Calling the pandemic “the most abnormal recession” ever in Canada, a leading economist sees the country’s economy poised for an even stronger climb to recovery in the second half of 2021 than has been projected by the Bank of Canada.

That is largely because the pandemic’s main economic victim has been the low-paying service sector, an industry capable of a quick turnaround, Benjamin Tal, deputy chief economist with CIBC Capital Markets, told a webinar audience recently.

Construction and manufacturing sectors, relatively untouched by comparison in the pandemic, are often hit hard in traditional recessions, experiencing slow recovery periods.

“If you look at the overall situation it is much easier, let’s face it, to open a new restaurant than to establish a new manufacturing facility,” Tal said.

A keynote speaker at the Ontario Construction Secretariat’s State of the Industry and Outlook Conference, Tal described the pandemic as “an event,” without any expected long-lasting economic scars, rather than “a condition” typical in traditional recessions that leaves long-term harm.

He told the audience the pandemic is the first recession ever in which the federal government injected so much money, at least $7 into the economy for every dollar decline in wages.

“It’s not surprising that incomes went up.”

Over the span of the past year or so, while high-paying jobs increased by 350,000, the economist said spending by that group declined.

Calling the group “passive savers,” Tal told the audience they represent a huge amount of pent-up spending demand.

“All those people are dying to go to a restaurant, but they are not willing to die to do so.”

Tal said production and financing capacities for increased demand for products and services, including construction, will be stronger than the market has been expecting.

He pointed out while work-from-home routines were established through evolving digital mediums, productivity was enhanced in much of the work-world.

GDP growth in the last two quarters of 2021 could hit five to seven per cent, based on an annual basis.

Meanwhile, the pandemic could change spending behaviours by government. Prior to the pandemic, the feds spent about 15 per cent of GDP, but through the crisis spending hit 35 per cent of GDP.

While that number is unsustainable, Tal suggested it might only drop to about 17 to 19 per cent in part to cover future social assistance programs. That might result in an increase in taxes, possibly two years from now.

While material costs, lumber for example, have risen during the crisis, Tal said he believes prices will stabilize eventually because the current demand isn’t sustainable in the U.S.

Materials prices, however, won’t ease in the next 12 months, he predicted.

Tal pointed out overall construction costs — including labour rates — won’t soften soon because of the increased demand for skilled workers in both Canada and the U.S. on major infrastructure projects.

He predicts a “relatively healthy” construction industry in the Greater Toronto Area and sees the residential sector doing “extremely well” over the next year as housing demand outstrips supply.

Tal said population growth projections as tabled by Statistics Canada don’t take into account all of the Canadians residing on foreign soil returning to Canada. Hong Kong is a case in point, where 60,000 of the 500,000 Canadians in Hong Kong returning home are not captured by Statistics Canada.

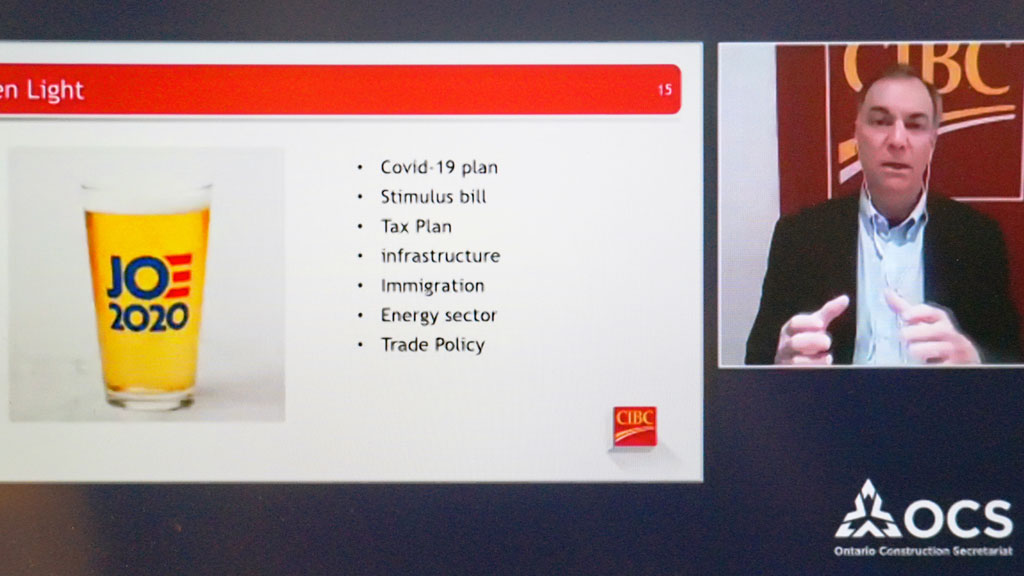

Tal also told the audience the Joe Biden administration’s nearly $2-trillion-dollar injection into the U.S. economy in the next few months will impact the Canadian economy.

He added with $2.1 trillion earmarked for infrastructure in the U.S., $400 to $500 billion for transit and most of the remainder to green industries over the next few years, Canada must be a part of the supply chain to feed the manufacturing industries for those projects.

“We must convince Biden that we are part of the North American umbrella as opposed to (the president choosing) Buying America.”

Recent Comments

comments for this post are closed