Economists offered contrasting visions of the 2022 construction marketplace in the United States during a recent webcast, with positive growth forecast for most sectors but sobering warnings of rising costs, labour shortages and supply chain disruptions that may threaten economic recovery.

The Nov. 3 event, billed as Where To In 2022?, was presented by ConstructConnect as part of its continuing economic webcast series.

The presentation was hosted by Paul Hart, vice-president, product marketing for data innovation for ConstructConnect, with three panellists, Jennifer Riskus, director of economic research for the American Institute of Architects (AIA), Associated General Contractors of America (AGC) chief economist Ken Simonson and Alex Carrick, chief economist for ConstructConnect, offering insights into the next year.

Hart outlined the conflicting visions for 2022 — moderate to strong growth in many sectors, but with significant concerns to be addressed.

“Are there positive signs? Absolutely. The demand for design and construction services remains high. But I’m willing to bet that everyone listening has felt some repercussion of disrupted supply chains and serious labour shortages.”

Simonson argued the workforce shortages his association has been warning of for years are being exacerbated by new concerns.

One third of 2,100 firms reported in a recent AGC survey that they had to reduce headcount in the previous 12 months, while 40 per cent had increased staffing, Simonson stated. Going forward, three quarters of the firms say they’ll be expanding.

“They wouldn’t be contractors if they weren’t optimistic,” he said. “But we do think that they’re going to have quite a bit of difficulty all adding workers.”

Eighty-nine per cent of firms that are looking to fill hourly craft positions reported having a hard time doing so while 86 per cent of firms seeking to fill salaried positions are also having a hard time hiring.

The reasons? Among them, seventy-two per cent of firms say potential candidates are unqualified.

Additionally, the wage premium the sector has always pointed to in comparison with average wages in other sectors has diminished, and it has been shown construction workers have a much lower vaccination rate than most other occupations.

“Only 57 per cent of the people who identify their occupation as construction said that they’ve been vaccinated. Eighty-one per cent of other respondents say they’ve been vaccinated,” said Simonson.

“So the implication is, construction firms may have trouble finding workers who are both healthy and eligible to get on the jobsites, particularly as more and more owners insist that anyone on their premises be vaccinated.”

As for wages, historically construction has paid a premium of nine to 12 per cent over the all-industry average hourly earnings, but that’s dropped to less than eight per cent, Simonson said.

“I fear that means that companies that are trying to get entry-level workers in particular, who might once have been attracted by that premium higher wage in construction, they’re now able to say, ‘wait a minute, I can stay indoors, perhaps even work from home. I don’t have to get up the crack of dawn.’”

Meanwhile, he predicted, other cost and supply challenges are going to continue over the next year — “probably all the way through 2022.”

“And we still don’t know if the President will be signing an infrastructure package. So I’m not ready to say that we’ll see a big burst in additional public spending.”

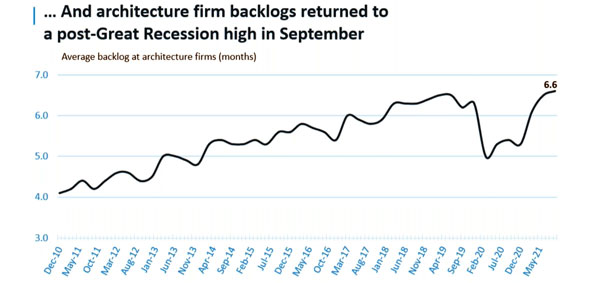

Riskus noted the architectural sector went into the pandemic with a large backlog of projects so it was able to survive in the early days, though 15,000 workers in the sector lost their jobs. The backlogs were rebuilt and are now at the highest level in a decade. Meanwhile, all but 1,000 of the architectural workers have been rehired.

Back in May, Riskus said, an AIA survey of architects found moderate concern related to construction materials, pricing and availability.

“However, the longer this is lingering, the more likely it is that it is going to continue to become an issue and affect more firms,” she said.

Carrick reviewed the long-term prospects for a number of sectors, suggesting offices might be in permanent trouble. PwC, he noted, has told its 40,000 employees it is up to them whether they return to the office or not.

On the other hand, he said, Jamie Dimon, CEO of JPMorgan Chase, made it clear where he stands.

“I love this,” said Carrick, paraphrasing Dimon. “As for working at home, it doesn’t work for people who want to hustle. And it doesn’t work for culture. And it doesn’t work for idea generation.”

“So there’s quite a tug of war going on.”

Follow the author on Twitter @DonWall_DCN.

Recent Comments

comments for this post are closed