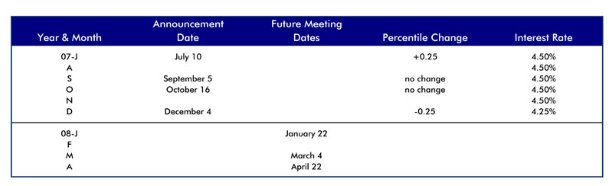

On December 4, 2007 the Bank of Canada (BOC) lowered its target overnight rate by 25 basis points (100 basis points = 1.0%) from 4.50% to 4.25%. The Bank of Canada’s key policy-setting interest rate now stands one-quarter percentage point below the federal funds rate of the Federal Reserve Board in the United States.

Economy at a Glance — December 18, 2007

On December 4, 2007 the Bank of Canada (BOC) lowered its target overnight rate by 25 basis points (100 basis points = 1.0%) from 4.50% to 4.25%. The Bank of Canada’s key policy-setting interest rate now stands one-quarter percentage point below the federal funds rate of the Federal Reserve Board in the United States.

There are four reasons why the BOC lowered its key interest rate.

(1) The Bank is worried about future economic growth in Canada in an environment that is likely to include at least some slowing, if not an outright recession, in the U.S. economy.

(2) There is the expectation that the Federal Reserve will drop its federal funds rate on December 11. The Fed is expected to take this course of action in order to combat liquidity problems in the U.S. and to provide enough stimulation to forestall a significant slowdown, or recession, in the U.S. economy.

(3) A drop in rates in Canada will help to stabilize, at a reasonable level (i.e., close to parity), the value of the Canadian dollar versus the U.S. dollar. This will put an end to the kind of speculation that saw the dollar rise to almost $1.10 U.S. about a month ago. The dollar at par will provide some relief to Canadian manufacturers trying to sell into the U.S. market. This will become even more important if the expected slowdown in the U.S. economy materializes.

(4) The Bank of Canada has been presented with a window of opportunity thanks to continuing low price inflation in Canada. The core rate of inflation in October was only +1.8%, below the target level of +2.0%. Restraint in prices will continue at least for the short term, particularly given the scheduled drop in the Goods and Services Tax (GST) from 6% to 5% on January 1, 2008.

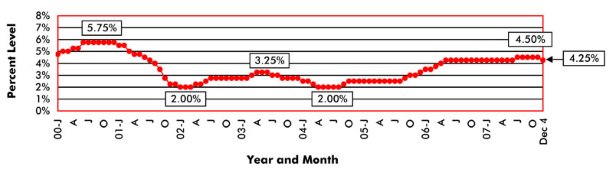

Bank of Canada Target Overnight Rate

Bank of Canada Target Overnight Rate — History

Data source: Bank of Canada.

Chart: Reed Construction Data — CanaData.

Bank of Canada Target Overnight Rate — History

Recent Comments

comments for this post are closed