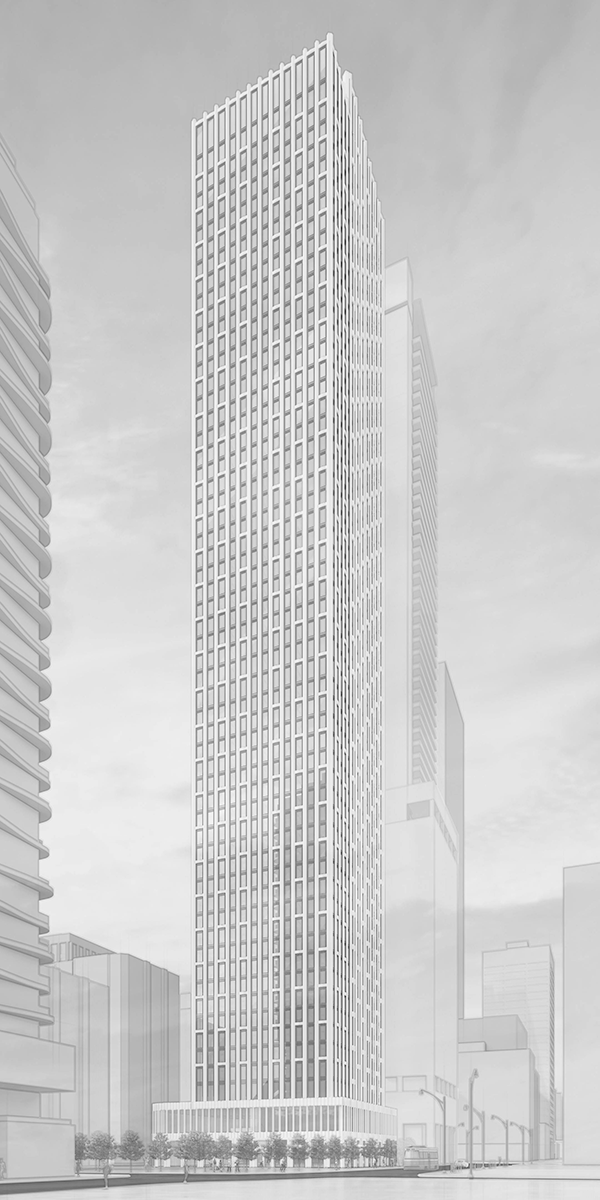

A 57-storey purpose-built rental (PBR) tower proposed in the heart of Toronto could be one of many rental highrises to come as the heated condo market cools but the urgent need for housing increases.

Near Dundas and University, the tower will feature more than 700 units and an 8,000 square foot park in a neighbourhood predominantly comprised of offices, hospitals and tall condos.

“We are likely to see this (PBR) type of housing to be the principle model for residential housing in terms of new construction work in Toronto within the next year or two,” says Aamer Shirazie, associate principal/studio manager, Living Plus Group, Arcadis Canada, the project’s developer.

“I think it will be a positive shift.”

The tower at 250 Dundas West has secured community council approval and is awaiting a final decision at city council, he says.

As many residents have been priced out of the buyer’s market in the Greater Toronto Area, it is not surprising the movement to develop PBRs will grow.

The CMHC’s Apartment Construction Loan Program is an example of the incentives to help stimulate the shift, Shirazie says, adding the City of Mississauga recently announced a 50-plus per cent reduction in development charges for PBR building permits by the fall of 2026.

The City of Toronto “has made great progress on speeding up approval times,” adds Michael Norton, chief development officer, CreateTO, the city’s real estate agency which has a portfolio of more than 8,000 properties.

A case in point is CreateTO’s 2444 Eglinton Ave. E. project which was approved in months rather than a year or so that historically has been required for an approval.

“What we’re noticing as a challenge is the continued access to financing and capital partners,” Norton says, pointing out nearly all of CreateTO’s in-flight and planned housing projects are PBRs.

He notes other incentives in Toronto such as lower development charges as compared to condos, the elimination of GST and a 15 per cent reduction of the municipal tax rate. The city’s Rental Housing Supply Program and the multi-unit ownership housing project program are also positives.

“These incentives have been well received by the development community with thousands of units about to move forward,” Norton says, adding most of the incentives stipulate a minimum percentage of affordable units in a project.

Developing PBRs can take three to five years from the drawing board to excavation, but Shirazie says timelines are site specific. Heritage building issues, neighbourhood impact studies and restricted construction staging space are among hurdles that can add time.

As PBRs are long-term assets, most PBRs going up in Toronto will be designed for energy efficiency and durability, he says, pointing out that 250 Dundas West, like many other PBRs planned, will have lower window-to-wall ratios and fewer if any balconies compared to condominium towers.

The trend to higher efficiency towers is in keeping with expectations in a number of municipalities for sustainable designs. The Toronto Green Standard design and performance requirements are an example.

Norton says CreateTO is “seeing great pride” from the development community in the architectural design, unit layouts and amenities and how PBRs are integrated with their communities.

“We don’t want anyone to look at the development and say, ‘That’s the rental building, that’s the condo building.’ There should not be a stigma attached to rental or co-op homes.”

Shirazie says to address the rising costs of construction through material and labour hikes, construction developers like Arcadis have turned to engineering and design innovation that can reduce construction timelines.

One example is the elimination of major structural transfers.

“We have designed 250 Dundas so the structural components run all the way up the building. It saves time on construction schedules and ultimately on the budget.”

Recent Comments