The evolution of environmental, social and corporate governance (ESG) was front and centre on the last day of the Royal Institution of Chartered Surveyors (RICS) conference.

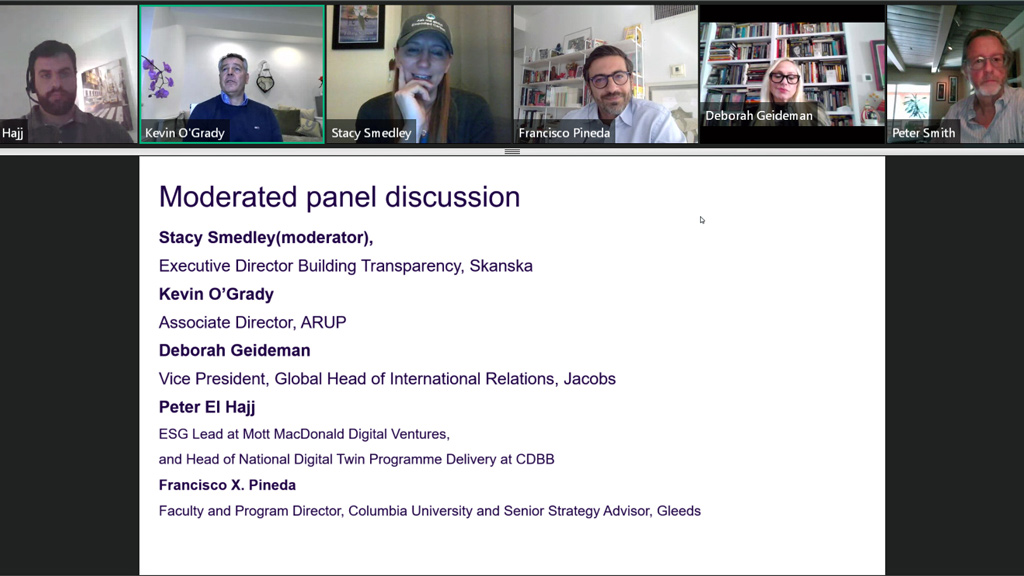

A panel of experts began by defining what the concept is and then explored what they are seeing in the construction industry and where they see ESG going.

Kevin O’Grady, an associate director for U.K.-based consulting firm Arup, explained that it goes far beyond environmentalism, which is often the first thing that ESG conjures up for people.

“Lots of people know about climate targets and resource scarcity, and those are important, but I think the term goes deeper and looks at social issues like labour practices, the rate you pay labour, talent retention, product quality, product safety, data security, board diversity, business ethics,” said O’Grady. “These points are all important. But it’s about how we evaluate these and measure these. If you don’t measure it, how can you improve it?”

O’Grady noted the business community is beginning to embrace ESG.

ESG portfolios are outperforming non-ESG portfolios and 80 per cent of global Fortune 500 companies generate environmental and social impact data. And companies are finding more ways to communicate the benefits to clients with concepts like using Blockchain to track and lease materials for reuse, or using more expensive Italian tile that can be maintained for decades instead of cheaper rubber mats that have a life cycle of only a few years.

O’Grady noted thinking about the ethical implications materials and practices all the way down the supply chain means there will be more time spent in the tender stage before entering a contract, but it could help raise standards for workers and the environment around the globe.

Francisco Pineda, a professor of construction administration at Columbia University and a recent adviser to the Joe Biden administration, explained while it is tempting to rally everyone around a singular method of reporting ESG data, things are more complicated.

“This is one of the messy challenges,” he said, using New York City’s Minority and Women-Owned Business Enterprise certification program as an example.

He noted achieving the program’s goals in a city as diverse as New York is far easier than other parts of the state, where populations are more uniform.

“Having an open idea of what will fit for what project I think right now is a better approach,” he said. “A program like LEED took many years and two decades of active integration to understand. I think there will be multiple levels of solutions.”

He believes LEED is a good example of a program that was able to develop organically with input from industry which has led to its wide adoption and success. However, he issued a warning.

“A lot of our customers are demanding things like LEED, but we have to be careful that this policy that’s meant to do good doesn’t get weaponized to stop important projects,” said Pineda. “Oftentimes with benchmarking this is something to consider and be aware of. We don’t want it used to create unnecessary obstacles.”

Peter El Hajj, a senior consultant at Mott Macdonald and the head of a national digital twinning program in the U.K., agreed that a one-size-fits-all approach would be difficult, especially for those that do business in multiple countries.

“In an ideal world, we would have one standardized framework but I don’t think we will ever achieve that,” said Hajj. “In some countries, especially developing ones, it is very difficult to access data needed to do ESG reporting.”

Hajj emphasized at a granular level, ESG can still be seen as a risk management activity. But perspective changes as you continue to zoom out and view a nation’s assets and even the world’s assets as an integrated system of systems.

“Once we are able to see the trade-off between sectors at a national and global level, we will better be able to manage this system of systems with less waste and less environmental impact,” said Hajj.

Recent Comments

comments for this post are closed