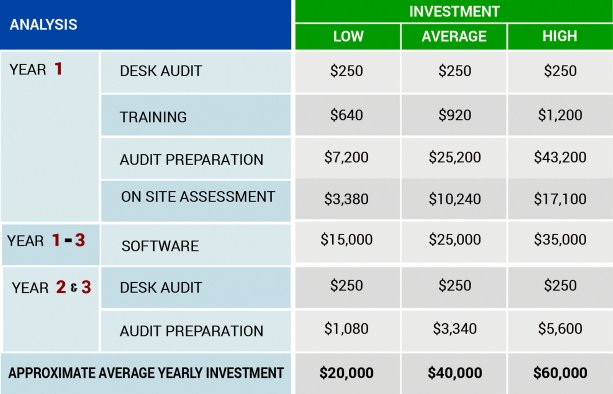

Investments in COR can be divided into hard costs (IHSA training, software and the audit itself) and soft costs (time to fill the gaps in your existing program, documentation, etc.). COR certification lasts three years and since resources are required for both achieving COR in year one and maintaining it in year two and three, it’s best to look at the average annual cost over the entire certification period.

To make our calculations applicable to a wide range of companies, we ran three different scenarios for the resources required to achieve and maintain COR: low, high and average (the midpoint between high and low). We found that for smaller companies (less than 100 employees) or exceptional companies with few gaps in their existing program, the cost can be as low as $20,000 per year. For bigger companies (500-plus employees) or companies with many gaps in their existing program, the cost can be as high as $60,000 per year, which gives an average cost for midrange companies (either in size or gaps in their program) of $40,000 per year.

The ROI of COR

The investment into COR comes with high returns. Statistics Canada found that the average profit margin for construction companies is 6.2 per cent. Since all TTC contracts over $5 million will require COR in 2016, we investigated what the ROI would be for winning just one of these contracts. To be conservative, we used the high-end cost of $60,000 per year. Taking these things into account, winning a single TTC contract could yield 5.2 times the original investment.

It should also be noted that this 5.2 times the ROI is calculated without considering the other potential financial benefits of COR such as lower insurance premiums, fewer penalties and other quantifiable benefits of reducing injury rates.

At the end of the day, the ROI of COR demonstrates that safety programs aren’t just another ‘cost of doing business.’ Rather, the 5.2 times the ROI shows that safety can be a game-changing revenue driver as well as a chance to demonstrate a genuine commitment to workplace safety.

Adrian Bartha is the CEO of eCompliance, a leading health and safety management software solution company. For more information visit www.ecompliance.com. To comment or propose Industry Perspectives column ideas email editor@dailycommercialnews.com.

Recent Comments

comments for this post are closed