Analysts generally speak of Canada’s ICI construction workforce crunch in terms of raw recruiting numbers but the problem is compounded by a lack of technical trade skills, a BuildForce economist told a conference of mechanical contractors recently.

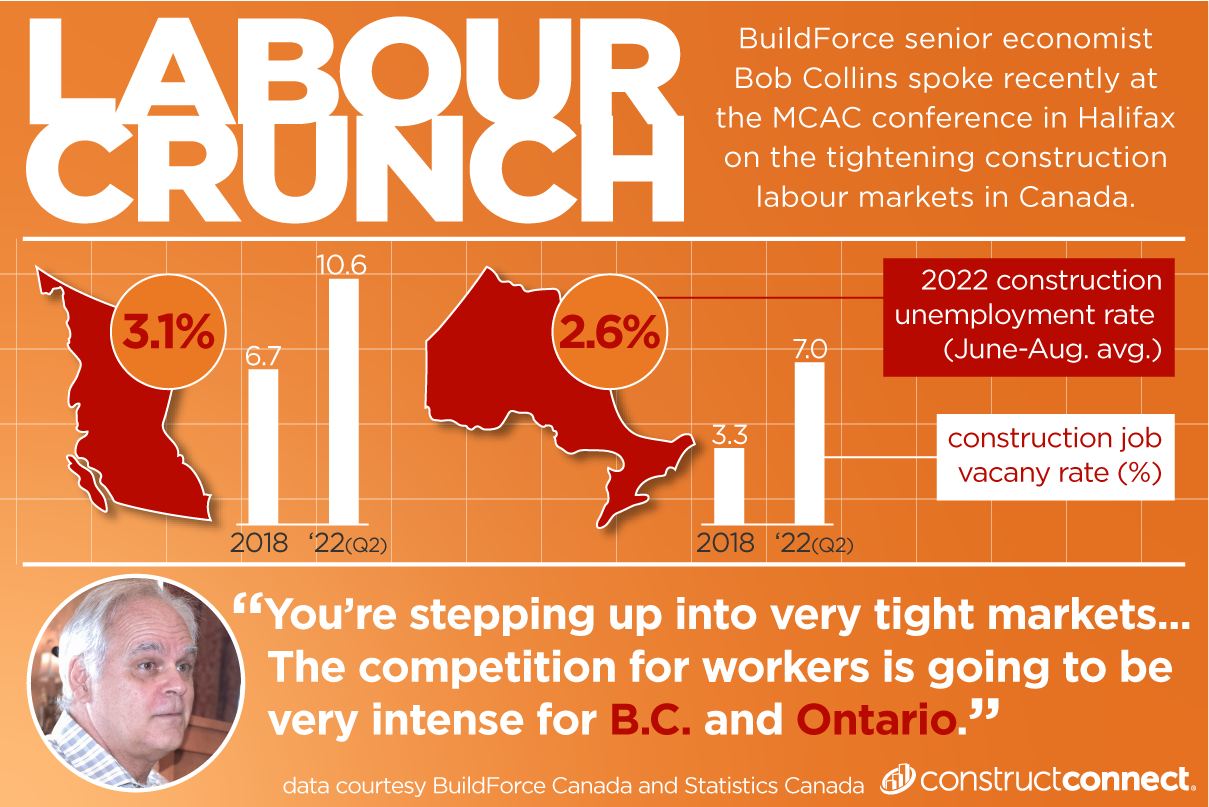

With construction unemployment now sitting at two or three per cent across the country, Bob Collins said, the labour gap ranks alongside other threats such as supply chain disruptions, rising costs and high interest rates as major issues for constructors heading into 2023.

The senior economist was addressing delegates on the second day of the 79th Mechanical Contractors Association of Canada conference held in Halifax Sept. 28 to Oct. 1.

“You’re stepping up into very tight markets,” Collins said. “If you do find people, the big question becomes, do they have the skill sets and experience as I step up my work? That’s what you’re hearing, right?

“It’s not an easy transition for the mechanical trades or other more specialized trades.”

Typically, low unemployment and busy project schedules are good news but it’s not that simple as Canada’s construction sector emerges from the pandemic, finds its footing in 2022 and heads into 2023, Collins said.

BuildForce’s spring 2022 report identified severe workforce pinch points in non-residential construction across the country, with especially tight labour markets in P.E.I., Quebec, Ontario and British Columbia.

“If you look at the unemployment rates on average, of three per cent, two per cent, this is your starting point,” said Collins. “This is what you’re dealing with − this is all industry, not necessarily mechanical, but you’re going to follow a similar path.

“When you have unemployment rates that low, you don’t have the traditional flexibility that you need to be able to function on your job, so you’re going to run into challenges.”

Risk-averse investors are taking into account the availability of workers as well as the other notable risk factors in future project evaluations.

“We’re on the edge and so there are so many levers involved, financing projects, workforce, the availability of materials, it’s a perfect storm,” Collins said.

BuildForce will soon be embarking on nationwide consultations towards its 2023 workforce report and Collins said the researchers will be looking for signs that investment decisions might be approaching a “tipping point.”

Forecasts from the spring are being evaluated and one trend being investigated is that due to the numerous uncertainties, project timelines might be extended − taking a project a year or two past its intended finish.

“It’s like opening up the paper any day of the week and having some new things that come up that change the dynamics,” said Collins.

New worker behaviours are also being evaluated. Collins said older workers are hesitating moving into retirement and are in fact being pulled out of retirement. But workers in the 25 to 54 age group were slow to return after the pandemic.

A key to filling jobs has always been worker mobility but that does not seem to be happening right now, Collins said. BuildForce is hearing workers are being more selective and are less willing to travel interprovincially or even intra-provincially.

Canada-wide, Collins said, of the mechanical trades − plumbers, pipefitters, sprinkler, HVAC − an estimated 16,500 workers, or 18 per cent of the current construction workforce, are expected to retire over the next decade. That is lower than the average for all trades, which is 22 per cent.

“Does the industry have the right workers?” Collins asked.

BuildForce expects sustained or increased employment into 2023, driven by high levels of residential activity and long lists of current and proposed non-residential construction projects.

There is competition for workers in British Columbia and Ontario in the short term but their traditional ability to draw workers from other provinces is no longer a sure thing.

With employment outpacing labour force growth, BuildForce sees impacts on worker productivity, safety and retention, and there is talk of increasing worker burnout.

Slower domestic population growth continues to prompt questions about the source of the next wave of recruits.

Continued recruitment of underrepresented groups such as women, Indigenous and BIPOC workers and new Canadians remains essential, Collins said, although despite the significant increases in immigration since 2015, the construction industry has not been successful in recruiting significant numbers of those newcomers to the industry.

All in all, Collins said, it adds up to major workforce uncertainty next year.

“I think 2023 is going to feel very much like 2022,” said Collins. “We could have some project deferrals. The competition for workers is going to be very intense for B.C. and Ontario for all the reasons I talked about.”

UNNERVING NUMBERS

- estimated 16,500 mechanical trades workers expected to retire

- over the next decade across Canada, 18 per cent of current construction workforce

- construction unemployment rate fell from 9.7 per cent in 2020 to 5.8 per cent in 2021.

- construction unemployment hit 5.5 per cent in 2020; previous 20-year low was 5.8

- unemployment rate June-August 2022 was 1.5 per cent in P.E.I., 2.2 in Manitoba, 2.6 in Ontario and Saskatchewan

- non-residential work projected for 2022-2027 in Ontario includes nuclear refurbishments and utilities, $31B; transit, $60B; utilities (power and wastewater), $30B; mining, $8B plus long list of projects awaiting final investment decisions.

Follow the author on Twitter @DonWall_DCN.

Recent Comments