It appears the analysts who in late 2016 were projecting the world economy was doomed to exhibit weak growth in perpetuity were wrong. One of the clearest illustrations of this mistaken view is performance by the German economy over the past year.

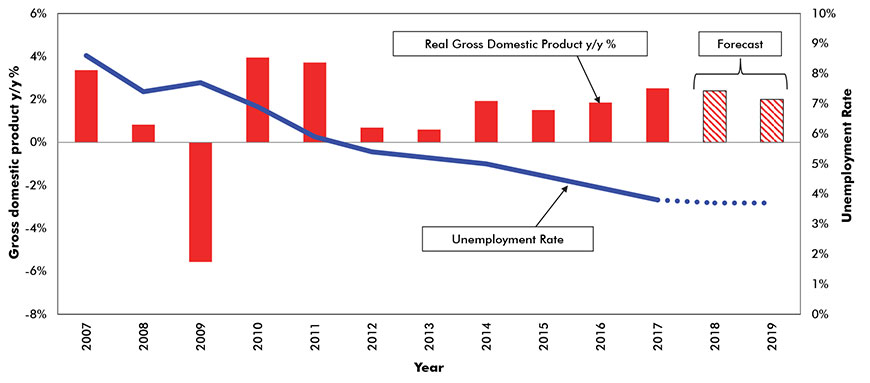

After posting a gain of 1.9% in 2016, the largest economy in the European Union grew by 2.5% in 2017. This increase, a seven-year high, was well ahead of the consensus estimate of 1.5% to 2% and just behind Canada, which exhibited the fastest growth (3%) among the G7 group of major developed countries.

While Germany’s growth in 2017 was broad-based, two sectors exhibited significant strength. First, driven by the vigorous growth of the global economy (discussed in Snapshot #4 – “Stock market hiccup does not signal cyclical global economic downturn” – and more recently by the OECD), the total value of German exports increased by 6.3% y/y following a very small gain of 0.9% y/y in 2016.

Across major commodity groups, the largest gains occurred in sales of motor vehicles, machinery and equipment, electric equipment and computer, electronic and optical products. By region, 9% of German exports are destined for the U.S., followed by 8% to France, 7% each to China, the UK and the Netherlands and 5% each to Italy, Austria and Poland.

Given that the U.S. is a market for just 5% of Germany’s steel exports, the self-destructive steel tariffs recently announced by the U.S. administration appear unlikely to have a significant impact on the German economy in the near term.

In December, new orders for manufacturing rose by 3.8% m/m largely due to an 11.8% jump in orders from countries within the euro area plus a 2.8% rise in orders from non-euro countries. Against the positive outlook for the global economy, exports of manufactured goods, especially durables, should continue to make a major contribution to the growth of the German economy through 2018 and into 2019.

As a result of the rapid acceleration in exports of manufactured goods and a concomitant rise in industrial capacity utilization to a ten-year high of 87%, business non-residential investment posted a gain of 4.4% in 2017, its strongest showing since 2014. Moreover, in light of the above-noted very strong rise in manufacturing orders, investment will likely continue to make a significant positive contribution to growth over the course of 2018.

While the overall outlook for investment remains positive, a recent easing in business confidence, a growing shortage of qualified workers, and the appreciation of the euro suggest that firms’ investment plans will moderate in the second half of the year.

The strong pattern of investment and the concomitant growth of industrial production boosted total employment by +1.5% y/y in 2017. This increase, the largest since 2007, was mostly due to strength in private sector hiring, and it caused Germany’s unemployment rate to decline from 4% to 3.6% over the past twelve months. This combination of sustained growth of employment and a 2.7% rise in wage rates caused private consumer spending to accelerate from 1.9% y/y in 2016 to 2.3% in 2017.

The recent positive pattern of exports, business investment and consumer spending has been accompanied by very strong housing demand in most of Germany’s major metro areas. In a recent analysis of the housing market, Deutsche Bank noted that the current real estate cycle which started in 2009 shows no signs of cooling. Over the past eight years, house prices and rents in Germany’s major metro areas have increased by 60% to 90%. Further, the combination of strong growth of employment and positive net immigration have severely depressed rental vacancy rates. Looking forward, the positive outlook for employment, persisting relatively low interest rates and sustained immigration should cause housing demand to remain strong and maintain upward pressure on both house prices and rents well into 2019.

The Germany economy appears likely to expand at or close to the same rate in 2018 as it did in 2017. However, with an unemployment rate at 3.6%, the lowest it has been since 1981, and the capacity utilization rate at 87.9%, just slightly below its record high (88.7%), the economy is operating at an unsustainably rapid pace and it will probably moderate in the second half of this year or early in 2019. This prospect for a more moderate, sustainable rate of growth in the range of 1.5% to 2.5% is based on a consensus assessment.

Germany: Real Gross Domestic Product y/y % vs Unemployment Rate

Chart: ConstructConnect — CanaData.

Recent Comments