An overhaul of Ontario’s multi-employer pension system that’s currently in the works is being described as a win-win-win by construction pension advocates.

The new framework will replace temporary regulations governing Specified Ontario Multi-Employer Pension Plans (MEPPS) with a new regime of permanent target benefit pension regulations.

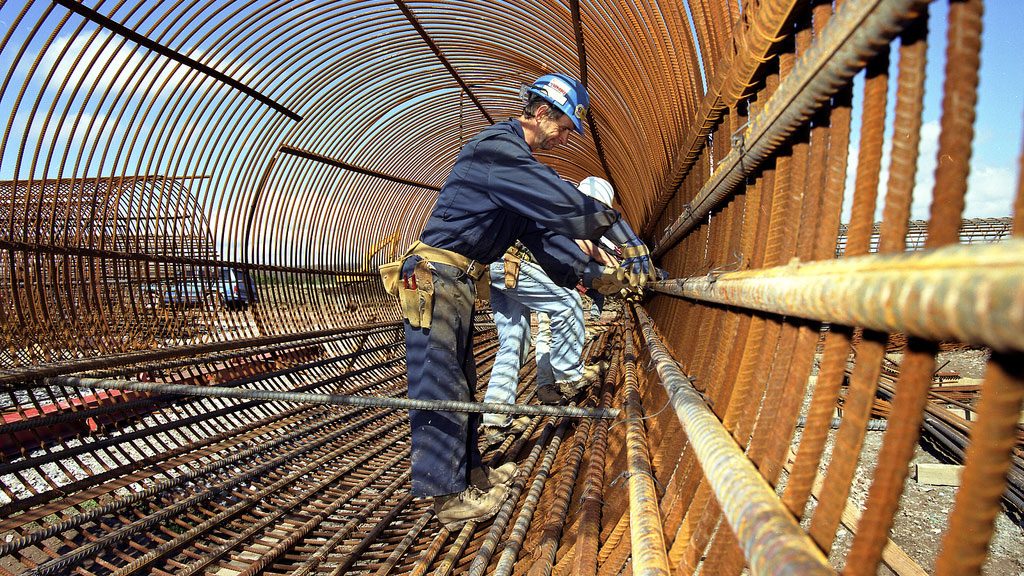

MEPPS provide pension benefits for members of a union or association within a specific industry where workers have multiple employers — especially industries involving the skilled trades, such as Ontario’s construction unions.

The existing framework was created by the Ontario government in 2007, and advocates such as LIUNA have been pushing for permanent reforms ever since.

Leading the charge for change has been the Multi-Employer Benefit Plan Council of Canada (MEBCO), with LIUNA and others throwing their weight behind the advocacy efforts.

“This is a good news story all around for pension plan beneficiaries, for trustees, for employers and for the government,” said MEBCO president Alex McKinnon. “It’s not perfect, and we’ll continue to work on a number of items, but in general, I think it’s a good news story all around for everyone.

“It provides a framework that trustees can administer the pension plan to provide for secure, sustainable retirement for plan members, which helps employers as well.”

First proposal rejected

The Ontario government issued a first proposal for reforms in March 2023 that was roundly criticized by stakeholders, who said it contained elements of systems that had failed in other provinces.

A second proposal was better received. Finally, in March 2024, legislative amendments to the Pension Benefits Act were proposed through the 2024 Budget Bill.

The Ministry of Finance is currently preparing regulations to implement the new framework, with opportunities for stakeholder review this summer. The government intends for the permanent framework to come into effect on Jan. 1, 2025.

“The proposed permanent framework is intended to strengthen plan governance, improve plan transparency and support long-term plan sustainability for plan members and employers,” said Ministry of Finance spokesperson Scott Blodgett in a statement.

The reforms are supported by LIUNA, with director of stakeholder relations Victoria Mancinelli commenting the new measures are welcome “after nearly 14 years of having to operate under temporary rules.

“This will provide greater stability and certainty for all multi-employer plans and their members.”

McKinnon explained the original system, which required the pension funds to keep an insolvency buffer appropriate for volatile conditions, was considered ill-suited for construction pension funds, which are well funded and have long-term horizons.

But the temporary measures introduced in 2007 tended to handcuff pension fund trustees, and they operated under conditions of uncertainty, because the regulations had to be continually renewed.

Square peg, round hole

“It was always trying to fit a square peg into a round hole,” said Michael Mazzuca, LIUNA pension adviser and partner with the law firm Koskie Minsky. “They just kept extending that temporary exemption. That doesn’t create stability or certainty for the plans, for their members.”

The important point from a member’s perspective, Mazzuca said, is that nothing has changed in the way pensions will be paid out. Employers still have fixed payments but pension trustees will no longer have unsuitable and unstable regulations to adhere to and can better focus on long-term investment strategies.

“The nature of the pension promise doesn’t change,” he said.

The ministry website states that the reforms encourage job mobility and will help to attract more people into the skilled trades, given the new stability of the pension funds. Mazzuca said that logic is solid.

“There are a number of reasons why people are enticed into the trades these days,” he said. “I think knowing that they also belong to a well-funded pension plan with good benefits is attractive.”

McKinnon said the employers’ needs are also met.

“Employers want stable funding. They don’t want to see all of a sudden solvency rules coming in,” he said.

“In general, when we’ve talked to our base, which is trustees from both the union and the employer side, some of the trade associations, they are generally happy with where we landed.”

Follow the author on X/Twitter @DonWall_DCN.

Recent Comments