The chief economist for Export Development Canada (EDC) has revised his economic forecasts for 2021 and now calls for a dramatic spike in the U.S. economy this year, with Canada poised to go along for the ride.

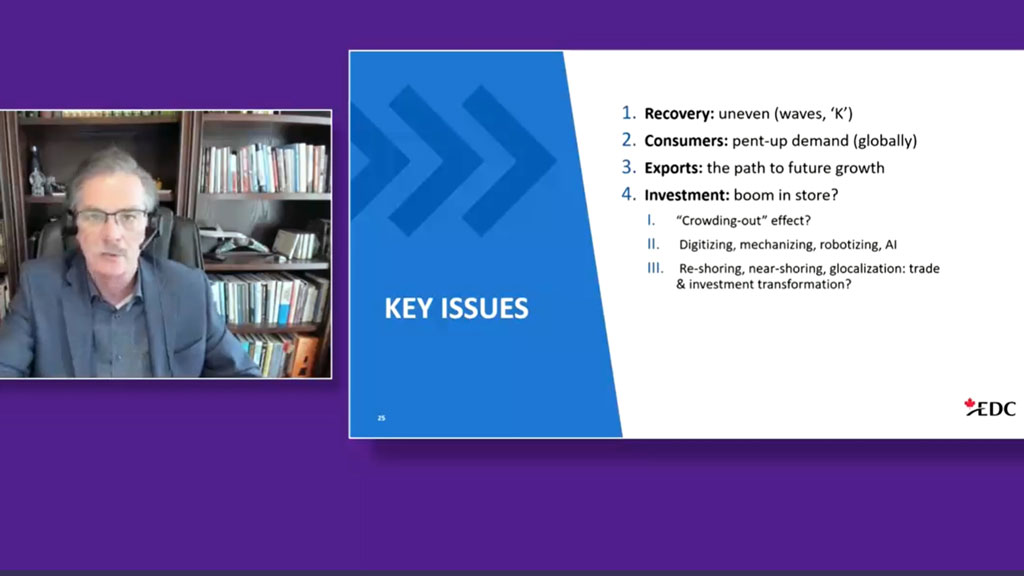

That’s great news for the construction sector, Peter Hall told a webinar audience March 25, day three of the Canadian Construction Association’s (CCA) recent conference. In fact, Hall said, the good news was so fresh that the slides he was presenting from the most recent EDC Global Economic Outlook were significantly off base.

“For this year, which is absolutely stupendous growth, I guess is the only way that I can say it, we’ve had to adjust our forecast principally for the United States, but we’ve gone up more than a per cent in our Canadian forecast as well,” said Hall.

With growth caused by post-COVID pent-up demand, global consumer and commodities demand and U.S. President Joe Biden’s stimulus plan along with other factors, “The second half of this year is going to be roaring ahead and you need to fasten your seat belts because the G force is going to be something you may not be able to handle,” he added.

Hall reiterated the forecast revisions in two consecutive weekly commentaries on the EDC website. On March 25 he reported that the 2021 forecasts assembled by Consensus Economics Inc. for the U.S. economy had taken a “mighty leap” in 30 days, from 4.7 per cent to 5.7 per cent; and on April 1, with Biden’s administration’s US$1.9-trillion stimulus program now official and US$750 billion “to hit the streets mere weeks from now,” the EDC raised its forecast for U.S. growth in 2021 to 6.3 per cent, a boost of over two percentage points from its previous outlook.

Canada’s growth is now predicted to see a rebound of 5.5 per cent in 2021, followed by 4.1.-per-cent growth in 2022. Emerging markets, swiftly gaining market share in world GDP, look to grow by 7.1 per cent this year, with China expected to bounce 10.8 per cent and India to jump 1.3 per cent.

Along with the Biden infrastructure stimulus, consumer spending will be a key driver of growth this year. The U.S. housing market never really recovered from the 2008-09 recession, Hall said, but just prior to COVID hitting, the U.S. market was on the verge of finally breaking through.

“So now what we see happening is U.S. housing starts getting up to the 1.6-million level. That’s music to my ears, folks, and it’s very supportable.”

Another indicator telling Hall the U.S. and Canadian economies will surge, he said, is bank demand deposits. That’s money sitting waiting to be spent, he said, and right now the amounts in the respective sets of reserve accounts represent 14 per cent of U.S. GDP and 11 per cent of Canadian GDP.

When that happens, “You got a really big punch that can be packed here from the private side of the economy. So when consumers, when businesses who are a part of this, feel confident enough to actually spend this money in the economy, it washes into the economy even more powerfully than that tsunami that hit us when we were in Hawaii that one time,” said Hall referencing a previous CCA conference.

And Canada will participate, Hall said: “This is pent-up demand, serious pent-up demand if there ever was one.”

That stimulus, combined with savings from government COVID subsidies and other sources, is already affecting homebuilding, he said.

“If you’re in that business and renovations, alterations and repairs on the personal side, that is going gangbusters.”

Even greater opportunities will accrue to firms smart enough to take advantage of long-term global growth, Hall said. Canada has always benefited with its close ties to the U.S. but in future, the nation’s trade with China will grow from the current five per cent of our exports to surpass that with the U.S. — expected by 2048, but possibly much sooner, Hall said.

That means ample work for constructors that can help firms expand to take advantage of that trade, and those that become involved in improving trade-enabling infrastructure.

“We’ve got all kinds of choke points,” Hall said, referring to West Coast infrastructure, air carriers, rail services, roads and trucking networks.

Folks, the time to build for that story is actually now. And so, entering into the conversation about this is fundamental for the construction industry, because there is so much that needs to be done.

“The implications for what we’re actually putting down as infrastructure to accommodate this kind of stuff are absolutely amazing for construction companies here in Canada.”

Follow the author on Twitter @DonWall_DCN.

Recent Comments