While some forward-looking indicators of economic activity in Ontario are flashing amber, signaling slower growth ahead, few are flashing the colour red which would show an imminent sharp contraction in output and a concomitant rapid escalation in unemployment.

Regarding the province’s external economic environment, the vital signs of the U.S. economy, the market for 78% of the province’s merchandise exports, are still positive. However, there are indications the U.S. is losing steam. For example, although the U.S. unemployment rate ticked down from 3.6% in February to 3.5% in March, close to its record low of 3.4%, the growth of establishment employment has slowed from +4.8% y/y to +2.7% y/y over the past 12 months.

Also, since February of 2022, the number of job openings has dropped by -12.5%. And two forward-looking economic indicators, the U.S. Manufacturing PMI and the Services PMI, are pointing to slower growth ahead.

Despite the dimming U.S. employment outlook and the Federal Reserve’s efforts to rein in inflation with higher interest rates, growth in the U.S. accelerated in the second half of 2022. The pickup was due in large part to solid gains in federal government spending, accompanied by stronger consumer spending. There was also an uptick in U.S. goods imports, a large portion of which were sourced in Ontario.

Province’s job market is cooling but definitely not cold

Probably the most sanguine indicator of the province’s economic health is its unemployment rate which, at 5.10%, is close to the record low of 5.09% it reached in July of 2022. However, as noted in Central 1’s Ontario Economic Briefing, the higher-than-expected gain in total employment in March was due to a surge in part-time hiring that more than offset a -12,000 drop in full-time hiring.

As in the U.S., employment growth in Ontario has been steadily slowing. Since June of 2022, it has moderated from +5.7% y/y to +1.8% in March of this year. Consistent with the fact the volume of residential and non-residential construction is down -10% year to date, the job vacancy rate in the province’s construction industry has fallen from 7.7% to 5.5% over the past six months.

Weak fundaments to depress housing demand into 2024

The Bank of Canada’s rapid hiking of interest rates by 400 basis points over the past 12 months has primarily impacted the housing market, the most interest-sensitive sector of the province’s economy. Over this period, sales of existing homes in the province have fallen by -43.5%, second only to British Columbia, where they are down by -46.5% y/y.

In the near term, the recent weak pattern of existing home sales, persisting elevated mortgage rates, the above-noted slowdown in hiring, the large volume of unabsorbed dwelling units, and the fact that applications to build residential dwelling units in the past six months are -21% lower than they were a year earlier, suggest residential construction will contract over the near term.

This year, we expect Ontario’s housing starts to total in the range of 75,000-85,000 units and 80,000-90,000 in 2024 compared to 96,000 in 2022. Beyond, 2024, the effects of the record-high levels of immigration the province has experienced should give a very strong boost in demand for rental units and subsequently put upward pressure on singles, semis, and row units.

Non-residential construction brightened by EV investment

The outlook for non-res capital spending in Canada and in Ontario is still clouded by lower profits, weak business confidence (as noted in the recent Bank of Canada Business Outlook Survey), and the prospect of persisting, historically-high interest rates.

However, this rather downbeat view is brightened by the fact that the value of non-residential building approvals over the past six months is up +18% compared to the same period a year earlier. Key drivers of the increase include a +94% gain in the value of factories and plants and a +34% rise in government and administrative buildings. The recent announcement by GM of the country’s first all-electric vehicle manufacturing facility in Ingersoll and Volkswagen’s announcement of an EV battery plant in St. Thomas will give a much-needed boost to non-residential investment in 2024 and beyond.

Negatives weigh on growth in 2nd half 2023 and into 2024

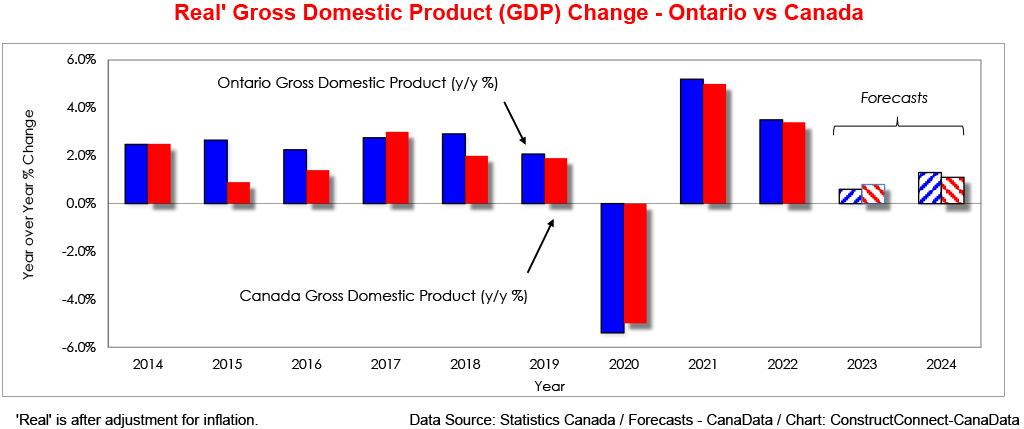

We expect the unprecedented infusion of fiscal stimulus on both sides of the border will temporarily keep growth positive into the second half of the year. However, the steady weakening of employment growth in the United States and Ontario, a further tightening of monetary policy by the U.S. Federal Reserve, plus the prospect of a slowdown in consumer spending and depressed residential construction, will likely cause the provincial economy to stall late in 2023 or early 2024.

John Clinkard has over 35 years’ experience as an economist in international, national and regional research and analysis with leading financial institutions and media outlets in Canada.

Recent Comments

comments for this post are closed