Construction of New York City’s fourth largest office tower topped out on the far west side of Manhattan earlier this year in Hudson Yards, a 28-acre mixed-use development site aiming to become a magnet for work, play and housing when it is completed in six or so years.

About 10 million square feet of office space is built already on the site that was several years ago dominated by rail lines operated by the Metropolitan Transit Authority (MTA).

Fully developed, Hudson Yards is projected to have more than 18 million square feet of commercial space, housing for 4,000 residents and feature a wealth of restaurants, retail, cultural amenities, academic and open space.

Billed as the largest private development in the U.S.’s history, Hudson Yards is projected to cost in excess of $25 billion and a Canadian developer is playing a key role in making it happen.

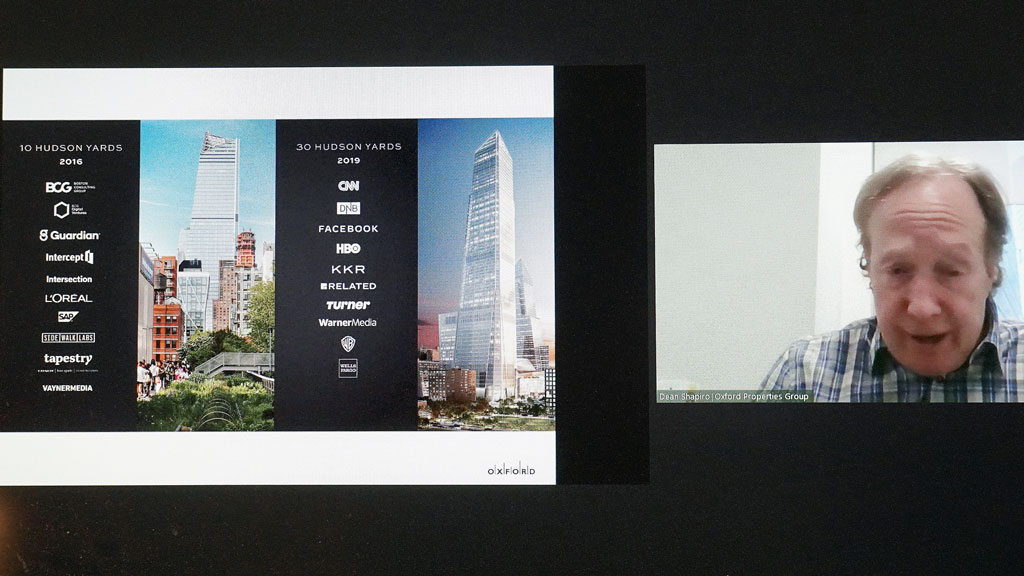

“We’re trying to create a new neighbourhood in New York,” Dean Shapiro, head of U.S. development for Canadian developer Oxford Properties Group, said, adding it is a “once-in-a-lifetime project.”

In 2010 Oxford came to Hudson Yards at the ground level through a joint venture with New York developer Related, Shapiro told a Urban Land Institute Toronto webinar presentation — a virtual tour of Hudson Yards.

The project, which was named for the rail yards that run through it, has faced many challenges over the past few years. A marriage of public and private entities has kept it moving forward.

One hurdle was engineering and building the towers on the working rail yards which are connected to “the most important traffic node in New York: Pennsylvania Station,” Shapiro pointed out.

He credits the owner, the MTA, for having the foresight when it built the train queuing yards in the 1980s to allow for the future installation of caissons between the tracks to support buildings above the rails.

Calling it “a TOD (transit-oriented development) on steroids,” planner Michael Samuelian said Hudson Yards could not have happened without significant public investment and the alignment of city and state governments.

A key to its success has been the installation of a new subway line that runs through the property, said Samuelian, founding director of Cornell Tech Urban Tech Hub.While most of the office space developed so far is fully leased, the one million square foot seven-storey retail centre completed in 2019 has fallen on hard times, in part because of a paradigm shift in retail and the extended lockdown caused by the pandemic.

Dealing with retail insolvencies and backfilling retail spaces, including 250,000 square feet originally leased by now-bankrupt Neiman Marcus, have been among the centre’s challenges, said webinar panellist Andrea Fellows, vice-president of legal for Oxford Properties.

Toronto-based Fellows said Oxford is looking at converting the space for office, which has been “the most successful” use of space at Hudson Yards to date.

Rachel Morrison Montoya, associate U.S. development for Oxford Properties, said the successful financial model used for 10 Hudson Yards, the first office building on the site, was replicated for other projects at the big development.

She told the webinar audience that of the total $1.4 billion cost for that tower, $500 million came from an anchor tenant, while a construction loan was secured for $500 million. Oxford and its partner Related then took on 90 per cent equity partners and then split the remaining $40 million.

“That’s how we got a $1.4 billion project built with only $20 million of Oxford’s equity,” she said, adding the building was “successfully recapitalized” in 2016 at $2.2 billion.

Shapiro credits Mayor Michael Bloomberg’s regime with implementing an urban planning framework for the redevelopment, which included rezoning, zoning bonuses, beneficial tax structures and funding for infrastructure improvements.

While the Yards growth is notable, Shapiro pointed out that it has only been a few years since the first sod was turned — a short span in the scheme of things, exacerbated by the pandemic.

He says the end result will be well worth the obstacles along the way.

“Nobody will ever have 28 acres of undeveloped land in New York City again.”

Recent Comments