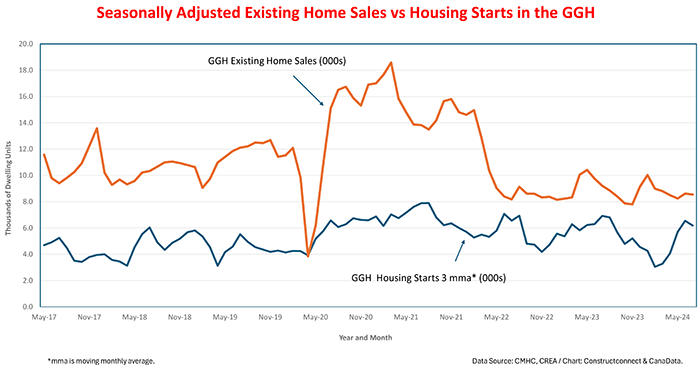

Seasonally adjusted sales of existing homes in the Greater Golden Horseshoe (GGH) slid lower by -8% month over month (m/m) in August following back-to-back declines of just over -10% in the previous two months. The combined decline in average house prices and successive interest rate cuts have not yet given a boost to existing home sales. The major factor which appears to have contributed to the weakness is the gradual rise of unemployment in eight of the GGH’s nine census metropolitan areas (CMAs).

Across the GGH, year-to-date home sales are down in eight CMAs led by a -19.3% drop in Peterborough. Year-to-date sales have also retreated in Niagara-St Catherines (-9.7%), Brantford (-8.1%), Hamilton (-5.4%), and in Toronto (-4.5%). The only CMAs to exhibit stronger sales year to date have been Oshawa (+2.1%) and Guelph (+0.8%).

Weak demand has depressed house prices

Reflecting the softening of demand over the past six months, average house prices year to date have retreated in all but two CMAs in the GGH. The largest drop has occurred in Kitchener-Cambridge (-8.2%), with smaller contractions occurring in Peterborough (-2.1%), Barrie (-1.9%), Brantford (-1.1%), St. Catherines-Niagara (-1.0%), and Oshawa (-0.7%). Year-to-date, average prices have risen in Hamilton (+1.4%) and, by a slight degree, in Guelph (+ 0.1%).

Although both existing home sales and average house prices have generally declined over the past few months, year-to-date new listings have exhibited double-digit increases in seven of the nine CMAs in the GGH. Consistent with the moderation in sales, the number-of-months supply of homes for sale moved up slightly in August.

Supply of new dwellings restricted by slowdown in permits and starts

The fact that for the GGH as a whole, housing starts and building permits have retreated by -10.2% and -16.4% year to date respectively is consistent with the pattern of depressed home sales through most of the first half of this year. Based on data from Statistics Canada and CMHC, this soft pattern of housing starts and building approvals (i.e., permits) year to date is due to the lingering impact of high mortgage rates, which hit near-term peaks in the first quarter of 2024.

Looking ahead, because mortgage rates are such an important driver of housing demand, we are focussed on the Bank of Canada’s next couple of interest rate announcements. In its latest Policy Rate Announcement of June 5, the Bank of Canada expected growth to strengthen late this year and into next fuelled, in part, by the impact of recent declines in borrowing costs which, given the recent softening of inflation, appear likely to ease further.

Excessive regulations and fewer admissions of permanent residents

However, as noted in a recent Globe and Mail editorial, the supply of housing is being impeded by overly complex, restrictive, and outdated regulations, which are simultaneously making new homes less affordable. Moreover, the weakening in housing demand has been exacerbated by a year-to-date drop (-19%) in admissions of permanent residents.

Across the GGH, admissions of permanent residents have declined in the majority of CMAs, led by a -14.6% fall-off in St Catherines-Niagara. Next in line with declines have been Brantford (-12.5%), Toronto (-11.9%), and Kitchener-Cambridge-Waterloo (-3.9%).

Year to date, two CMAs in the GGH have added permanent residents, Oshawa and Guelph. In Oshawa, the number of permanent residents has increased by +37.6% due the addition of 590 individuals. Guelph has posted a barely discernible gain of +3.6%.

Recent comments by Immigration Minister Marc Miller suggest that given the decline in job vacancies and the increase in the unemployment rate over the past several months, he is considering lowering the number of permanent residents admitted each year. However, the near record inflow of new permanent residents during H1 2024, plus the recent changes which the federal government has announced to mortgages regulations ‒ i.e., increasing the $1 million price cap on insured mortgages to $1.5 million and expanding eligibility for 30-year mortgage amortizations to first-time buyers ‒ will underpin housing demand next year and beyond.

Recent Comments

comments for this post are closed