Driven in large part by a 9% year-to-date rebound in investment in building construction Canada’s construction industry has, over the past year, added just over 70,000 jobs. This is proportionately more than four times the increase in the United States which has ten times our population. To put some additional perspective on this increase, over the past 17 years, construction employment has increased on average by 25,000 a year.

Over the past twelve months, most of the jobs added were by building equipment contractors (16,000), firms doing heavy and civil engineering construction (+15,000), and those directly involved in residential construction (+13,500).

Job vacancies in construction hit record high in Q3/2021

There is compelling evidence that the rate at which individuals are entering the labour force is lagging behind the rate at which they are being hired.

Over the past year the all-industry job vacancy rate, which averaged 1.7% between 2011 and 2020, has risen from 3% in Q1/2020 to a record high of 5.4% in Q3/2021. In the construction industry, the situation is more acute largely due to a 17.8% increase in investment in residential buildings.

Although employment in the industry has increased by 10.8% year to date, its job vacancy rate has increased from 3.4% at the beginning of 2020 to an unprecedented 6.3% in Q3/2021. This data is not seasonally adjusted consequently the fact that the vacancy rate has increased when it typically has declined highlights how difficult it is for firms to fill vacant positions during a seasonal lull. Consistent with this increase in the (all industry) job vacancy rate, the average offered hourly wages in the construction industry have increased from $25.50 in Q1/2020 to $26.70 in Q3/2021. This 13% rise over the past seven quarters is more than twice the all industry increase of 6.1%.

All provinces need more construction workers

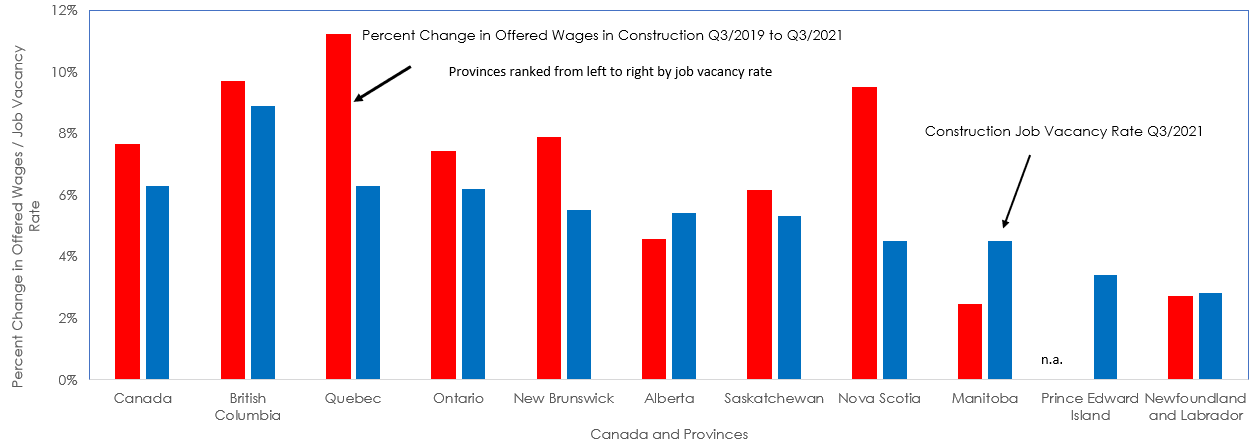

Driven in large part by the above-noted strength of residential investment, the job vacancy rate in construction rose in all ten of the country’s ten provinces between Q3/2019 and Q3/2021.

In British Columbia, the vacancy rate increased from 5.3% to a country leading 8.9% which highlights that the province has the most acute shortage of skilled construction workers in the country. Over the same period, offered wages in BC construction increased by 10.5%, well ahead of the 7.2% gain for the country as a whole.

Stats Canada noted that vacancies for skilled trades, such as carpenters increased at a higher rate than did those for less skilled trade helpers and labourers. Quebec has the second most severe shortage of construction workers with a job vacancy rate of 6.3% in Q3/2021, up from 3.9% two years prior.

This shortage of workers appears to have been due in large part to very strong gains in the starts of single-family dwellings (+37%) and of multiples (+26%).

Over the past two years, offered wages in construction rose by 11.6% from $25.60 to $28.05. In Ontario, the number of job vacancies in construction has risen from 14,000 to a record high of 25,000 over the past two years. As a result, the job vacancy rate in the industry now stands at 6.2%, the third-highest in Canada.

As in Quebec, the surge in job vacancies appears to be driven by the increased staffing needs of firms involved in the construction of single-family dwellings. A recovery in economic activity following an extended hiatus appears to have caused construction in Alberta to steadily gain momentum since early in 2021. Increased hiring in the industry more than doubled the number of job vacancies in the province. Since Q3/2019 the job vacancy rate in construction has jumped from 2.5% to 5.4%. At the same time offered wages have risen by 13% from $24.65 to $27.90.

Omicron variant unlikely to hit construction as hard as Alpha and Delta did

After posting very strong growth during the first quarter of 2021, the third wave of COVID-19 caused firms in the construction industry to scale back their activities and reduce their staffing needs. Reflecting this cut back, construction employment declined from 1,468,000 in March to 1,421,000 in September.

Ahead of the recent onset of the Omicron variant of Covid-19, there were signs that the late-year (2021) rise in housing demand (on the back of low interest rates and sustained growth of disposable incomes) was fuelling a rebound in residential construction and a concomitant increase in construction employment.

Non-residential building has flatlined since mid-2020. The increasing evidence that the Omicron variant causes a milder, less severe disease, implies that it will not dampen economic activity in general and housing demand in particular as much as previous Covid variants. This view is reinforced by the solid increase in the Canadian Federation of Independent Business short-term construction index in December.

In our view, sustained hiring by firms either directly or indirectly involved in residential construction will cause the job vacancy rate in the industry to remain high and likely increase pressure on wages into the second half of this year.

John Clinkard has over 35 years’ experience as an economist in international, national and regional research and analysis with leading financial institutions and media outlets in Canada.

Construction Job Vacancy Rate vs Change in Offered Wages

Chart: ConstructConnect — CanaData.

Please click on the following link to download the PDF version of this article:

Economic Snapshot Vol. 20, Issue 1 – Help Definitely Wanted in Construction – PDF

Recent Comments

comments for this post are closed