There was good news for employers across the board and for much of the construction sector as Ontario’s Workplace Safety and Insurance Board (WSIB) announced average premium rate reductions of five per cent for 2017.

The drop in premiums comes as a dividend of a faster-than-expected reduction in the WSIB’s unfunded liability (UFL) after five years of holding the line with continuing high premiums.

Seven of 13 rate groups within the construction sector will see rate reductions of more than the five-per-cent average next year, with three categories — homebuilding, siding and outside finishing, and formwork and demolition — all achieving the maximum reduction of 14 per cent.

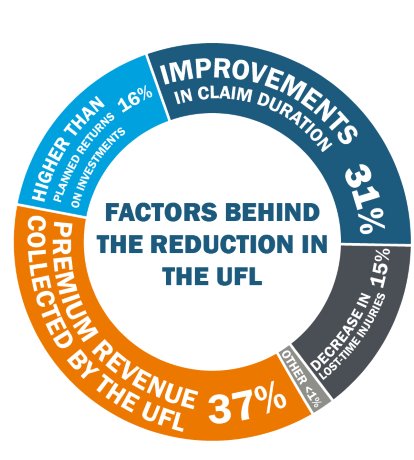

The announcement came to WSIB stakeholders at its annual general meeting held Sept. 14 in Toronto. An economic statement presented at the meeting offered four main reasons for the financial turnaround since 2009, when the UFL stood at $14.2 billion: increased premium revenue from employers; higher investment returns than anticipated; fewer claims; and improved recovery and return-to-work results. "It was good news for the whole system, it was good news for workers, good news for employers," said Tom Teahen, WSIB president and CEO. "It was good news in that they heard there will be a rate decrease next year. I think they can see a future where there will be more stable and predictable rates. And lower rates."

Worker advocacy groups such as the Ontario Network of Injured Workers Groups, which protested at the meeting, argued that workers paid an inordinately large price as the WSIB took steps to reverse course over the past five years.

Carmine Tiano, director of occupational health services with the Provincial Building and Construction Trades Council of Ontario, said that the WSIB went too fast, too soon. Both Tiano and David Frame, director of government relations for the Ontario General Contractors Association, pointed to changes in the treatment of pre-existing conditions as particularly controversial.

"Do I think there was a co-ordinated plan of the WSIB to go after and downgrade workers’ benefits?" asked Tiano. "I don’t think so, but I believe that since 2011 and continuing, there has been severe unintended consequences that have impacted workers’ benefits."

In Frame’s analysis, "The board’s part of getting the UFL under control, they looked at the duration of claims and the cost of health care, and those costs had gone way up. So they looked to get health care costs under control, and they looked to get duration of claims under control."

Teahen denied that "tightening" of compensation played a major role in fighting the UFL over the past five years.

"I wouldn’t use the language of tightened up, I’d say we’ve refocused our efforts on return to work and on outcomes that are better for workers," he said. "And in doing that, there has been a corresponding financial benefit, because if workers are back to work sooner, their claims aren’t going on as long. But that’s a secondary outcome beyond focusing on the return to work for workers, and when you are focused on that rather than just paying a claim, the system is better off and that’s what we’re seeing."

After five years of no rate reductions for anyone, all but two rate groups will see either no change in premiums or else reductions in 2017. The total value of the lower premiums next year amounts to $250 million.

Frame said even the 14-per-cent reduction earned by some construction rate groups shortchanges them based on recent performance.

"Much of the construction industry, because there has been disproportionate growth in the construction industry, has paid a bigger part of the unfunded liability," said Frame.

"If they had gone to targets, it would have been more…Some of the target rates, for homebuilding, the target rate had gone down 35, 36, 38 per cent but they are doing a maximum decrease of 14 per cent."

Teahen also denied that the construction sector, which contributed 27 per cent of the total of premium receipts in 2015, effectively subsidized the WSIB’s return to financial health.

"The reality is, all rate groups have been paying toward the UFL, and their contribution towards the UFL over time has changed based on the experience they have delivered in terms of improved outcomes and improved health and safety over time, and the contribution levels from any sector or rate group to the UFL reduction over the course of the UFL has varied.

"So yes, while construction might say today they may notionally have overpaid, others may have said that in the past as compared with construction, so the overall message is, employers have been contributing to this reduction in the UFL and they’ve agreed to do that. They have been telling us, it is important to get the unfunded liability eliminated so that we can bring greater stability to the system. And they’ve all accepted that."

Other rate groups within the construction sector will see the following rates in 2017, with either no change or the percentage reduction in premiums indicated: Electrical and Incidental Construction Services, 3.5; Mechanical and Sheet Metal Work, no change; Roadbuilding and Excavating, 6.4; Inside Finishing, 11.5; Industrial, Commercial and Institutional Construction, no change; Roofing, 7.4; Heavy Civil Construction, 5.4; Millwrighting and Welding, 2.6; Masonry, no change; and Non-Exempt Partners and Executive Officers in Construction, no change.

Teahen said the Harry Arthurs report of 2012 pointed the way towards the goal of restoration of 100-per-cent funding, and now, according to the recent WSIB economic statement, the target is a Sufficiency Ratio of 115 to 125 per cent. Full funding could be achieved by 2021, suggested the report, if positive economic conditions exist, well ahead of the provincially legislated mandate of 80 per cent by 2022.

The current UFL is $5.2 billion.

Recent Comments

comments for this post are closed