More and more Canadian companies are turning their attention to creating sustainable project plans as the infrastructure sector continues to face high inflation, increasing interest rates, high material costs and supply chain constraints.

This was a key finding in the fall 2022 edition of Turner & Townsend’s Market Intelligence report.

“In North America, we’ve got central banks rapidly tightening policy trying to cool the surge of inflation, but all across Canada and North America in general we are still seeing strong activity in the construction sector,” said Darren Cash, director, cost management lead — Canada, Turner & Townsend. “We’re speaking to contractors, architects, anybody across the supply chain and while there is certainly a bit of hesitation in the market, looking forward the outlook for most remains strong.”

There has been a bit of a slowdown in multi-family projects which Cash said is interesting when you consider the lack of supply in that market.

“The ongoing construction cost escalation impact we’ve seen year over year is 15 to 20 per cent depending on the asset class. That’s really starting to trouble pro formas, and when you couple that with the increasing borrowing rates and the hikes in development charges that’s happened across many Canadian municipalities, it’s really starting to cause a bit of a squeeze on multi-family projects at large,” he noted. “We walked into 2022 thinking that 2020 and 2021 were the worst of it and obviously with the energy crisis now that is existing across the globe, particularly in Europe, the Canadian economy isn’t isolated from that.

“All this stuff is percolating in the background and it is causing a bit of uncertainty.”

It’s difficult to predict the future, he added.

“If we sat here 12 months ago, 20 months ago and informed our clients escalation was going to continue to be at 12 to 15 per cent per annum, I think people would have said ‘you’re out of your mind.’

“But really next year we can easily say it will be fine, it will go back down to the three to four per cent year-over-year raise which is typical but it is all dependent on a number of things which are outside of anyone’s control.”

Cash said if pro formas are being set on the assumption that it is going to be three- to four- per cent next year they may be challenged but if pro formas are set assuming a 12 to 15 per cent raise, more projects would become unaffordable which “may dampen some of the more speculative investment that continues to be apparent in the market.”

“If we’re looking into our crystal ball, we are anticipating that by Q2 2023…unless — and I hope there isn’t — a large sharp recession, that we’ll start to see a levelling off of construction prices, particularly the supply chain will have caught up in theory. We’ll ideally have a better understanding of the global energy prices, global commodity prices which are starting to drop…But that’s not going to feed into our industry overnight. It’s going to take a bit of time.”

Supply chain constraints are also having a significant impact on projects.

“What’s happening there is that we’ve gone from a just-in-time delivery policy on construction projects that has been in existence for years, decades to now a just-in-case,” said Cash.

Equipment and appliances are now being procured almost a year ahead of time. The cost of sheet metal, copper piping, curtain walling, conduit, duct work and structural steel have also increased significantly.

The skilled labour shortage is another factor and is being felt in every sector.

“There is a huge war on talent within the industry itself where we’re all competing for the same pool of individuals and with that comes added pressure for bringing in people at a higher salary,” said Cash.

“In Ontario we had the recent collective bargaining agreement ratified which is a fairly historic increase…We are in a very hot market so margins are up because people don’t need to be as competitive as they once used to have to be. Roll it all up in a nice little ball and it’s been a difficult market for the last 24 months or so.”

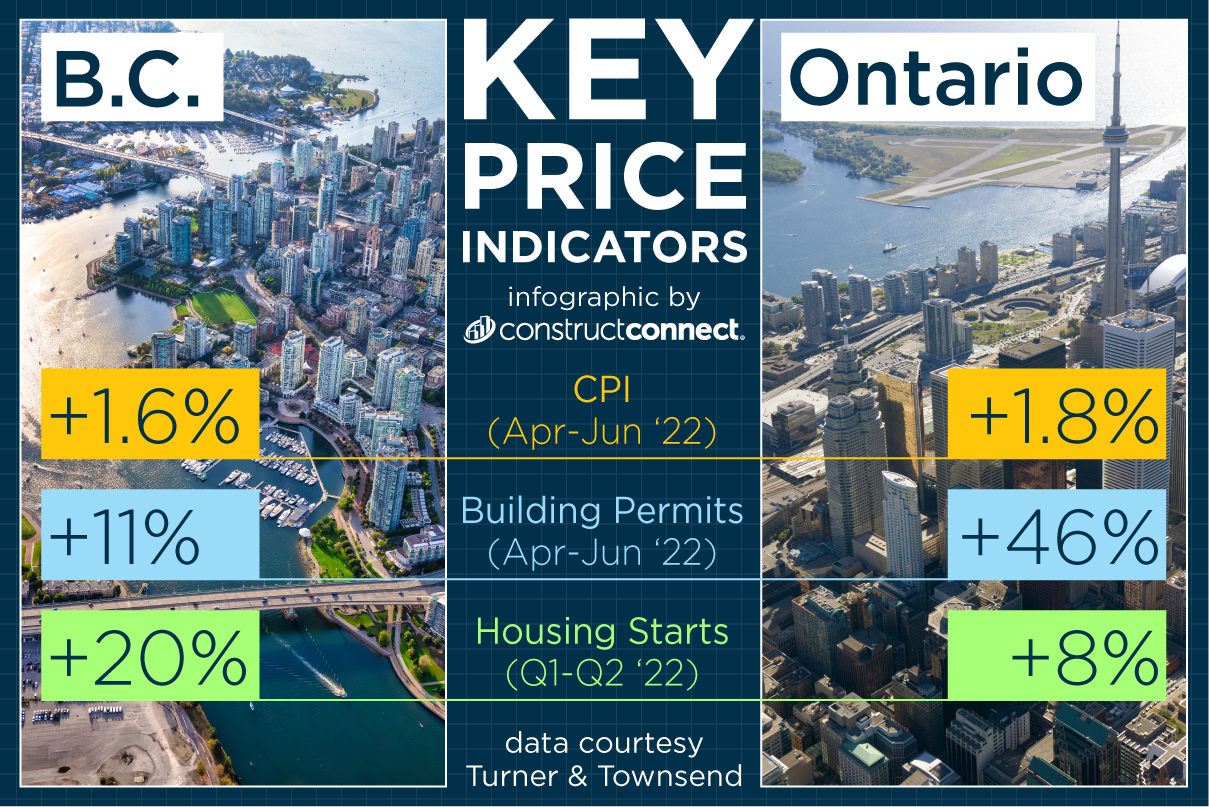

T&T’s report breakdown by province

Inflation in B.C. has not risen quite to the same extent as other provinces in Canada.

“B.C.’s growth rate slowed down a little bit. The housing market certainly dropped a little bit,” said Cash. “They’re still at capacity for service trades, façade trades, fit out trades…the construction industry is still very busy.

“They’ve got some really significant major projects now that are driving up the construction volume.”

Alberta’s economic outlook contrasts with slowing growth in most other provinces in Canada and migration into the province is up, the report notes.

In the last 12 or 18 months Calgary especially has become one of the more expensive places to construct in Canada.

“Historically that hasn’t been the case,” said Cash. “Investment is definitely continuing to be drawn into that particular province. Some of the things going on in the natural resources sector, some of the big pipelines, LNG stuff that is going on but now you’ve got quite a lot of interest in people that are a little bit fed up with the house prices in Ontario.”

In Ontario, and particularly in Toronto, there are a lot of big projects in the infrastructure pipeline and there is a lot of emphasis on bringing people into the city, Cash said.

“There is a lot of public-private investment,” he noted. “It’s a similar story to Alberta and B.C. where the supply chain is at capacity. Housing starts are levelling out.

“There are still a lot of building permits put in for big commercial office towers, mixed use developments.”

Quebec’s regional outlook is facing similar challenges to other provinces but is showing resilience and continuing to attract investments in the industrial, science and technology real-estate sub sector which are expected to further energize the local construction market, the report states.

Follow the author on Twitter @DCN_Angela.

Recent Comments

comments for this post are closed