The fact employment in the construction industry has contracted in four of the past six months sends a clear signal that higher interest rates have started to cool residential construction. Investment in residential projects year to date has contracted by -7%. This weakening has been offset, in part, by a gain in non-residential investment, which is up by +1.6% in real terms due to spending on major projects in Quebec, Alberta, Nova Scotia, and Saskatchewan. Several indicators highlight that the pullback in labour demand will continue to occur gradually.

High job vacancy rates still in place

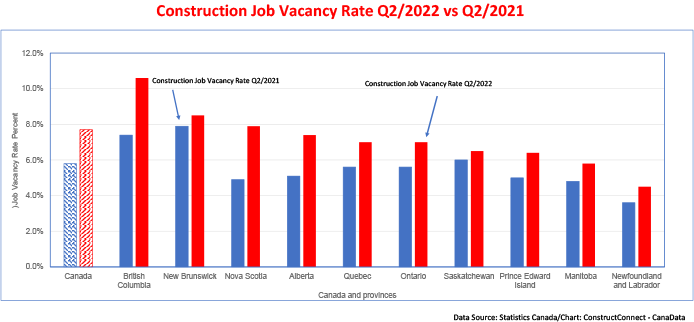

First, the job vacancy rate in the construction industry hit 7.7% at mid-year, a record high. Consistent with this very high job vacancy rate, the Canadian Federation of Independent Business reported, in its latest Business Barometer, that the shortages of both skilled and unskilled labour were by far the major factors limiting their members’ ability to do business. The problem is particularly acute in the construction industry given that construction job vacancies are at record peaks in eight of the ten provinces.

Companies across the country are having difficulty hiring qualified staff. The three provinces with the most acute labour shortages (i.e., the highest construction job vacancy rates) are British Columbia, with a job vacancy rate of 10.6%, due to an upsurge in institutional and commercial construction projects; New Brunswick (8.5%), due to a dearth of workers needed to construct buildings; and Nova Scotia (7.9%), which is also short of workers to undertake building projects.

Job tenure in construction close to long term average

Another indicator of labour demand in the construction industry is average job tenure or job ‘churn’. Since construction projects are, on average, of limited duration, workers in the industry tend to remain with their employer for a shorter period than they do in other industries.

During the past 12 months, employees in all industries remained with employers for an average 8.3 years. Job tenure in the construction industry has averaged a lower 7.6 years. To retain valuable employees and avoid searching for and training new ‘hires’ after a temporary slowdown, more employers are likely to “hoard” labour by keeping employees on staff. Such a practice will reduce the costs associated with taking on a new hire.

Consistent with the above-noted job numbers, job tenure in the construction industry at 92 months in September was slightly higher than it was in June, at 91 months, suggesting that firms have not yet started to trim their workforces.

Residential plans cooling fastest in Ontario and Quebec

Against this backdrop of strong demand for construction workers, the total volume of investment in building construction is beginning to shrink due to a drop in spending on residential projects. Year to date, the total has contracted by -4.7%, driven by a -7% decline in spending on homebuilding. This setback has more than offset a slight (+1.3%) rise in non-residential investment and it reinforces the above-noted view that, as occurred in 2006, 2011 and again in 2018, hiring by companies involved in the construction of new dwellings is more interest-rate sensitive than in other sectors of the construction industry.

Across the country, the most pronounced weakening in residential building intentions has occurred in Ontario, where the value of applications to build (mainly) condo apartments has fallen by -17%. Plans to build single-family dwellings are -13% and semi-detached units, -33.8%. In Quebec, residential construction plans have declined mostly due to a -16% retreat in applications to build apartments, accompanied by a -33% drop in plans to build semi-detached dwellings.

Fuelled by exceptionally strong net migration and despite the headwind of higher mortgage rates, applications to build new dwellings have posted solid gains in British Columbia (+56% ytd) and Alberta (+32% ytd). Following the pattern of previous cycles, we expect hiring in residential construction to contract more quickly than it will in non-residential construction. However, both construction sectors will likely be shedding jobs by mid-2023.

Higher rates will chill residential ahead of non-res

Looking ahead, Bank of Canada governor Tiff Macklin recently stated that ‘further interest rate increases are warranted’ to bring inflation back to 2%. This indicates monetary policy is going to become more restrictive and put even more drag on housing demand. This will lead, initially, to a steeper decline of employment in new home building. Subsequently, non-residential construction will likely be similarly affected over the next 12 to 18 months.

John Clinkard has over 35 years’ experience as an economist in international, national and regional research and analysis with leading financial institutions and media outlets in Canada.

Recent Comments