The Ontario Construction Secretariat’s 2024 Contractors Survey indicates fewer ICI contractors than last year have a positive outlook for the upcoming year but OCS director of research Katherine Jacobs suggests there’s still significant optimism with lots of work in the marketplace.

The survey was released at the OCS’s annual State of the Industry and Outlook Conference held in Toronto March 7. Two-thirds (66 per cent) of contractors are feeling positive, down from 81 per cent in last year’s survey.

Ontario Construction Secretariat

While most predicted more business, with lots of current work in the pipeline, various concerns dampened the enthusiasm, Jacobs said, including labour market challenges and costs, economic uncertainty, high interest rates and the cost of materials.

“This year’s survey was a bit of a mixed picture,” Jacobs told 300 delegates attending the conference. “We came off a really strong 2023. And last year’s survey was fairly optimistic.”

This year the contractors were “not quite as optimistic but still had a very strong outlook for this coming year.”

The brightest news came from contractors reporting on problems with the supply chain. Only 58 per cent of contractors said they experienced significant disruptions in the past year, down dramatically from 73 per cent last survey.

Hiring intentions remained close to the same as in last year’s survey, with 34 per cent of contractors expecting to increase their hiring. Fifty-eight per cent expect to hire the same number and eight per cent said they would hire fewer workers.

Contractors pointed to rising costs and project delays as the top two consequences of labour market challenges — 73 per cent identified that cost increases would be a direct result of skilled labour shortages, while 52 per cent said projects would be delayed, the same percentage of firms that said they would use less qualified labour.

Forty-six per cent of contractors said the labour shortage would force them to turn down work.

“So there are pretty serious consequences when we can’t supply labour,” said Jacobs.

More union contractors employ apprentices

Among other findings:

- Over three-quarters (78 per cent) of union contractors employ apprentices. That’s in contrast to 50 per cent of non-union contractors.

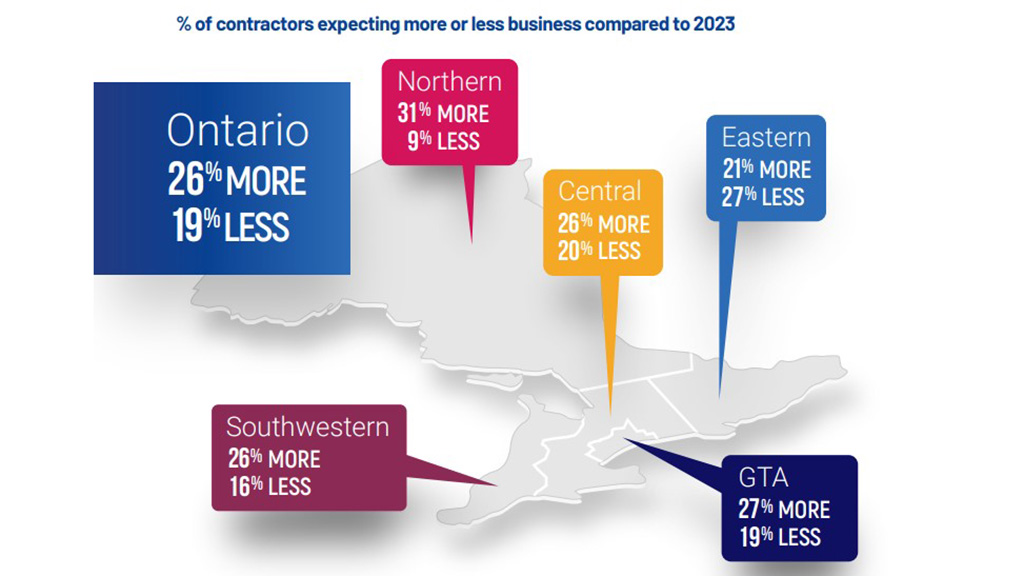

- 35 per cent of contractors expect an increase in revenues in 2024. But one in five contractors (19 per cent) is anticipating a decline in revenue.

- Just over one-third of contractors reported having projects cancelled by the owner. Of those, 56 per cent report having projects postponed to a later start date, up slightly from 53 per cent last year.

- The high cost of materials was the number one reason for cancellations, cited by 71 per cent of contractors who had projects cancelled, followed by interest rates (65 per cent) and labour costs.

- The survey found 81 per cent of contractors said that adopting new technologies is important to the future of their business, up from 71 per cent in 2018. But only 15 per cent reported having a budget for technology.

“More of them are saying that it’s important to the bottom line,” said Jacobs. “I wish we’d seen a bit more movement on the budget line because, you know, if you really want to adopt it, you need to put some money towards it.”

- Among motivators for the adoption of new technologies, productivity enhancement took the top spot, representing 28 per cent of responses. The next two motivators were reducing costs (22 per cent) and client needs (21 per cent).

Despite the buzz about AI in the past 15 months, to Ontario contractors it remains a niche technology, with only 11 per cent reporting using it.

The most commonly used technologies were BIM (44 per cent), jobsite data collection apps (43 per cent), smart sensors (38 per cent), advanced building materials (35 per cent), clean tech (29 per cent) and prefabricated or modular building (29 per cent).

Jacobs suggested the data probably underestimates the impact technology is having on the sector. Many of the 500 contractors surveyed are small, she said, while it is well known that the giants of the sector such as EllisDon are significant adopters. The momentum being generated by the large firms will soon filter down to the smaller ones, she suggested.

Follow the author on Twitter @DonWall_DCN.

Recent Comments

comments for this post are closed