The number of business openings in Canada fell by -2.2% in June. This was their largest one-month decline since the Covid-fueled drop of -2.8% in May 2020.

Across the country, the number of openings rose in just three provinces: Saskatchewan (+1.9%), Alberta (+1.2%), and Nova Scotia (+1.2%). The number of openings retreated in the remaining provinces with the most pronounced declines occurring in Quebec (-8.1%), Prince Edward Island (-8.8%) and Manitoba (-3.7%).

It is worth noting that a sharp drop in openings was accompanied by a -0.3% decline in payroll employment and little change in ‘real’ (i.e., inflation-excluded) gross national product (GNP), due to a falloff in goods production that was just offset by a +0.1% increase in services-producing output.

Business closings in Ontario highest in Canada

Reflecting persistent weak overall demand accompanied by lingering excess capacity, noted in the most recent Bank of Canada Business Outlook (Q3/24) Survey, business closings in Canada were up by +4.4% in the first half of 2024. The bulk of this increase resulted from a +63.0% rise in Ontario, together with gains of +23.9% in Alberta and +11.2% in British Columbia.

In Ontario, the year-to-date increase in business closures resulted in large part from a +20% rise by companies in the transportation and warehousing industry. Other industries that saw significant increases in business closures included construction (+17.5%) and tourism (+16.7%).

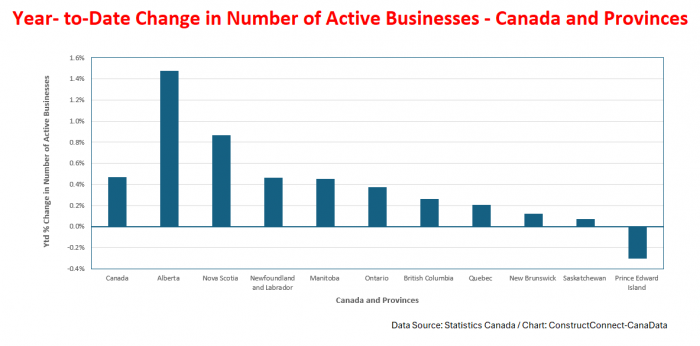

Over the past 12 months, among Canada’s 19 major industries, the number of active businesses rose in just three, led by health care and social assistance (+2,522), and followed at a great distance by education services (+64) and utilities (+8).

The industries which recorded the most pronounced declines in active businesses included transportation and warehousing (-2,122), construction (- 1,348), retail trade (-1,287), and wholesale trade (-1,172).

Construction firms have been hit 2nd hardest

Turning to the construction industry, given that the inflation-adjusted investment in construction has declined in two of the past three quarters, it is not surprising that the number of active businesses in the industry has steadily contracted over the past five months.

Across the country, two-thirds of the decline in active construction companies occurred in Ontario where, over the past 12 months, a -18% fall in the number of business openings has been accompanied by a +19.1% rise in business closings.

Other provinces experiencing significant declines in business openings accompanied by increases in closings have included British Columbia, Quebec, and Alberta.

In Ontario’s major census metro areas there was a more pronounced decline in business openings of new construction firms than closings. For example, the number of business openings in Toronto year to date is down by -21.4%, whereas business closings of construction firms over the same period have been a moderate -8%.

Outlook still cloudy with patches of blue

For several reasons, the best way to describe the near-term outlook for total business openings and closings as well as the outlook for openings and closings of construction companies is clouded.

First, as noted above, the most recent Bank of Canada Business Outlook Survey indicates that demand is weak, although inflationary pressure is muted (reinforced by September’s inflation report, +1.6% year over year for the ‘all items’ CPI). Moreover, consistent with the most recent CFIB Business Barometer report, firms’ investment plans and hiring intentions remain sub-par due to excess capacity and lingering supply chain issues.

Looking further ahead the outlook brightens as the impact of lower interest rates, both recent and prospective, will contribute to a strengthening of employment and both residential and non- residential construction. These positive factors will lift new business formations in general and in the construction sector in particular.

Recent Comments

comments for this post are closed