Contractors and allies are fighting back against a dramatic escalation in penalties introduced by the Ontario government for some violations of the health and safety act by collaborating to help create a new insurance product to defend managers.

The Working for Workers Act introduced by Minister of Labour Monte McNaughton and passed by the legislature last year hiked penalties under the Occupational Health and Safety Act (OHSA) for directors and officers of corporations. Those managers, who previously were subject to a maximum fine of $100,000, now face a maximum fine of $1.5 million, the same as the maximum penalty that can be imposed on a corporation.

The bill also increased the maximum monetary penalty for all other individuals to $500,000, five times the previous amount.

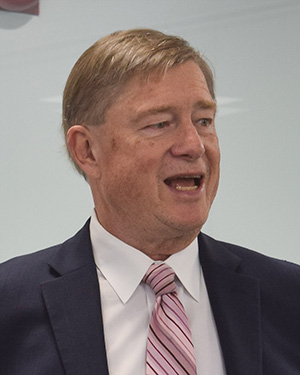

Former Ontario General Contractors Association president Clive Thurston, now a consultant, spearheaded the initiative. He told an audience gathered for the product launch July 26 that the OHSA measures were introduced with no consultation with contractors.

The new fines will fail to improve health and safety in the sector, he predicted, and will send health and safety underground.

“This is a disincentive. It creates a gulf,” said Thurston, president of Thurston Consulting. “And distrust and fear, and fear doesn’t work. We know that. It’s not going to have the effect that they want. Threatening people never does. This is an industry that doesn’t like to be threatened.”

The new product covers legal costs only, not fines, and is primarily intended to help with recruitment and retention, he said.

Thurston convened an industry working group over the last 18 months that included HUB International, Fenn & Fenn Insurance Practice, Gen-Pro Construction president John Dawson, David Frame from the Infrastructure Health and Safety Association, Matt Ainley from the General Contractors Alliance of Canada, Sandra Skivsky of the National Trade Contractors Coalition, Eric Cote representing Quebec contractors, Patrick McManus of the Ontario Sewer and Watermain Contractors Association and Norm Keith, partner with KPMG.

“This is pushback time,” said Simon Fenn, senior vice-president of Fenn & Fenn, who presented details of the new product. “You’ve got an opportunity here with a product that’s going to provide people with affordable defence, to actually turn around to the ministry and say, ‘OK, you’re suing us? Well, we’re going to defend ourselves now.’

“So all of a sudden, it’s going to become a little bit of a deterrent for the Ministry of Labour.”

Thurston said Dawson told him several years ago his firm was having trouble recruiting, retaining and promoting supervisors because of the legal burdens of the OHSA.

“It has had a detrimental impact on us being able to promote people,” said Thurston. “What’s the good of bringing people into the trades if they can’t progress? People are afraid to take new jobs because of this type of action.

“It could have been avoided had this been done in a collaborative manner.”

Most major advances in health and safety in the sector have come from the private sector, Thurston claimed, noting the Certificate of Recognition (COR) program, the League of Champions and the industry-wide collaborations that led to new safety guidelines during the pandemic.

Contractors focused on boosting safety culture 20 years ago, he said, and that has led the sector to new heights in health and safety achievements as measured by declining lost-time injuries and lower WSIB rates.

“Unfortunately, the ministry today believes in the big-stick theory,” said Thurston. “But if you hit people with a bigger stick, they don’t perform better. This does not work.”

The new insurance product could include not only contractors but vendors, subcontractors, suppliers, engineers, architects and project management companies.

The HUB International presentation demonstrated how buyers could access an online portal and purchase insurance instantly. There are different rates for COR-certified and non-COR firms. The maximum payout is $100,000 for each occurrence or $500,000 in aggregate.

Fenn said the product was tailored specifically for health and safety proceedings in the construction sector.

Circumstances covered include investigations brought under occupational health and safety legislation, police investigations, criminal prosecutions and civil actions.

“Our objective was to provide affordable legal representation to construction companies and their employees against health and safety regulation, regulatory charges and other perils,” said Fenn. “In addition, we wanted to improve worker retention.

“And we wanted to attract workers and to provide qualified defence counsel.”

Thurston said the action was in no way intended to provide protection for unsafe contractors.

“I think we all know in this room that we want to hunt them down as much as anyone else,” he said. “The trouble with the government is, it doesn’t differentiate between a good practitioner of health and safety and a bad one. They go after everybody equally hard.”

Follow the author on Twitter @DonWall_DCN

Recent Comments