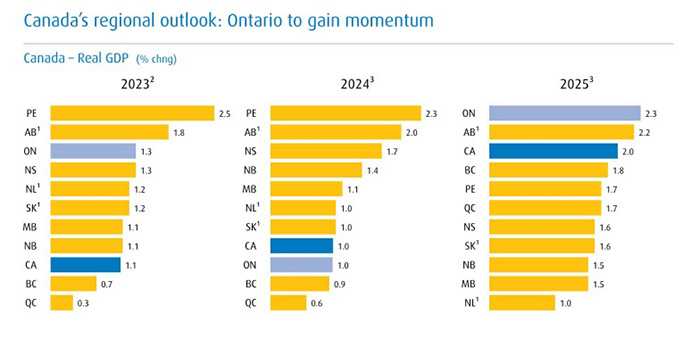

Growth in Ontario’s economy looks to be sluggish in the near term, with stubborn high costs and elevated interest rates continuing to impact the economy, economist Robert Kavcic told a construction audience recently.

But there’s ample reason for hope in the not-to-distant future, Kavcic explained, as the province looks poised to withstand the worst impacts of the high rates and rebound.

“The good news is that the economy hasn’t cracked yet. And if this is as tough as it’s going to get from a rate perspective, over the next six to 12 months, we say maybe we’re going to get through this with a relatively soft landing,” said Kavcic, a Toronto-based senior economist with BMO.

Kavcic’s presentation to 300 delegates attending the March 7 Ontario Construction Secretariat’s State of the Industry and Outlook Conference offered forecasts for the province’s key economic indicators and a glimpse into prospects for the provincial construction sector.

OCS director of research Katherine Jacobs also contributed a five-year construction sector forecast for the province.

Typically, Kavcic said, rate increases take 12 to 18 months to be absorbed into the economy, so the Bank of Canada’s rate hikes in 2022 and 2023 will still be felt for another six months, he suggested.

“But through the back half of this year and into 2025, I think conditions actually start to firm up and look noticeably better, especially given the fact that in the second half of this year, we’re optimistic that the Bank of Canada could actually start to cut interest rates,” he said.

“Once we start to get a little bit of interest rate relief…the economy starts to get a little bit hotter.”

Rate decreases on their way

The rate hikes were intended to slay inflation, Kavcic said, and they’ve achieved about 90 per cent of that goal.

But there will be resistance to reaching the traditional goal of two per cent inflation, he said, because wages spikes will persist.

The end game for interest rates, Kavcic said, is that they will probably not return to the low rates of the pre-pandemic era.

“Where do interest rates actually settle down over the next three years, five years and beyond? It will be a lot higher than we’ve been used to over the last 10 to 15 years,” he predicted.

“When we come down this interest rate mountain, we are probably looking at mortgage rates in a normal environment in the low four-per-cent range.”

Switching to housing supply, Kavcic had further sobering observations. He believes housing construction activity in the near term will slow down in Ontario from the recent record pace.

“I think we’re looking at something like about 85,000 housing starts this year versus 95,000 (in 2023),” he said. “That kind of flies in the face of federal policy targets to try and double or triple the rate of construction.”

Right now, Kavcic said, homebuilders are building more than they ever have, “and we just really can’t do any more.”

Moderation in fiscal policy foreseen

Addressing government fiscal policy in the future, Kavcic said the message from the federal government is that capital spending will head into neutral gear.

“Overall, I think fiscal policy is still very supportive of construction,” he said, with population growth fuelled by immigration supporting high levels of construction activity.

Jacobs later weighed in with the latest preliminary data from BuildForce Canada.

ICI investment over the next five years is being driven by government spending, said Jacobs.

“It’s been a major contributor of growth in that ICI buildings component, but also private investment has been fairly strong over the last few years and is continuing to help fuel activity going forward,” she stated.

Over the next five years, non-residential investment is expected to continue to climb, led by growth in ICI investment just shy of $24 billion and engineering spending of around $31 billion.

The institutional sector, meanwhile, will lead growth over the forecast period as investment climbs to $10.8 billion in 2027. That’s an increase of 31 per cent over last year.

“The non-residential sector is thriving and that’s a good message,” said Jacobs. “It’s good for contractors and it’s good for workers.”

Follow the author on Twitter @DonWall_DCN.

Recent Comments

comments for this post are closed