Contractors surveyed by the Associated General Contractors of America and consultant Sage have restrained expectations about the prospects for 2024, with less confidence than a year ago due to uncertain demand for some types of projects, continued high interest rates, labour shortages and high costs.

“2024 offers a mixed bag for construction contractors,” said AGC CEO Stephen Sandherr during a recent webinar outlining the findings of the business outlook and hiring survey.

“On one hand, demand for many types of projects should continue to expand, and firms will continue to invest in the tools they need to be more efficient. The contractors are less enthusiastic about most market segments than they were at the start of 2023.”

Contractors face “significant challenges when it comes to finding workers, coping with rising costs and weathering the impacts of higher interest rates,” Sandherr added.

Contractors predict private sector demand in 2024 will be less reliable than in 2023 for segments such as manufacturing and multifamily residential and will also decline for lodging, retail and private office construction.

“Contractors’ top worries for the new year include fears about the impacts of higher interest rates on demand for construction and the risk that the economy could enter a recession,” Sandherr said.

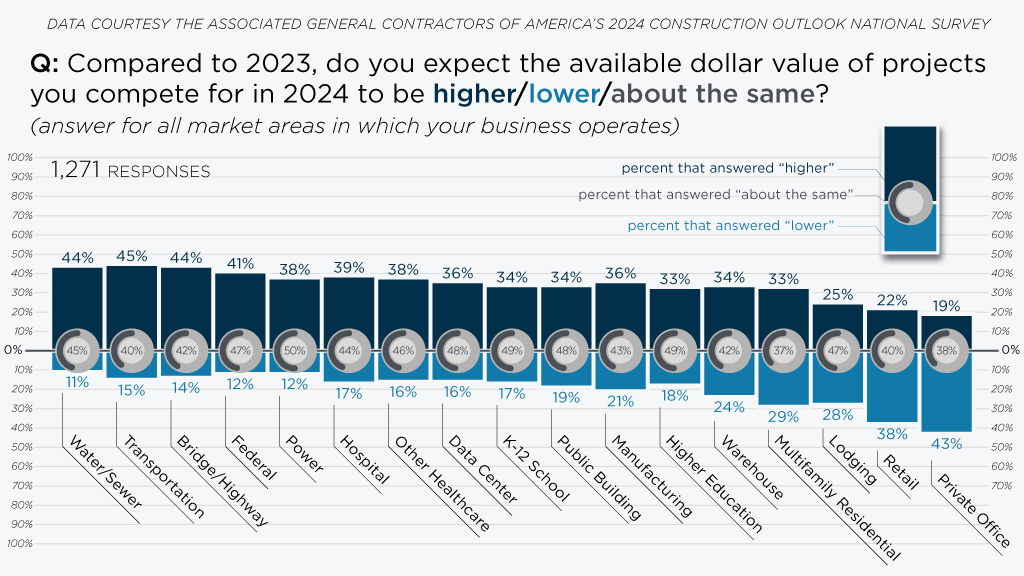

The report was titled A Construction Market in Transition. It found in 14 out of 17 categories of construction, there was a higher percentage of respondents who expect the available dollar value of projects to expand compared to the percentage who expect it to shrink.

But a smaller share than last year expects the markets they compete in to expand in the coming year.

“Despite the largely positive net readings, fewer respondents are confident about growth prospects than they were a year ago,” said AGC chief economist Ken Simonson.

The survey’s net reading decreased from the 2023 survey for nine project types, increased for six types, and remained unchanged for two.

The highest net positive reading in the 2024 survey, 32 per cent, is for water and sewer construction. Next comes highway and bridge construction and transportation projects. The highest expectation among predominantly private-sector categories is for power projects, followed by hospital construction and non-hospital health care facilities.

The biggest climber among categories from the previous survey is data centre construction, up eight per cent in net positive indication. Schools and colleges are also strong categories.

The survey found contractors continue to see projects being delayed, sometimes indefinitely, because of rising costs, slower schedules and shrinking demand for the finished products. As in the past two surveys, nearly two-thirds of respondents say projects have been postponed or cancelled. Ten per cent have already experienced postponement or cancellation of a project that had been scheduled for the first half of 2024.

Perhaps because of these challenges, Sandherr said, contractors plan to invest in new technologies to make their operations more efficient and productive. Many firms report they will make new or continued investments in drones and artificial intelligence tools.

But, Sandherr said, “Many firms worry they lack the time and personnel to properly implement the training for these technologies.”

Simonson said the decline in optimism regarding infrastructure projects may be because contractors have been slow to benefit from federal infrastructure legislation, such as the Infrastructure Investment and Jobs Act that passed more than two years ago.

Only nine per cent of respondents say they have worked on new projects funded by the law while six per cent have won bids but haven’t started work yet. Seven per cent say they’ve bid on projects but have not won any awards yet, while 12 per cent plan to bid on projects but nothing suitable has been offered yet.

However, one North Carolina contractor who participated in the webinar said North and South Carolina have “definitely” benefited from the Joe Biden administration infrastructure funding, with “significant amounts” spent on roads already.

“They continue to have a fairly robust plans for the coming year,” said Lynn Hansen, CEO of Crowder Constructors. “We expect to increase our work in the sector although we do expect more competition in the coming year.”

Sandherr said many of the challenges contractors are facing require government action. If the Biden administration were to act on congressionally mandated permitting reforms, he said, many more infrastructure and construction projects would start this year.

Most firms anticipate adding workers in 2024 to accommodate the higher demand for projects, the survey indicated. More than two thirds, or 69 per cent, of the respondents expect to add staff, compared to only 10 per cent who expect to decrease.

Twenty-three per cent of respondents say they have not had any significant supply chain problems.

Simonson reported, “By far the most frequently mentioned issues are with electrical items such as panels, transformers and the switchgear used to control protected isolated electrical equipment inside the building. Numerous contractors also mentioned heating, ventilating and air conditioning equipment.”

Follow the author on X/Twitter @DonWall_DCN.

Recent Comments