Mass timber construction is making headlines, especially in Toronto and Vancouver where high-profile projects are turning heads, but the “fast-growing” new industry still only makes up about one per cent of all construction in Canada.

Like many young industries, the sector faces hurdles to growth. One of those is the lack of product standardization.

Among manufacturers standardization increases production efficiencies, lowers costs and simplifies the building design process, allowing for fast, repetitive construction methods, says Adrian Mitchell, principal consultant, mass timber and off-site construction with Loam Saw Inc.

As it stands, most North American mass timber producers offer unique panels/products that give them “a competitive advantage,” Mitchell says.

But that is not good for the industry as a whole.

The Vancouver-based consultant recently gave a WoodWorks webinar on how to advance North American mass timber projects by harnessing local expertise.

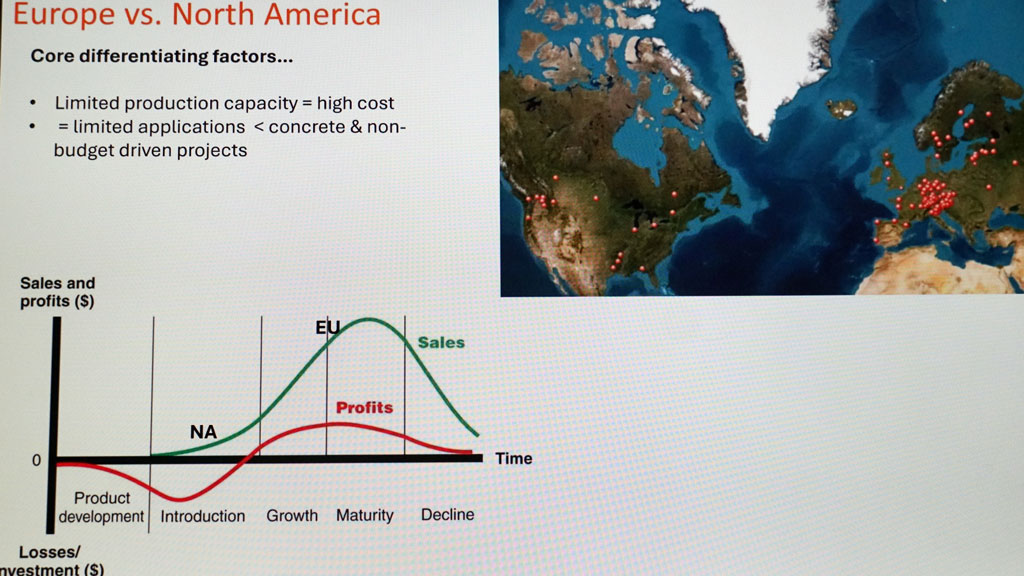

He says while production capacity is projected to double in North America by 2029, it pales in comparison to activity in Europe where standardization is common.

Formerly of Simpson Strong-Tie and Rothoblaas, Mitchell says in many instances European builders can pick up standard-sized glulam or CLT billets from a local mass timber distributor for current projects. It drives up production efficiencies.

“They have a mature market where they see woodworkers and integration shops working alongside billet producers to service the market.

“It is not about whose panel size got designed by the engineer into a project from the start, giving that manufacturer an advantage because no one else produces that panel size, which is what is happening here,” he points out.

Mitchell says if a Canadian mass timber supplier wants to bid on a project that doesn’t have its panel or beam size “engineered into the design” it has to redesign that project otherwise it won’t be cost effective.

“It requires a huge team of engineers and estimators at these producers to constantly be redesigning projects and that just adds costs overall.”

There are about 70 mass timber producers in Europe in a concentrated area but only a handful of producers in North America spread over a wide area.

Overseas, mass timber has been widely used in small applications such as low density residential because the European market is “hitting maturity with a healthy and competitive supply chain which substantially reduces costs of material.”

As North America is years behind Europe, the focus here is primarily on large-scale projects, he says.

Mitchell says he expects standardization will happen “organically” in the Canadian industry over time, as has been the case in Europe.

“When someone gets the right recipe, let’s call it, and they start dominating and getting a lot of work, that will force the competitors to match that.”

He suggests it could take 10 years to see widespread product standardization in Canada once many mass timber production facilities are operating, largely driven by the pressing need for affordable midrise housing in larger cities.

“What can really change that equation on short notice are carbon caps in the building code,” forcing the construction industry to turn to mass timber and away from concrete and steel, he says.

“I would say that could happen in five years or less at a provincial level in B.C. and Ontario.”

Mitchell has a concern about the supply of locally grown timber to mass timber producers in B.C.

He has advised the B.C. government’s labour ministry on concerns the industry has that lumber harvested in the province is being exported as a raw material overseas and to the U.S., leaving local wood mills short of supply.

He says potential Canadian and European investors in mass timber manufacturing facilities are scared off if there is no ready supply of product or it can’t be purchased at a market competitive price.

The WoodWorks webinar was funded by Natural Resources Canada’s GCWOOD Program.

The article highlights a crucial issue hindering the widespread adoption of mass timber in Canada: the lack of product standardization. It’s clear that achieving consistency in product dimensions, performance, and testing protocols is essential for driving down costs and accelerating construction timelines.

I’m curious about the potential role of government regulations and incentives in fostering product standardization within the mass timber industry. Could you elaborate on the specific policies or programs that could be implemented to encourage manufacturers to adopt standardized practices?