The idea of a 20-storey residential building comprised of modular structural steel boxes constructed in a factory and assembled on-site, almost like Lego, may sound far-fetched, but for a division of EllisDon it is not a stretch.

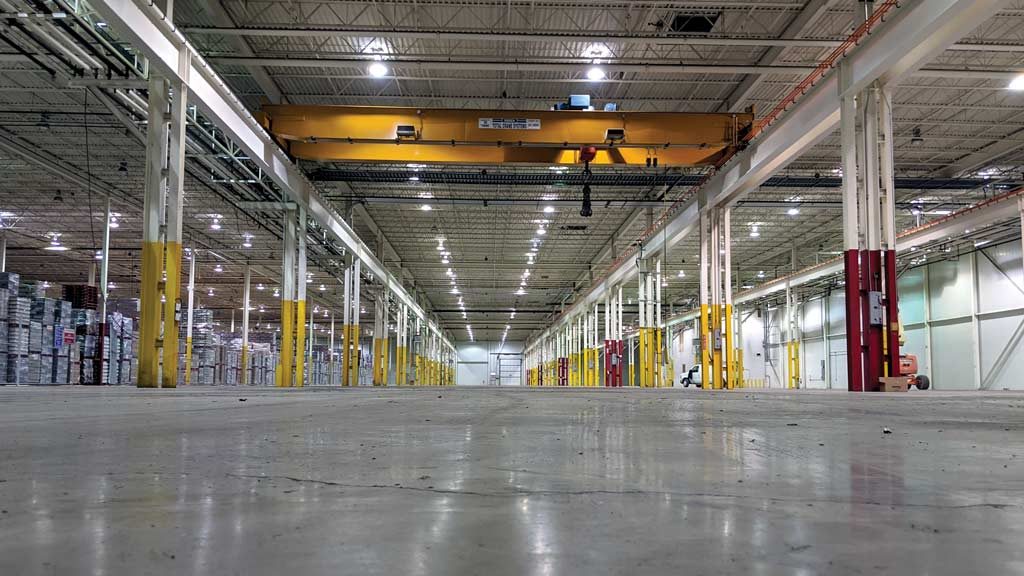

The company, ED Modular, expects to have a plant capable of producing one million square feet of modular components annually in operation this summer in Stoney Creek, Ont.

The target market is buildings with repeatable floorplates. Examples include student housing, long-term care facilities, hotels and rental housing, ED Modular vice-president Xavier Toby says.

The plant will be the biggest modular building facility in Canada.

“It is really about bringing a new technology and a new building method to the industry,” says Toby.

The objective is to “completely change the way certain building types are built. We’re trying to offer a product that is equal to or superior to conventional construction, much faster to build and slightly less expensive,” says Toby.

He says a modular design might cost only five to 10 per cent less than a conventional building but construction time is cut by 30 to 50 per cent.

The new plant in Stoney Creek will have materials placing and welding robots to help assemble structural steel boxes — at the heart of the modular system — but the company will also employ a broad mix of skilled trades (about 150 employees) for conventional construction on the production line.

To eliminate work on jobsites, Toby says each modular box can be wired, plumbed and more before it leaves the factory. For a client that is a brand hotel that “more” could include installing all fixtures and fittings.

“We want to even put the beds in, the lamps…everything in,” says Toby. Even the building envelope can be done in the plant.

ED Modular’s components will be shipped to the site and stacked, ready for connection by qualified tradespeople.

“It’s kind of like a complicated punchlist, where you walk around a building, putting in connection pieces,” Toby says.

While other companies are also shifting to modularization, Toby says part of what separates the EllisDon division from other companies is that it also does on-site work and can manage the design-build process.

“Basically, we have vertically integrated the whole stream of the construction process. By adding as much value as we can, we remove work from the jobsite,” he says, noting that construction sites “are inefficient places to get work done, compared to factories.”

Research indicates that employers of fabrication plants spend 80 per cent of their time working while workers on construction sites are only 50 per cent productive because of various activities performed such as materials and process setups and just moving between tasks, he says.

ED Modular has partnered with Z Modular, a company that uses a modular steel structural system for off-site construction. Z Modular helps to reduce the cost of design, fabrication and building assembly. The company was close to signing its first contract at press time. Once the first project is completed and proven successful, Toby expects others will follow quickly.

He says the factory has the capacity to add a second or even third shift — potentially doubling the number of employees.

But that won’t happen overnight.

“It takes a lot of handholding and a lot of education to get people comfortable with the new technology. Everything (construction) happens in a different sequence,” he says.

Toby says the Stoney Creek plant — an existing, leased facility — was selected because it is close to the major Toronto market and because there are plenty of skilled trades in the area.

Perhaps Black & McDonald can get to this stage in the near future.